Lengthy-term Ethereum (ETH) holders have displayed sturdy confidence within the cryptocurrency’s potential for continued value development, particularly in comparison with short-term traders. BeInCrypto famous this development after analyzing market sentiment utilizing on-chain knowledge.

This sentiment might be linked to ETH’s current resurgence, which has pushed its value above $2,600. Nevertheless, the important thing query stays: will Ethereum’s worth maintain climbing?

Ethereum LTH-NUPL Suggests Rising Confidence

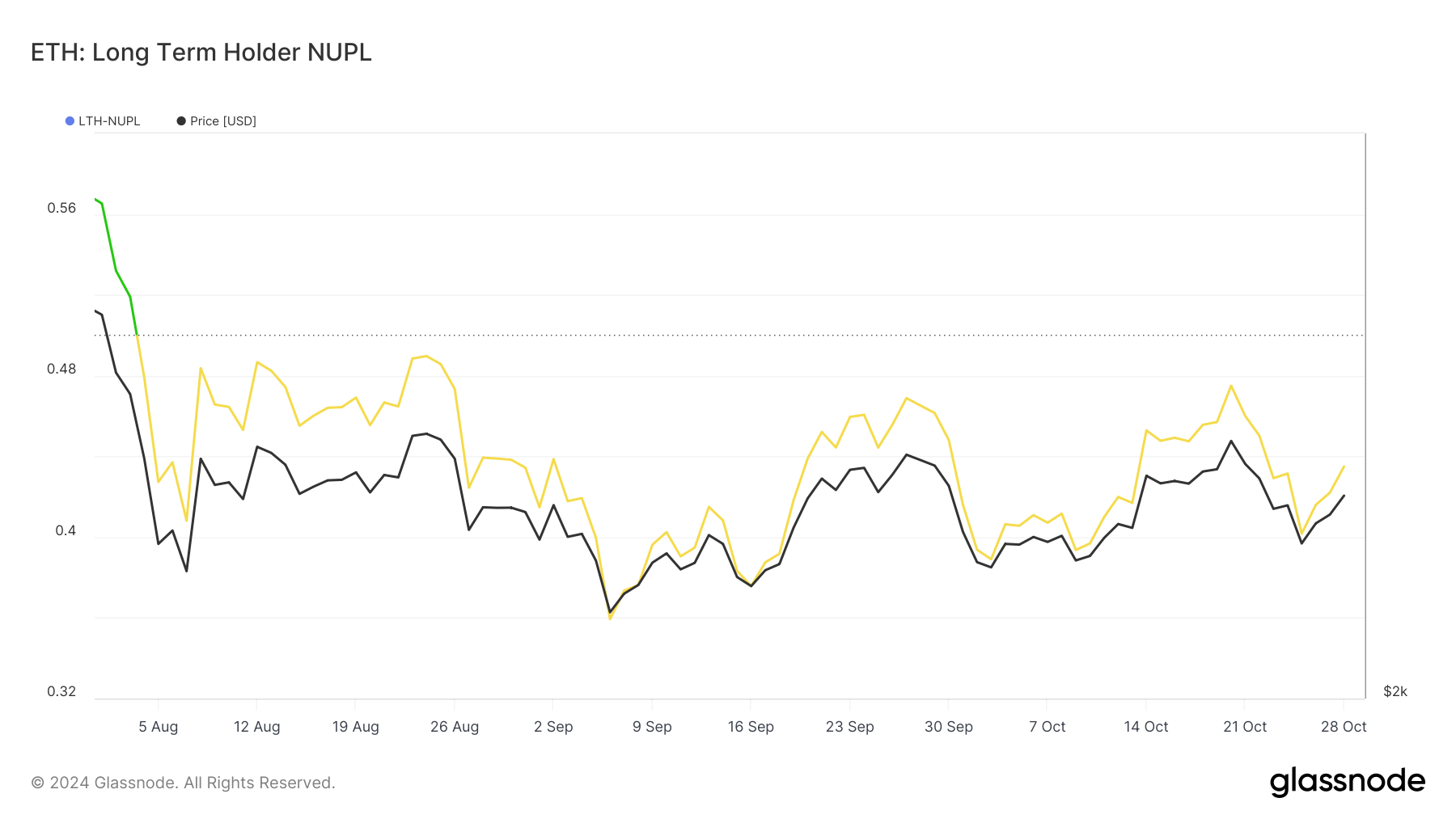

In August, Ethereum’s Lengthy-Time period Holders Web Unrealized Revenue/Loss (LTH-NUPL) positioned within the “perception zone” (inexperienced). The LTH-NUPL metric assesses the sentiment of traders who’ve held onto their ETH for at the very least 155 days, gauging their unrealized earnings or losses.

This zone means that long-term Ethereum holders are assured of sitting on extra unrealized positive factors. After ETH’s value dropped beneath $2,400 in early October, the sentiment shifted to be bearish.

Since ETH climbed above $2,600, the LTH-NUPL has shifted into the “optimistic” (yellow) zone. This transformation signifies that holders are experiencing stable unrealized positive factors, which might increase market sentiment and encourage additional accumulation.

