On Monday, Ethereum exchange-traded funds (ETFs) recorded their highest inflows in 30 days. This alerts robust investor curiosity regardless of ETH’s lackluster worth efficiency in current weeks.

The surge in ETF investments coincides with elevated market optimism following Donald Trump’s inauguration, which has elevated traders’ confidence.

Ethereum ETF Inflows Surge

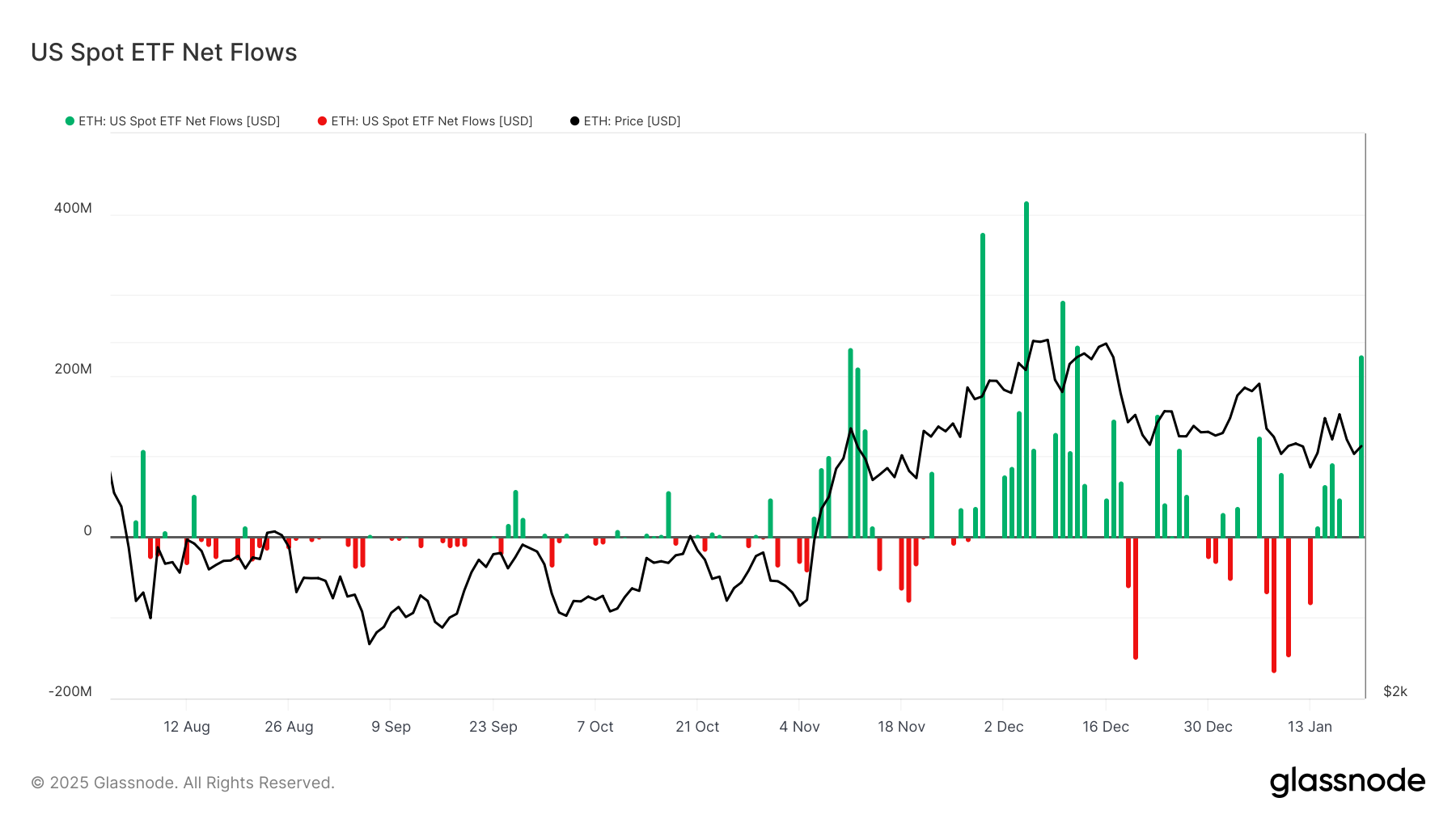

In keeping with information from Glassnode, inflows into US ETH spot ETFs totaled $227 million on Monday. This represented the single-day highest web inflows since December 9. The spike in ETF inflows got here as pro-crypto Donald Trump was sworn in as US president, which boosted confidence in total market circumstances.

