Twelve new crypto wallets collectively withdrew 156,733 Ethereum (ETH), value roughly $574 million, from Coinbase. This transaction occurred at a mean worth of $3,664 per ETH.

Nevertheless, regardless of this accumulation, the value of Ethereum has been struggling.

Will Ethereum Worth Drop 7%?

Based on information from the on-chain evaluation platform Spot On Chain, 11 of those 12 crypto wallets withdrew about 13,059 ETH. Notably, one crypto pockets – 0xdfa, withdrew a barely greater quantity, 13,084 ETH.

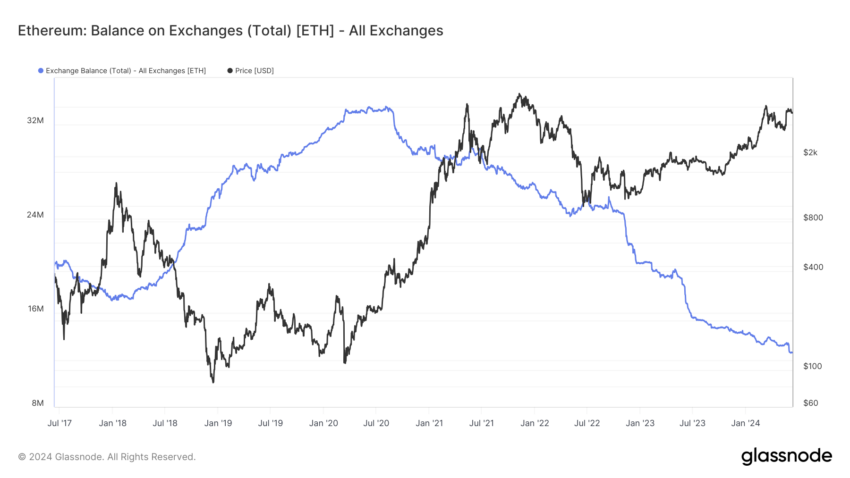

Concurrently, Ethereum’s availability on crypto exchanges has decreased considerably, reaching a seven-year low, as reported by the on-chain information from Glassnode. Lark Davis, an skilled crypto investor, make clear this development.

“ETH provide on exchanges is at a 7-year low. Ethereum ETFs are about to trigger a large provide shock. In consequence, the value of ETH may skyrocket,” Davis mentioned.

Learn extra: The best way to Put money into Ethereum ETFs?

Ethereum Stability on Trade. Supply: Glassnode

The crypto group is abuzz with the latest US Securities and Trade Fee’s (SEC) approval of spot Ethereum ETFs. This improvement marks an important development for the crypto market. It opens the door to potential substantial investments, reflecting the early success seen with Bitcoin ETFs.

Outstanding crypto researcher Bobby Banzai predicted month-to-month inflows of $569 million into Ethereum ETFs. His forecast is predicated on the efficiency of worldwide ETFs and Chicago Mercantile Trade futures information.

Regardless of these optimistic developments and market optimism, the instant worth impression for Ethereum has been unfavorable. After the massive withdrawals, Ethereum’s worth has fallen over 4% from Monday’s highs, presently buying and selling round $3,600.

Spot On Chain recommended that the contemporary wallets’ transactions may very well be a part of over-the-counter (OTC) offers, as they didn’t have an effect on the market worth straight.

Evaluation suggests a cautious short-term outlook for Ethereum, predicting a possible 7% correction from its present market worth. Since Could 20, Ethereum has been consolidating between $3,624 and $3,950.

Nevertheless, ETH confronted challenges this Tuesday, buying and selling at $3,551 and presumably breaking down from the established vary. If this downward development persists, Ethereum may discover its subsequent assist stage round $3,302.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

The broader crypto market can be present process a correction section. Up to now 24 hours, Bitcoin has declined about 3%, BNB practically 7%, and Solana 3.5%.