Learn extra: Purchase Ethereum (ETH) and Every thing You Have to Know

Ethereum LTH-NUPL. Supply: Glassnode

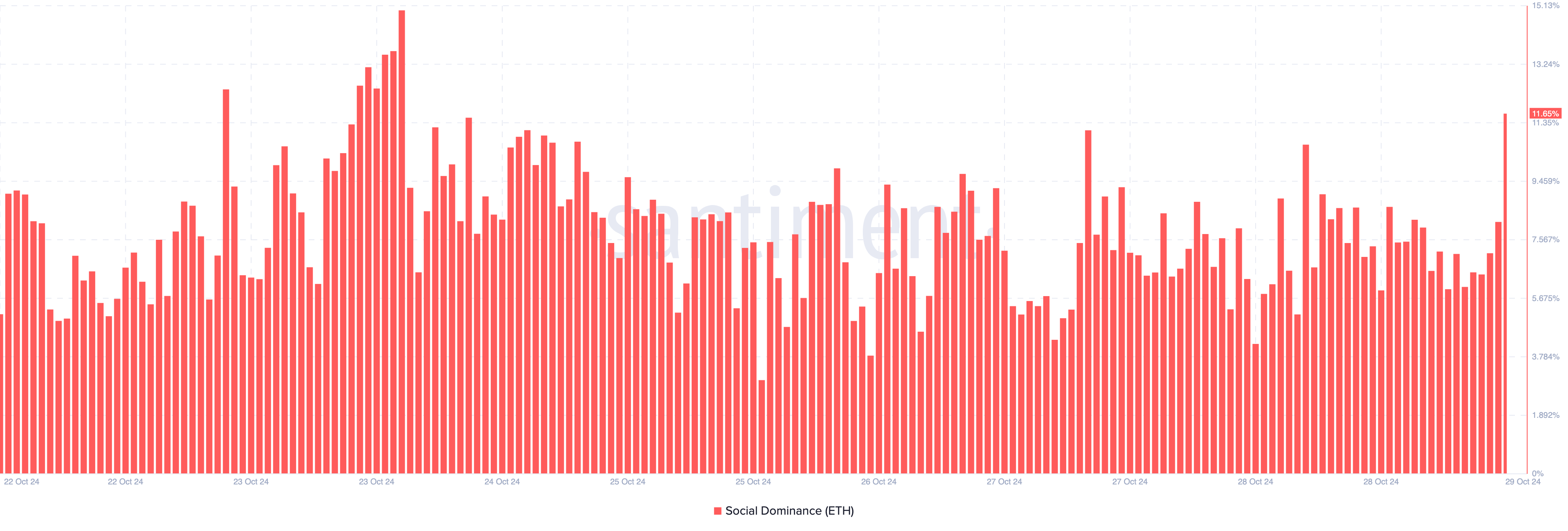

Past that, Ethereum’s social dominance has surged, indicating heightened curiosity in and discussions of the cryptocurrency on social platforms.

Elevated social dominance typically displays rising consideration from the broader market, which might amplify demand as extra traders change into conscious of Ethereum’s current value actions. If sustained, the traction may act as a catalyst to drive ETH’s value larger.

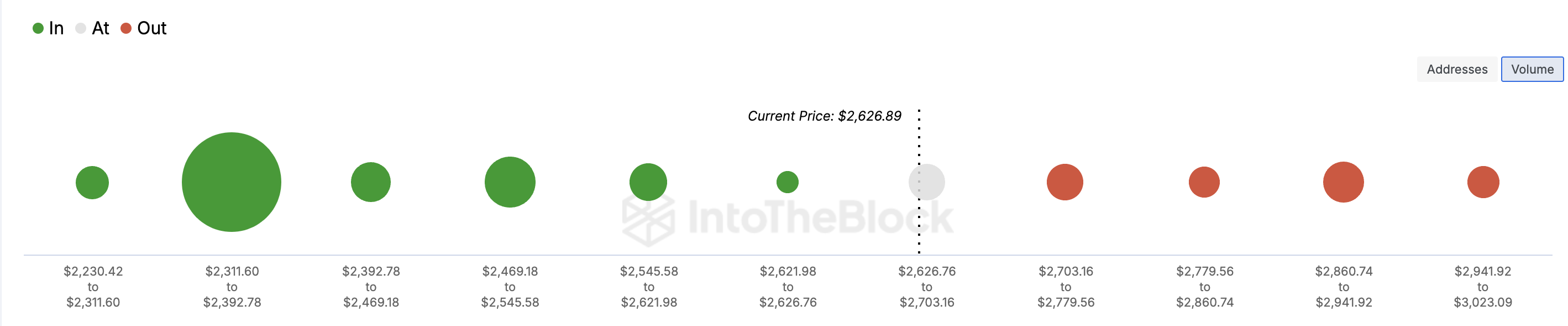

Ethereum IOMAP. Supply: IntoTheBlock

ETH Worth Prediction: Uptrend More likely to Proceed

From an on-chain perspective, the In/Out of Cash Round Worth (IOMAP) revealed that ETH may rise a lot larger within the quick time period. The IOMAP classifies addresses primarily based on these getting cash on the present value, these not, and holders on the breakeven level.

When an handle purchases a crypto at a cheaper price than the present worth, it’s within the cash. However, if addresses gathered at a price larger than the present one, it’s out of the cash.

By way of value, the bigger the “within the cash” cluster, the stronger the assist degree, as these holders are much less more likely to promote at a loss. Conversely, if a big cluster is “out of the cash, it creates a stronger resistance degree, as holders might look to promote upon reaching break-even, doubtlessly limiting additional upward motion.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum IOMAP. Supply: IntoTheBlock

As seen above, the quantity of ETH and the variety of Ethereum long-term holders within the cash are a lot larger than these between $2,703 and $3,023. Due to this fact, it’s probably that the cryptocurrency’s value may surpass $3,000 quickly.

Nevertheless, if shopping for strain reduces, this forecast may not come to move. As an alternative, Ethereum’s value may slide to $2,355.