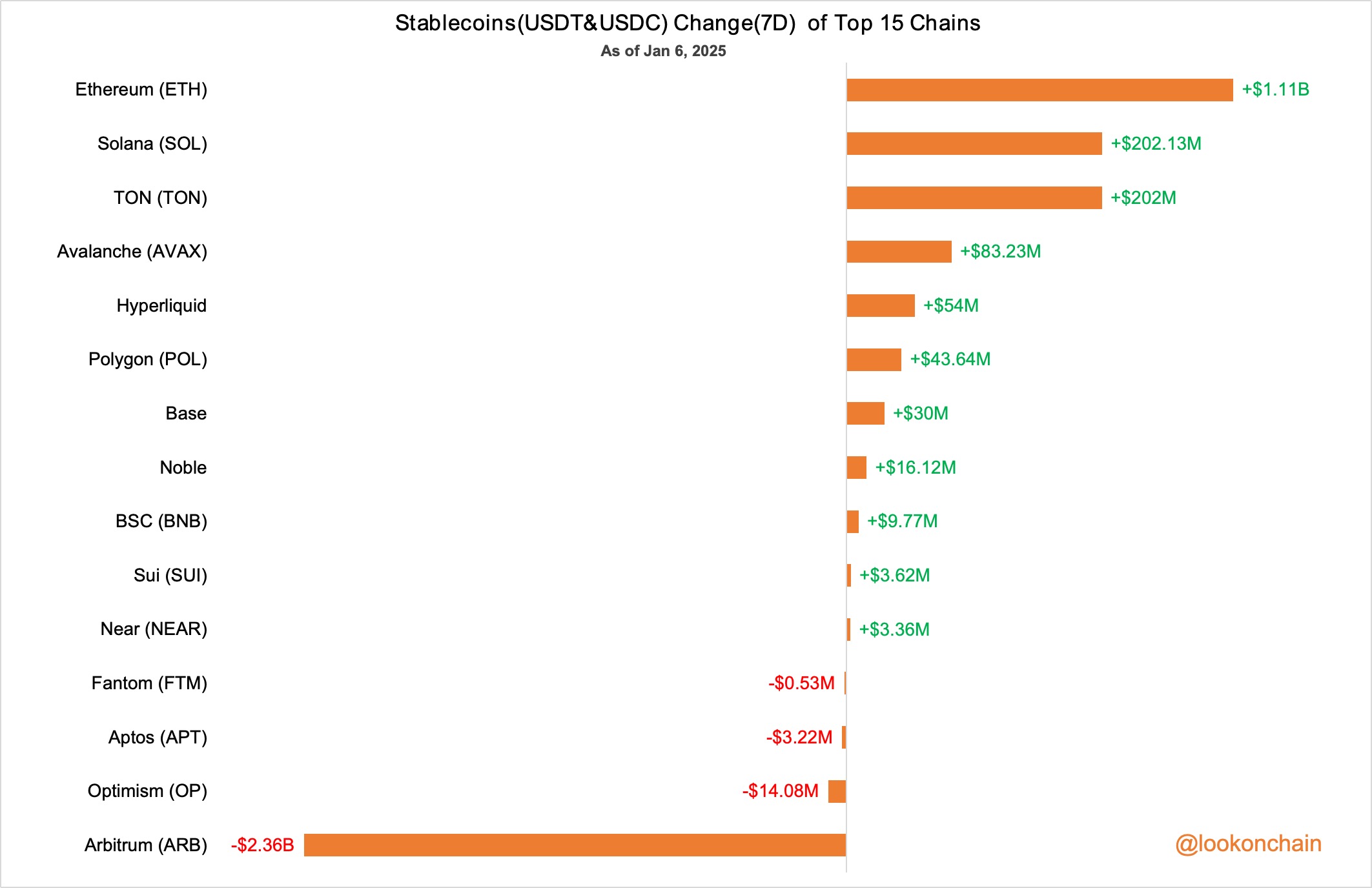

Ethereum’s stablecoin influx has considerably elevated, as 2025 will get underway, indicating heightened market exercise on its community. Stablecoins on Ethereum, akin to USDT and USDC, have risen an astounding $111 billion within the final seven days. Among the many main blockchain ecosystems, that is the best, indicating robust investor confidence and exercise. Solana, in distinction, noticed a stablecoin improve of $202.13 million, indicating strong however comparatively modest development.

A big influx of stablecoins normally indicators elevated ecosystemic liquidity and buying energy. With a purpose to purchase different digital property or participate in DeFi actions, buyers incessantly transfer stablecoins onto blockchain networks. Ethereum, the preferred good contract platform, continues to be the primary hub for these sorts of actions. On the identical time, $14.08 million price of stablecoins left Arbitrum, which may be an indication that liquidity is transferring again to Ethereum mainnet from layer-2 options.

However the rising acceptance of substitute options, this sample highlights Ethereum’s supremacy. This optimism is mirrored within the Ethereum value chart. With a major breakout above its predominant transferring averages, together with the 50 EMA, ETH is sustaining its stability at $3,642. Ethereum is positioned for a possible short-term take a look at of $4,000 primarily based on present momentum.

Buying and selling volumes, nonetheless, haven’t but elevated noticeably, suggesting that the market continues to be cautious. Ethereum continues to be not in overbought territory, with RSI ranges above 55 indicating potential for extra development. The bullish momentum of Ethereum could proceed if the stablecoin influx turns into energetic shopping for. Cash is being redistributed all through the broader cryptocurrency market, with Ethereum and Solana garnering curiosity.

This sample means that buyers could also be shifting again towards extra established ecosystems on the expense of more moderen chains, akin to Arbitrum. Inflows of stablecoins strengthen Ethereum’s standing because the market’s cornerstone.

As 2025 approaches, Ethereum appears able to take the lead. A vital indicator to regulate is the $1.11 billion stablecoin influx, which is able to most likely pave the best way for future enlargement and uptake within the coming weeks.