Ethereum started November with a outstanding 40% rally, however sustaining the momentum has confirmed difficult for the altcoin king.

As the worth stabilizes above $3,000, a big increase from institutional curiosity may assist reignite Ethereum’s bullish pattern. Ethereum ETFs are on the heart of this resurgence, recording historic inflows.

Ethereum Has the Establishments’ Assist

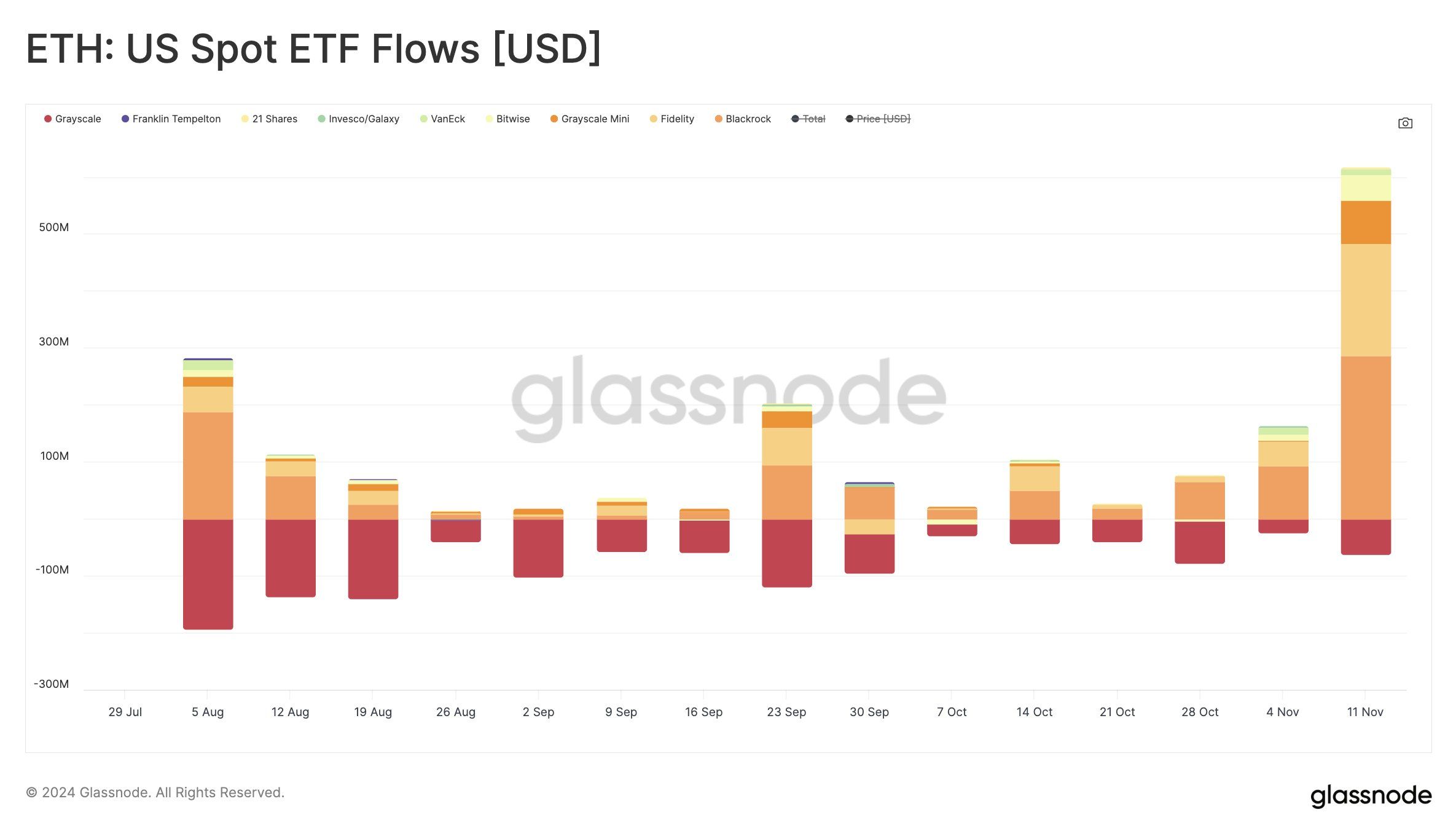

Over the previous week, Ethereum ETFs skilled their largest weekly inflows since launch. BlackRock led the surge with a staggering $286 million, whereas the mixed inflows throughout all ETFs reached $550 million. This inflow displays rising institutional confidence, pushed by Ethereum’s value restoration and Bitcoin’s current all-time highs.

