The second-largest cryptocurrency by market capitalization Ethereum ($ETH) has seen demand for it skyrocket to its second-highest stage on report, as everlasting holders gathered 298,000 ETH price $1.04 billion, in a single day.

That’s in accordance with CryptoQuant’s head of analysis Julio Moreno, who famous on the microblogging platform X (previously generally known as Twitter) that it got here near the report day by day shopping for, which occurred final September and noticed everlasting ETH holders accumulate 317,000 tokens.

Ethereum demand has spiked.

Shopping for by everlasting holders was the second highest on report yesterday: 298K ETH.

The report day by day shopping for was final September 11: 317K ETH. pic.twitter.com/0qMVpNU8ht

— Julio Moreno (@jjcmoreno) June 13, 2024

The near-record shopping for spree got here amid a wider cryptocurrency market correction and after Ethereum’s worth plunged to a low under the $3,500 mark. CryptoGlobe has reported there was ongoing Ethereum accumulating, with a “large” ETH whale lately restarting their accumulation.

In accordance with blockchain analytics agency SpotOnChain, this “large whale” has lately withdrawn 7,000 ETH price over $26 million from main cryptocurrency trade Binance at round $3,800 per coin, after withdrawing most of their ETH throughout final yr’s bear market, and depositing it again onto the centralized trade as soon as the value rose.

The Ethereum shopping for exercise exploded after U.S. Securities and Trade Fee (SEC) Chairman Gary Gensler stated in a funds listening to ultimate approvals for spot Ethereum exchange-traded funds (ETFs) may very well be granted by summer season’s finish.

Talking to a subcommittee of the Senate Appropriations Committee in a listening to on the regulator’s funds, Gensler stated the approval course of was “working easily” after the preliminary go-ahead given to a bunch of those ETFs, referring to the SEC clearing the trail for these funds.

The SEC’s approval was met with optimism within the cryptocurrency house, with the value of ETH surging round 20% in a day after the choice was revealed, whereas the cryptocurrency market as a complete added over $200 billion to its market capitalization.

The approval marks a big shift for the SEC, which has traditionally been cautious about cryptocurrency and had been investigating whether or not to deem the second-largest cryptocurrency a commodity or a safety.

Whereas the trade purposes had been permitted, particular person ETF issuers together with VanEck, ARK Investments, and BlackRock nonetheless want the SEC to greenlight their registration statements earlier than buying and selling can start.

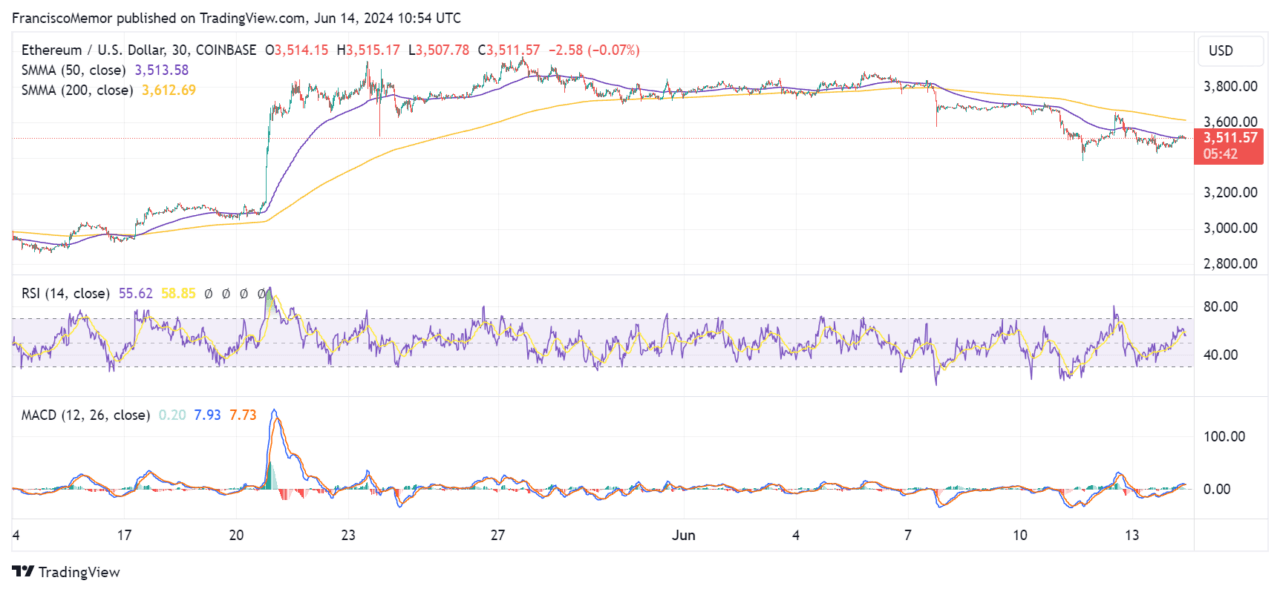

Ethereum Worth Evaluation

Ethereum is at the moment buying and selling simply above the $3,500 mark, close to its 50 transferring common, and under its 200 transferring common which at the moment sits at $3,600 on the month-to-month chart.

This counsel that the cryptocurrency is at the moment in a bearish development after the 50-SMA crossed under its 200-SMA to kind a “demise cross,” extensively interpreted as a bearish sign.

The cryptocurrency’s relative power index (RSI) is at the moment in a impartial zone and seems to be transferring upwards in what seems to be short-term bullish momentum.

Its Transferring Common Convergence Divergence (MACD) is in the meantime indicating a possible bullish sign, though its histogram suggests weak momentum for it.

ETHUSD Chart by way of TradingView

Knowledge means that Ethereum’s resistance ranges are at the moment round $3,500 and $3,600 – the degrees of its transferring averages on the month-to-month chart – with an instantaneous assist stage close to its current lows of $3,200.

Featured picture by way of Unsplash.