For a lot of the previous 12 months, predictions had been rife that Ethereum’s (ETH) value may attain five-digits. Nonetheless, as Bitcoin (BTC) surged in 2024 whereas ETH lagged behind, market analysts have reassessed their forecasts.

With ETH struggling to maintain tempo, expectations for a $6,000 price ticket have now been tempered, and indicators present that it is likely to be time to decrease expectations this cycle.

Buyers Favor Bitcoin Over Ethereum

In August, the Pi Cycle High revealed that Ethereum’s value may surpass $6,000 earlier than the top of this bull market. Since then, a number of components have shifted, making the preliminary prediction much less attainable.

The Pi Cycle High has traditionally been a dependable indicator of the best value a cryptocurrency can attain inside a selected interval. It makes use of the 111-day Easy Transferring Common (SMA) and the 350-day SMA to forecast this peak.

Presently, Ethereum’s value is at $2,603, however the 350-day SMA (purple line), which indicators potential peak worth, is now at $5,699. This implies that ETH would possibly battle to surpass this value area within the close to time period, making additional vital value will increase more difficult.

Learn extra: Easy methods to Put money into Ethereum ETFs

Ethereum Pi Cycle High. Supply: Glassnode

This decline in Ethereum’s potential value enhance could possibly be linked to dwindling investor curiosity within the asset, particularly when in comparison with Bitcoin.

For example, Bitcoin ETFs have seen $1 billion in inflows inside simply three days this week, signaling sturdy institutional curiosity. In distinction, Ethereum ETFs solely garnered $5 million on October 17, highlighting that institutional traders are favoring Bitcoin over Ethereum.

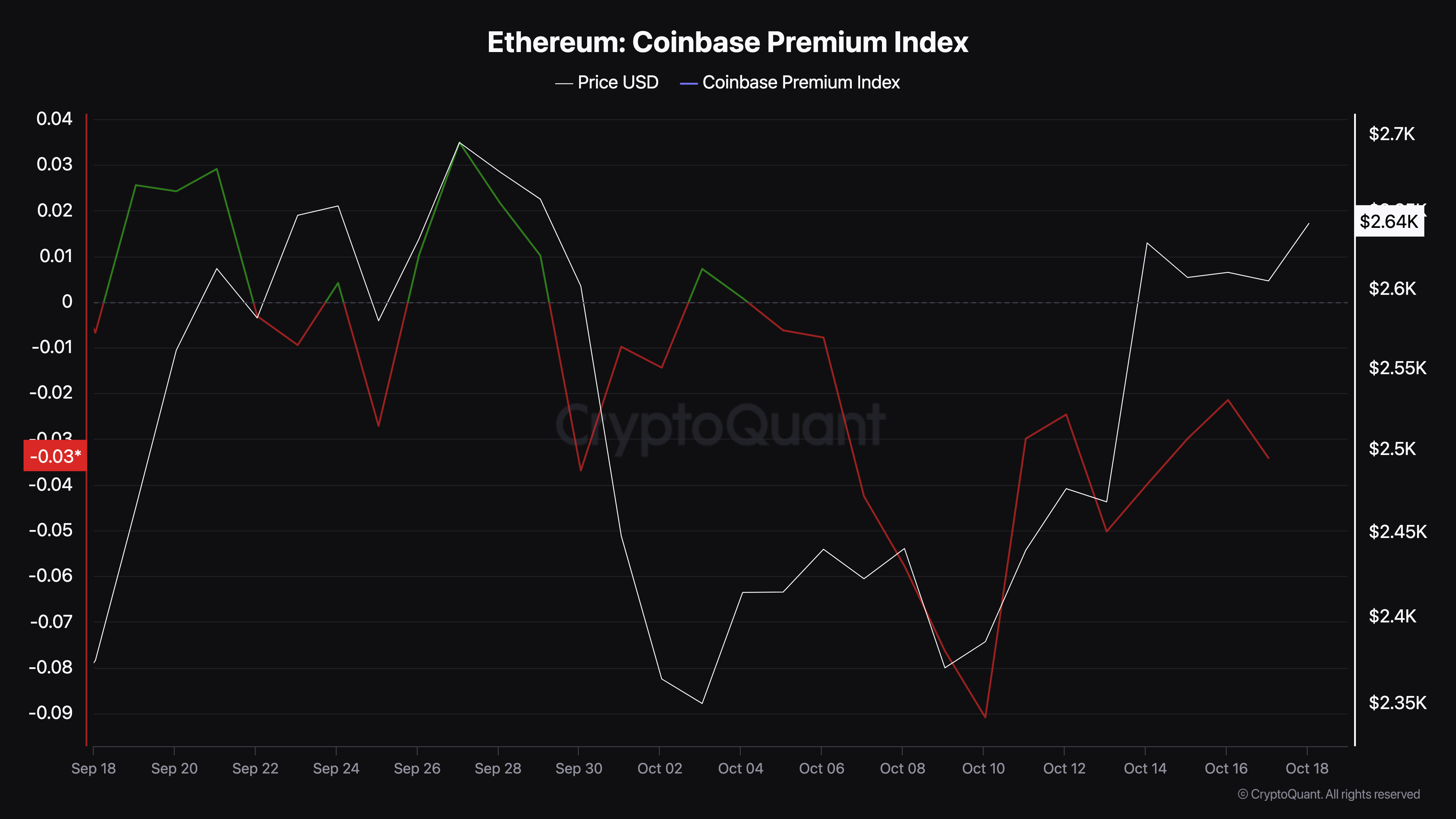

Furthermore, this sentiment appears to have prolonged to retail traders within the US. In keeping with CryptoQuant, the Coinbase Premium Index, which tracks shopping for and promoting stress, has just lately dropped into the adverse area. This shift signifies that extra traders are promoting ETH quite than shopping for, reflecting a bearish outlook for the altcoin.

Ethereum Coinbase Premium Index. Supply: CryptoQuant

ETH Value Prediction: Retracement Nonetheless Looms

Ethereum presently trades in the same sample to the value motion in Could and November 2021. On the weekly chart, every time this occurs, ETH’s value falls by double-digits. For instance, in Could of the talked about 12 months, the altcoin dropped by 52%.

With the same technical setup, it declined by 45% by November. Presently, ETH has been banking on the $2,455 assist to stop such an prevalence once more. Nonetheless, the low buying and selling quantity means that the cryptocurrency would possibly fail to carry the assist for lengthy.

Learn extra: Easy methods to Purchase Ethereum (ETH) With a Credit score Card: Full Information

Ethereum Weekly Value Evaluation. Supply: TradingView

If that occurs, then ETH’s value may lower to $2,186. On the flip facet, if traders’ curiosity in Ethereum picks up, this prediction may not come true. As a substitute, ETH may leap to $3,814 within the mid to long-term.