- Ethereum ETFs file their longest outflow streak with 5 days of consecutive detrimental flows.

- Ethereum change web move has elevated to 31K ETH, its highest for the reason that market crash on August 5.

- Vitalik Buterin says Ethereum is rising primarily based on a number of key metrics.

- Ethereum technical indicators recommend a range-bound motion amid combined sentiments from futures merchants and fund traders.

Ethereum (ETH) is down 1% on Thursday as its ETF and change web flows recommend that sellers dominate the market. Regardless of the promoting strain, Ethereum co-founder Vitalik Buterin shared a publish depicting its development throughout a number of metrics.

Each day digest market movers: Ethereum ETF five-day outflow streak, optimistic change web flows, Vitalik’s metrics

Ethereum ETFs recorded its longest detrimental flows streak — 5 consecutive days — on Wednesday after posting outflows of $18 million.

The flows had been spearheaded by outflows of $31.1 million in Grayscale’s ETHE, bringing its cumulative outflows since launch to over $2.5 billion. ETHA accompanied its milestone of over $1 billion in cumulative web inflows with zero flows on Wednesday.

With the constant detrimental flows, Ethereum ETFs may file one other week of web outflows as cumulative flows since Monday have amounted to $38 million in outflows.

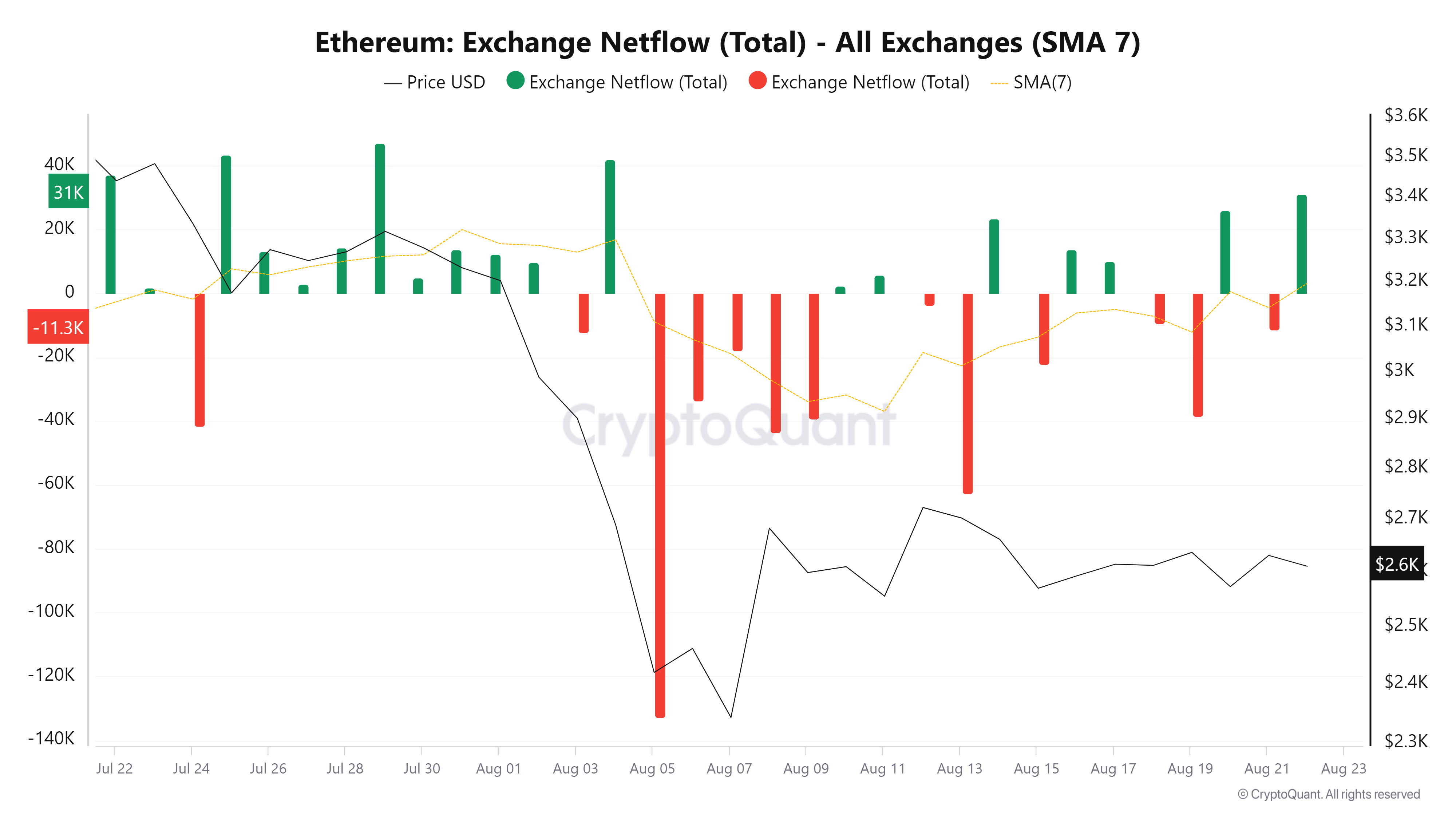

An analogous development is going on with ETH change flows. In contrast to ETF flows, optimistic change web flows point out promoting strain is rising and should result in worth declines.

Ethereum web change influx elevated to 31K ETH on Thursday, its highest for the reason that market crash on August 5. The 7-day shifting common change netflow has additionally been rising since August 11.

ETH Trade Web Circulate

In the meantime, Ethereum co-founder Vitalik Buterin shared an X publish with a number of metrics suggesting that ETH has continued on its development path. A number of the factors he highlighted embody the next:

- Elevated staking decentralization.

- Enchancment in cross-L2 pockets person expertise (UX).

- Extra readability on account abstraction roadmap.

- Mature zero-knowledge (ZK) tooling and plenty of others.

“The basics for Ethereum are literally loopy robust proper now,” famous Buterin.

Ethereum has gotten stronger:

* Underneath $0.01 txfees on L2

* Two EVM L2s (@Optimism @arbitrum) now at stage 1

* Cross-L2 pockets UX has improved so much (eg. no extra manually switching networks), although nonetheless a protracted approach to go

* Way more highly effective and mature ZK tooling making life… pic.twitter.com/4jQGeZ3qEA— vitalik.eth (@VitalikButerin) August 22, 2024

ETH technical evaluation: Ethereum may proceed range-bound motion