The rise in ETF inflows highlights the rising institutional curiosity in ETH as a viable funding automobile, even amidst the coin’s poor worth efficiency in current weeks. In keeping with the newest Coinshares weekly report, ETH recorded inflows totaling $246 million final week, reversing the outflows it had skilled earlier this yr.

This development highlights the strengthening institutional demand for the altcoin, whilst its worth continues to commerce inside a slim vary.

US Spot ETF Web Flows. Supply: Glassnode

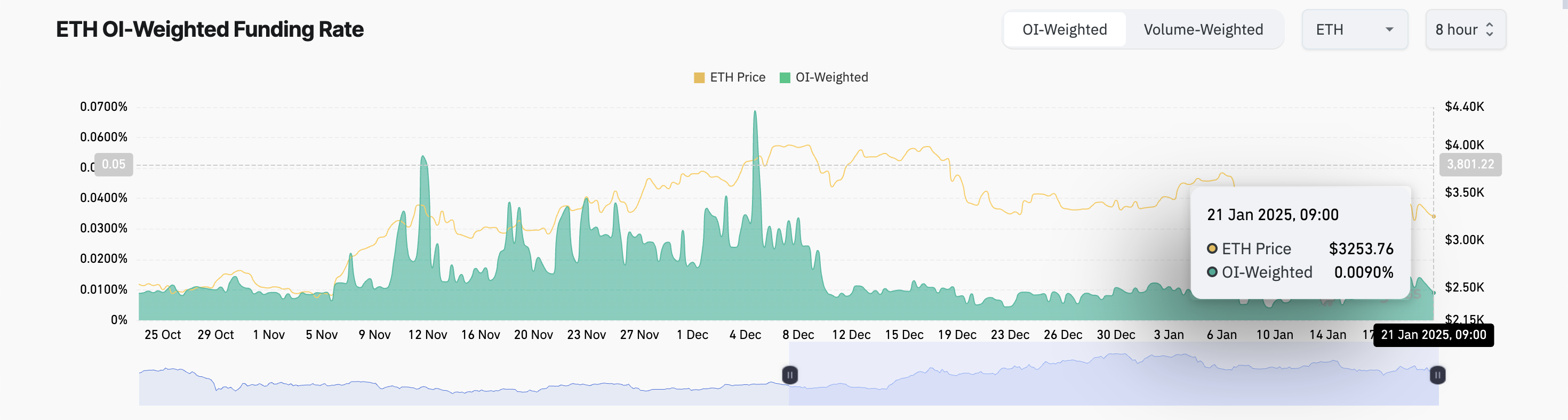

Furthermore, the persistent optimistic funding fee within the futures market confirms the bullish bias towards the coin regardless of its efficiency. As of this writing, this stands at 0.0090%, indicating the desire for lengthy positions amongst ETH’s derivatives merchants.

The funding fee is a periodic price exchanged between lengthy and brief merchants in futures contracts to keep up worth alignment between the futures and the underlying asset.

Ethereum Funding Charge. Supply: Coinglass

As with ETH, a optimistic funding fee signifies that lengthy merchants are paying brief merchants, signaling bullish sentiment as extra merchants are betting on the worth enhance.

ETH Value Prediction: Will Market Demand Push It Previous $3,500?

ETH presently trades at $3,265. If market demand for the altcoin will increase, its worth will escape of its slim vary to commerce above $3,500 and rally towards $3,675.

ETH Value Evaluation. Supply: TradingView

Nevertheless, if it stays rangebound and bearish stress strengthens, ETH’s worth may break to the draw back and fall to $3,022.