- Ethereum ETF issuers are anticipated to file up to date S-1s earlier than weekend following Bitwise filings.

- SEC did not explicitly declare ETH a commodity regardless of closing Ethereum 2.0 investigation.

- Ethereum’s elevated implied volatility could also be deceptive as establishments could make use of related cash-and-carry arbitrage technique when spot ETH ETFs launch.

Ethereum’s (ETH) worth elevated over 4% prior to now 24 hours after the Securities & Alternate Fee (SEC) dropped its Ethereum 2.0 investigations amid expectations of spot ETH ETFs. Nevertheless, the latest pleasure surrounding ETH ETFs could not result in the anticipated worth improve.

Day by day digest market movers: Bitwise recordsdata up to date ETH ETF S-1, SEC drops Ethereum 2.0 investigation

Bitwise filed an up to date S-1 draft for its spot ETH ETF with the SEC after the company commented on issuers’ preliminary S-1 filings final week. The submitting disclosed that asset supervisor Pantera Capital will buy $100 million of the ETF shares when it launches.

Additionally learn: World Ethereum ETFs expertise surge in internet inflows as Hashdex recordsdata for mixed spot ETH and Bitcoin ETF

Bloomberg analyst Eric Balchunas had earlier shifted his over/underneath date prediction for when ETH ETFs will launch to July 2 after saying he heard that the SEC’s first spherical of feedback on the S-1s had been “mild” and “nothing main.” He additionally talked about that the company expects issuers to return these drafts earlier than the top of the week with an honest probability of working to declare them efficient subsequent week.

In the meantime, Ethereum infrastructure supplier Consensys introduced that the SEC’s enforcement division is closing its investigation into Ethereum 2.0, which means that the company “won’t deliver expenses alleging that gross sales of ETH are securities transactions.”

Consensys disclosed that the choice comes after it despatched a letter to the SEC on June 7 asking whether or not the approval of spot ETH ETFs on Might 23 signifies the company would finish its Ethereum 2.0 investigation.

Learn extra: Ethereum survives SEC scrutiny: Enforcement division closes investigation into Ether, Consensys says

Nevertheless, the SEC’s letter to Consensys did not affirm whether or not it was concluding that ETH is a commodity. SEC Chair Gary Gensler additionally failed to provide a direct reply when questioned if ETH is a commodity in a Senate listening to final week.

Fortune earlier reported that the SEC started investigating the Ethereum Basis and a number of other Ethereum-related corporations primarily based on ETH’s potential safety standing.

ETH technical evaluation: Might Ethereum’s worth fail to rise following ETF launch?

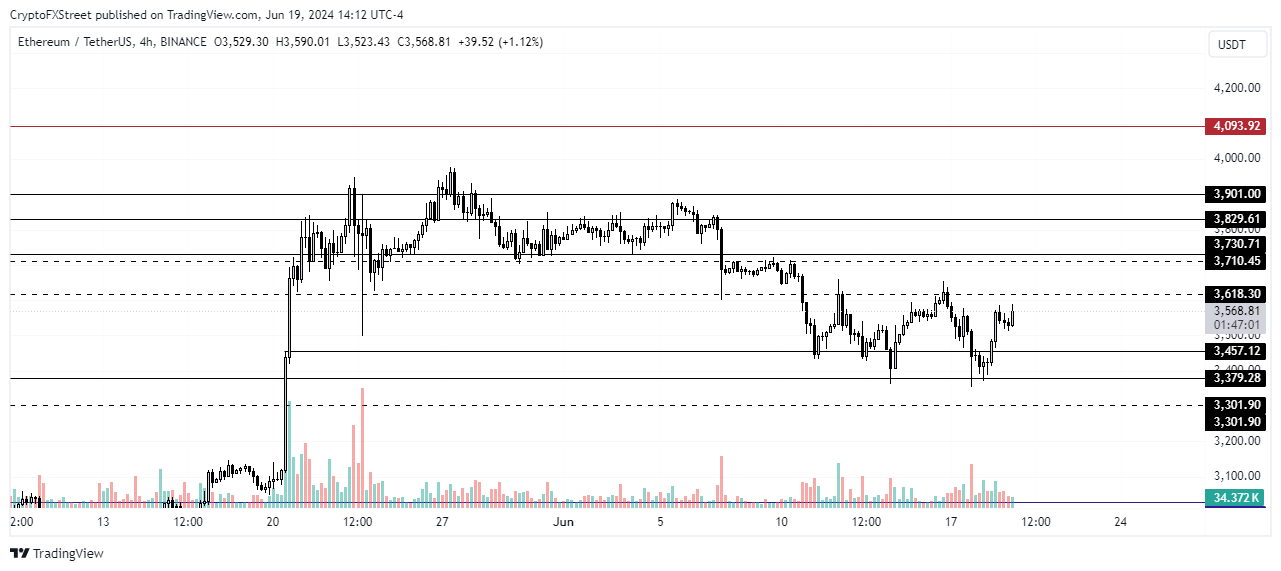

Ethereum is buying and selling round $3,557, up greater than 4% prior to now 24 hours. Complete ETH liquidations prior to now 24 hours are at $34.37 million with $22.34 million briefly liquidations exceeding these of longs.

ETH implied volatility (IV) rose to 65% within the entrance finish after its worth rebounded following the newest developments mentioned above, based on QCP Capital analysts. Implied volatility measures how a lot the market expects the longer term worth of an asset or choices contract to vary over a sure interval.

“Regardless of uncertainty surrounding the reception of ETH ETFs, capturing 10-20% of BTC ETF flows will propel them above $4,000, nearing its peak of $4,800,” famous the analysts.

Additionally learn: Ethereum resumes downtrend as Canada sees one other staked ETH ETF launch

Nevertheless, Amberdata’s director of derivatives, Greg Magadini, believes the present pleasure surrounding spot ETH ETFs and its anticipated impression on the worth of ETH could also be unfounded.

“I proceed to stay skeptical that this relative volatility premium stays persistent. A number of chilly water was splashed on the BTC ETF inflows narrative, given the hypothesis that funds are merely buying and selling the BTC foundation versus taking outright ETF publicity,” wrote Magadini.

The assertion follows a stalemate in Bitcoin’s worth regardless of document ETF inflows after reviews that hedge funds are using a cash-and-carry arbitrage technique on the highest digital asset. Usually, hedge funds achieve spot publicity to Bitcoin by spot BTC ETFs after which quick its equal futures contract, benefiting from its greater futures premium and funding price charges.

Magadini expects establishments to make use of an analogous technique with ETH ETFs after they go stay, probably triggering a sideways worth motion for the primary altcoin.

He additionally pointed to the Chicago Mercantile Alternate’s (CME) Ethereum open curiosity (OI) in comparison with Bitcoin.

“The true decision to this query [about persistent of [E]ther vol premium] comes after we see the precise ETF inflows and quantity. If this appears something just like the CME OI between BTC futures and ETH futures, I believe ETH nonetheless does not have the mainstream enthusiasm that BTC has seen,” famous Magadini.

ETH/USDT 4-hour chart

As of the time of writing, Ethereum CME OI is at $1.32 billion, whereas Bitcoin’s determine is $10.14 billion.

A breakout above the $3,900 resistance may see ETH beat this cycle’s present excessive of $4,000 and rally to a brand new all-time excessive above the $4,878 worth stage. Nevertheless, a breach beneath the $3,300 help could ship ETH crashing to lows across the $2,852 stage.