- Ethereum traders are underpricing the affect of spot ETH ETF launch, says K33 Analysis.

- Grayscale’s strikes to scale back potential outflows for ETHE upon its ETF conversion.

- Ethereum may face sell-off if key indicator declines additional.

Ethereum (ETH) is up 2% on Tuesday following predictions from K33 Analysis that traders are underpricing the upcoming ETH ETF launch. In the meantime, Grayscale is making strikes to scale back potential outflows from its Grayscale Ethereum Belief via its Ethereum Mini Belief.

Each day digest market movers: Underpriced ETH ETF, Grayscale’s Mini Belief transfer

Ethereum has been the preferred crypto amongst merchants up to now 24 hours after issuers submitted their amended spot ETH ETF S-1 registration statements with the Securities & Change Fee (SEC) on Monday. Based on Santiment’s information, current discussions surrounding ETH look like bullish regardless of wider bearish sentiments throughout altcoins. Many analysts count on the ETFs to start buying and selling inside/after two weeks.

The SEC authorized issuers’ spot ETH ETF 19b-4 filings in Might but in addition must greenlight their S-1 drafts earlier than the merchandise can go reside on exchanges.

Whereas the present ETH value suggests that almost all merchants aren’t overly bullish on the ETH ETF launch, K33 Analysis analysts recommend in a current report that the market is underpricing the affect of those merchandise.

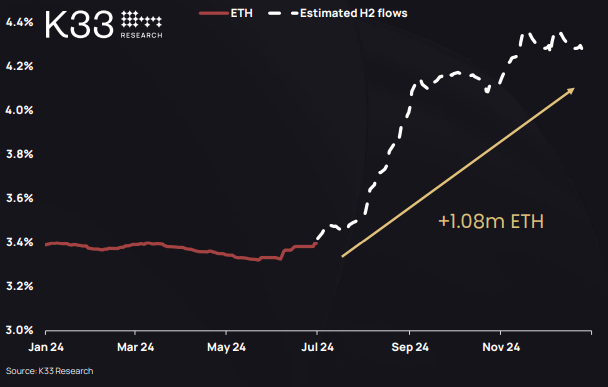

“We consider the market underappreciates the ETH ETF impact and forecast that US ETH ETFs will take up 1% of the circulating ETH provide. We count on the ETH ETF impact to result in ETH outperformance in H2 2024,” stated K33 Analysis analysts.

Proportion of circulating ETH provide held in funding autos

In the meantime, Grayscale has introduced a “report date” of July 18 for the preliminary creation and distribution of shares of its Ethereum Mini Belief to holders of the Grayscale Ethereum Belief (ETHE) forward of its conversion when spot ETH ETFs launch. Based on the announcement, Grayscale will contribute 10% of ETHE (about $500M-$600M) to the Mini Belief.

Contemplating Grayscale’s Ethereum Mini Belief filings have but to be authorized by the SEC, the transfer may assist scale back outflows for ETHE after its conversion to an ETF. “It seems prefer it successfully locks up 10% of ETHE NAV (web asset worth) till the Mini-trust is authorized for buying and selling…decreasing potential for outflows,” stated Scott Johnsson, common accomplice at Van Buren Capital.

If ETHE holders are something like GBTC holders (maybe a improper assumption), Grayscale possible simply took about $500-600M of outflows off the desk within the first six months of ETH ETF buying and selling. How that results web flows is one other query in fact.

— Scott Johnsson (@SGJohnsson) July 8, 2024

ETH technical evaluation: Ethereum STHs may decide ETH’s subsequent transfer

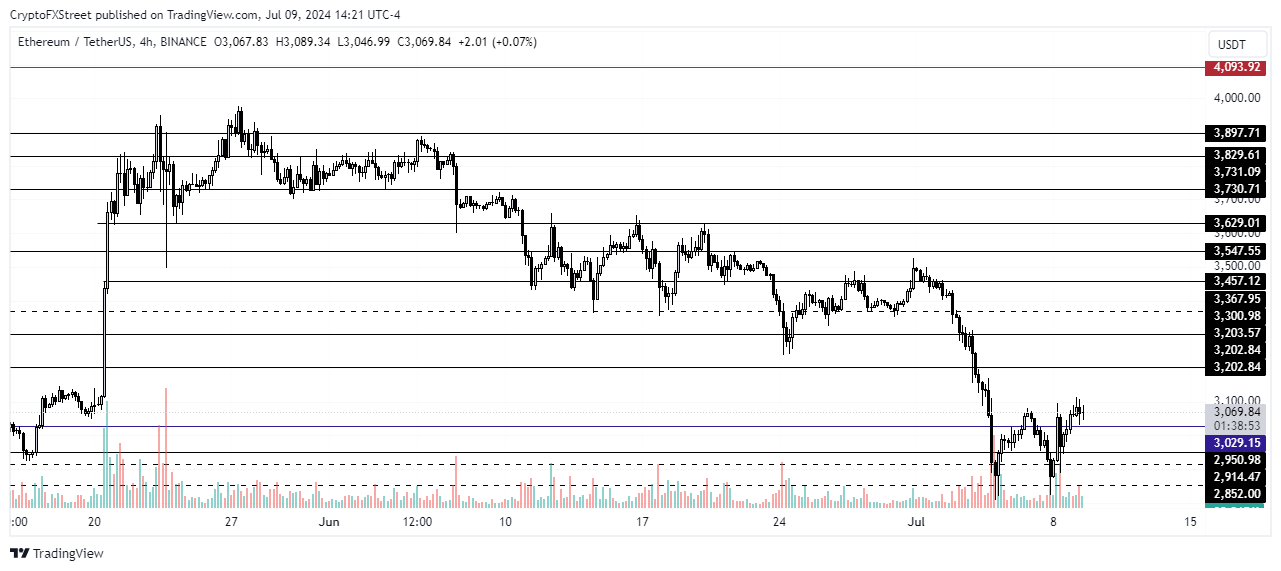

Ethereum is buying and selling round $3,050 on Tuesday, up about 2% on the day. ETH’s value sustaining above $3,000 has seen its quick liquidations attain $18.30 million and lengthy liquidations at just below $12 million up to now 24 hours, in accordance with Coinglass information.

The liquidation information aligns ETH’s Taker Purchase Promote Ratio, which measures the variety of purchase orders versus promote orders. The ratio is at 1.004, indicating the bearish strain has cooled.

Moreover, ETH’s 180-day Market worth to realized worth ratio, which measures the profitability of all cash bought within the final 180 days, is hovering round -5 %, that means most short-term holders (STHs) are at a 5% loss. That is its lowest stage since October. An additional drop may trigger panic amongst most STHs, who might dump their tokens to chop losses.

On the flip aspect, the low MVRV signifies a possible shopping for alternative forward of the launch of spot ETH ETFs, which can propel ETH to new highs. If the ETFs show profitable, ETH faces resistance at $3,547, whereas the $2,852 stage stays a key help stage if bearish sentiment persists.

ETH/USDT 4-hour chart

ETH may rise to $3,104 within the quick time period to brush a $3.78 million liquidation wall.