The surge in ETF exercise highlights institutional buyers’ growing reliance on Ethereum as a diversified asset. This pattern is strengthening Ethereum’s place within the crypto market, probably offering the momentum wanted to beat its current value stagnation. Market sentiment seems to be favoring a bullish outlook.

Ethereum ETF Inflows. Supply: Glassnode

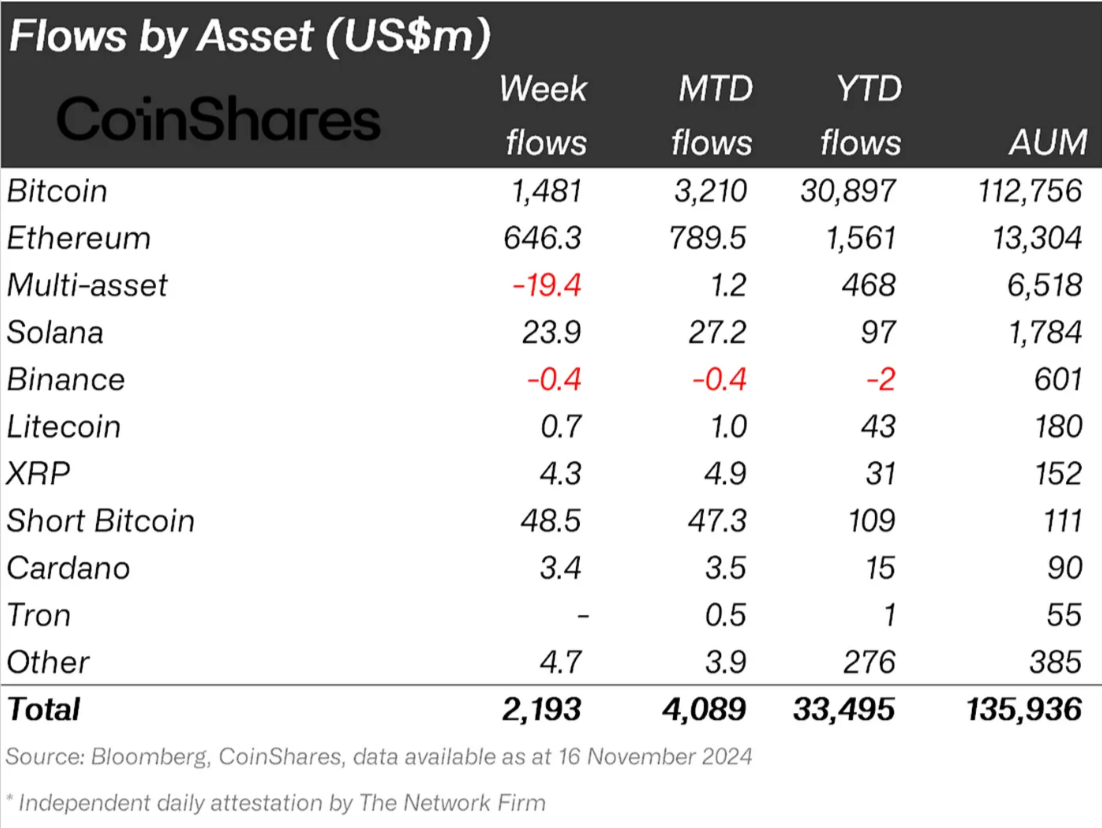

Ethereum’s institutional demand extends past ETFs. In accordance with the newest CoinShares ETP netflow report, November has already seen $789 million in Ethereum inflows from establishments. These large-scale investments replicate renewed curiosity in Ethereum as a long-term asset.

Moreover, massive pockets holders are exhibiting heightened exercise, additional validating Ethereum’s robust macro momentum. Their investments may very well be pivotal in driving ETH’s value upward, particularly as establishments amplify their publicity to the cryptocurrency. This degree of curiosity highlights Ethereum’s rising function as a key participant in institutional portfolios.

Ethereum Institutional Flows. Supply: CoinShares

ETH Value Prediction: Wanting Ahead

Ethereum is presently buying and selling at $3,108, holding steadily above its crucial assist at $3,001. This degree aligns with the 61.8% Fibonacci Retracement line, generally known as the bull market assist ground, offering a secure basis for potential positive factors.

Ought to institutional exercise and optimistic market sentiment persist, Ethereum might breach the $3,248 resistance, enabling a continued uptrend. This transfer would place the altcoin king for additional development, solidifying its bullish trajectory.

Ethereum Value Evaluation. Supply: TradingView

decline would invalidate the bullish outlook, probably dampening investor confidence. Ethereum’s capacity to keep up momentum hinges on sustaining key assist ranges and capitalizing on its institutional backing.