Ethereum is buying and selling round $2,610 on Thursday, down 1% on the day. Prior to now 24 hours, ETH has seen $31.34 million in liquidations, with lengthy and quick liquidations accounting for $24.1 million and $7.24 million, respectively.

Ethereum is consolidating on the 4-hour chart, the place the 200-day Easy Transferring Common (SMA) serves as help to stop additional worth declines. Earlier than costs may rally, ETH wants to beat the $2,775 resistance which — coupled with the 50-day SMA — has prevented any upward try.

ETH/USDT 4-hour chart

The ETH Lengthy/Brief Ratio at 0.96 exhibits sellers dominate the market. Nonetheless, comparatively robust shopping for strain from Coinbase and Ethereum Funds traders, as evidenced by their premiums of 0.024 and 0.38, respectively, has stored costs on a horizontal development.

ETH will possible stay range-bound with a bias towards the draw back, as depicted by a key trendline extending from Might 29 to September 27.

The Relative Energy Index (RSI) has moved under its midline at 48, indicating neutrality in momentum. The Superior Oscillator (AO) additionally aligns with the impartial sentiment, posting quick bars simply shy above zero.

Within the quick time period, ETH may rise to $2,666 to liquidate positions value $65 million.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with good contracts performance. Serving because the basal community for the Ether (ETH) cryptocurrency, it’s the second largest crypto and largest altcoin by market capitalization. The Ethereum community is tailor-made for scalability, programmability, safety, and decentralization, attributes that make it standard amongst builders.

Ethereum makes use of decentralized blockchain expertise, the place builders can construct and deploy purposes which can be unbiased of the central authority. To make this simpler, the community has a programming language in place, which helps customers create self-executing good contracts. A wise contract is mainly a code that may be verified and permits inter-user transactions.

Staking is a course of the place traders develop their portfolios by locking their property for a specified period as an alternative of promoting them. It’s utilized by most blockchains, particularly those that make use of Proof-of-Stake (PoS) mechanism, with customers incomes rewards as an incentive for committing their tokens. For many long-term cryptocurrency holders, staking is a technique to make passive earnings out of your property, placing them to work in change for reward era.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an occasion christened “The Merge.” The transformation got here because the community wished to attain extra safety, reduce down on vitality consumption by 99.95%, and execute new scaling options with a potential threshold of 100,000 transactions per second. With PoS, there are much less entry limitations for miners contemplating the lowered vitality calls for.