The Ethereum Basis (EF), a nonprofit supporting Ethereum’s blockchain ecosystem, has launched its 2024 annual report detailing monetary updates, treasury holdings, and up to date coverage initiatives.

The report highlighted the group’s price range breakdown, spending from latest years, and new insurance policies designed to foster transparency and integrity throughout the Ethereum ecosystem.

Treasury holding

As of Oct. 31, 2024, the EF’s treasury totaled roughly $970.2 million, comprising $788.7 million in crypto—primarily ETH—and $181.5 million in non-crypto investments.

EF’s mentioned its ETH holdings signify round 0.26% of Ethereum’s whole provide as of Oct. 31. These substantial ETH reserves mirror the Basis’s confidence in Ethereum’s long-term potential and its dedication to sustaining a powerful presence throughout the community.

The EF clarified that its treasury serves as a monetary spine for important tasks throughout the Ethereum ecosystem. The Basis periodically converts a portion of its ETH holdings to fiat foreign money, particularly throughout market upswings, to make sure enough sources throughout market downturns.

Ecosystem treasury

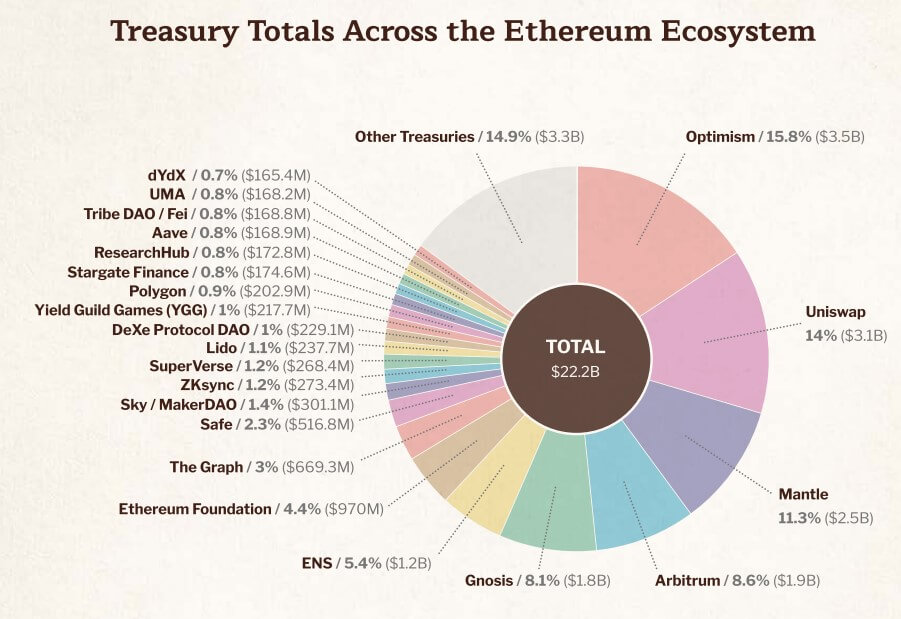

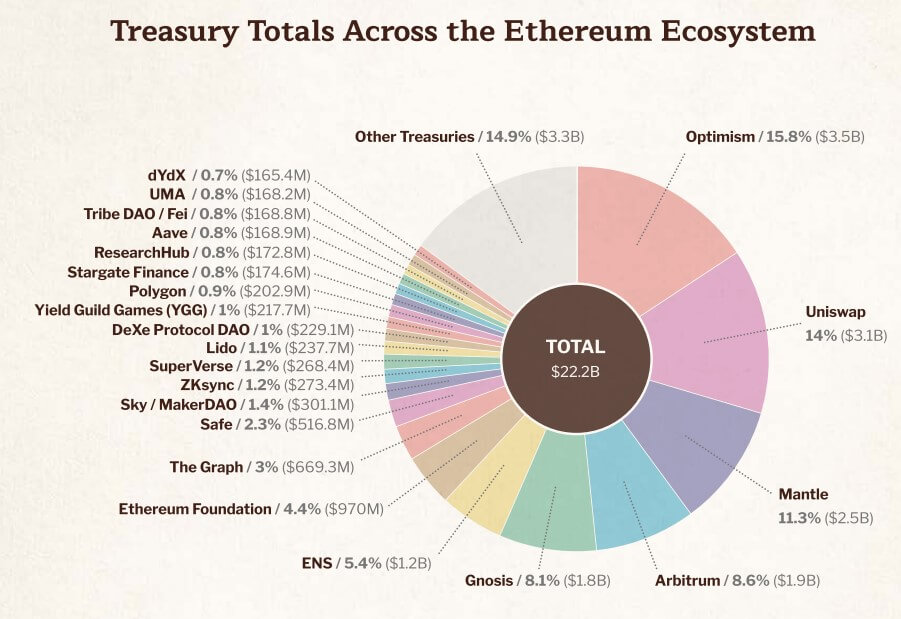

Past EF’s holdings, Ethereum’s ecosystem advantages from over $22 billion in mixed treasury belongings held by numerous foundations, organizations, and DAOs.

The treasuries primarily comprise the native tokens of crypto tasks like dYdX, Aave, Polygon, The Graph, Optimism, Uniswap, Mantle, Arbitrum, Lido, Gnosis, and the Ethereum Title Service.

The report emphasizes that even a small allocation from these treasuries would offer vital sources to maintain and develop the Ethereum ecosystem over the long run.

Ecosystem funding

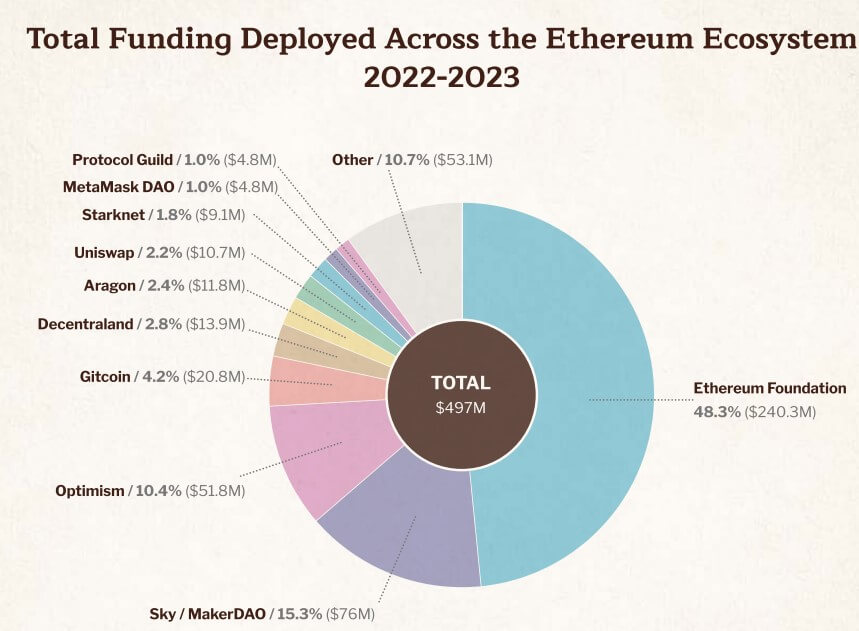

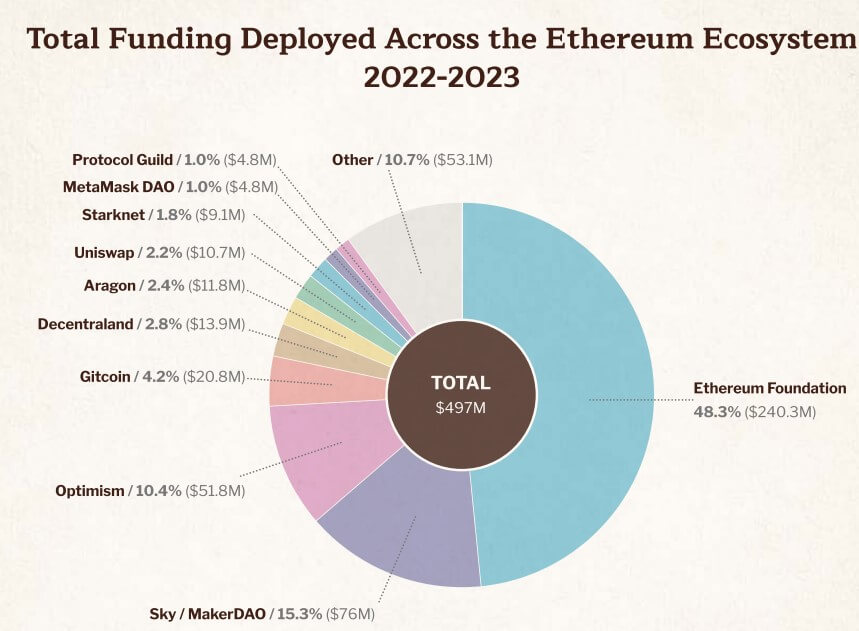

The Ethereum Basis and ecosystem companions allotted practically $500 million to ecosystem tasks throughout 2022 and 2023.

EF contributed $240.3 million (48.3% of whole funding), with the remaining help from organizations like MakerDAO (rebranded as Sky), Optimism, Gitcoin, Decentraland, Aragon, Uniswap, Starknet, MetaMask DAO, and Protocol Guild.

This collective funding emphasizes the collaborative nature of Ethereum’s ecosystem, driving innovation and help for builders throughout the group.

EF Director Aya Miyaguchi emphasised that this funding strategy parallels Ethereum’s decentralized analysis and growth processes, which encourage collaboration and resource-sharing tasks. She acknowledged:

“Proud to say that ecosystem funding is a shared effort at this time, very similar to Ethereum’s R&D course of, which helps builders throughout the Ethereum ecosystem discover extra paths to maintain innovating.”

Battle of curiosity coverage

To strengthen its transparency, the Ethereum Basis has applied a battle of curiosity coverage, mandating disclosure for investments e to strengthen its transparency exceeding $500,000 (excluding ETH).

The coverage goals to stop potential conflicts amongst EF members by excluding them from related selections if they’re extremely uncovered to associated belongings. Miyaguchi defined that this transfer represents a step towards enhancing integrity inside EF and the broader Ethereum ecosystem.

It’s notably prescient contemplating Ethereum Basis researchers not too long ago got here underneath fireplace for taking advisory roles with restaking protocol EigenLayer.

Talked about on this article