- SEC delays determination on Ethereum ETF S-1 drafts as analysts shifted their potential launch date once more.

- Ethereum whale dangers liquidation if ETH declines to $2,984.

- Ethereum breaches key help amid key perception from CME open curiosity.

Ethereum is down greater than 5% on Thursday following the Securities & Alternate Fee’s (SEC) failure to approve ETH ETF issuers’ S-1 drafts. In the meantime, the current decline has strengthened the bearish outlook after ETH moved beneath a key help degree, sparking $90 million in lengthy liquidations.

Day by day digest market movers: SEC but to approve ETH ETF

Regardless of its gentle feedback on issuers’ S-1 drafts, the SEC has but to approve spot ETH ETFs following the US Independence Day vacation. Consequently, Bloomberg analyst James Seyffart shifted his over/below date for a possible approval to subsequent weekend.

The SEC accredited spot ETH ETF issuers’ 19b-4 filings in Might, but in addition have to log out on their S-1s earlier than the merchandise go stay.

Nate Geraci, President of ETF Retailer, famous that the SEC expects issuers to amend their S-1s by July 8, with one other spherical of filings probably due round July 12. This “would theoretically imply launch week of July 15” for spot ETH ETFs, wrote Geraci in an X submit.

In the meantime, following the current market decline, a whale who longed ETH by way of the Compound protocol is about to be liquidated, in response to knowledge from Lookonchain. The whale deposited 12,734 ETH price $40 million to Compound and borrowed $31.4 million price of dollar-denominated stablecoins with a well being price of 1.06. The whale dangers liquidation if the value of ETH drops to $2,984.

ETH technical evaluation: Ethereum bears lead market amid slight bullish sentiment from US buyers

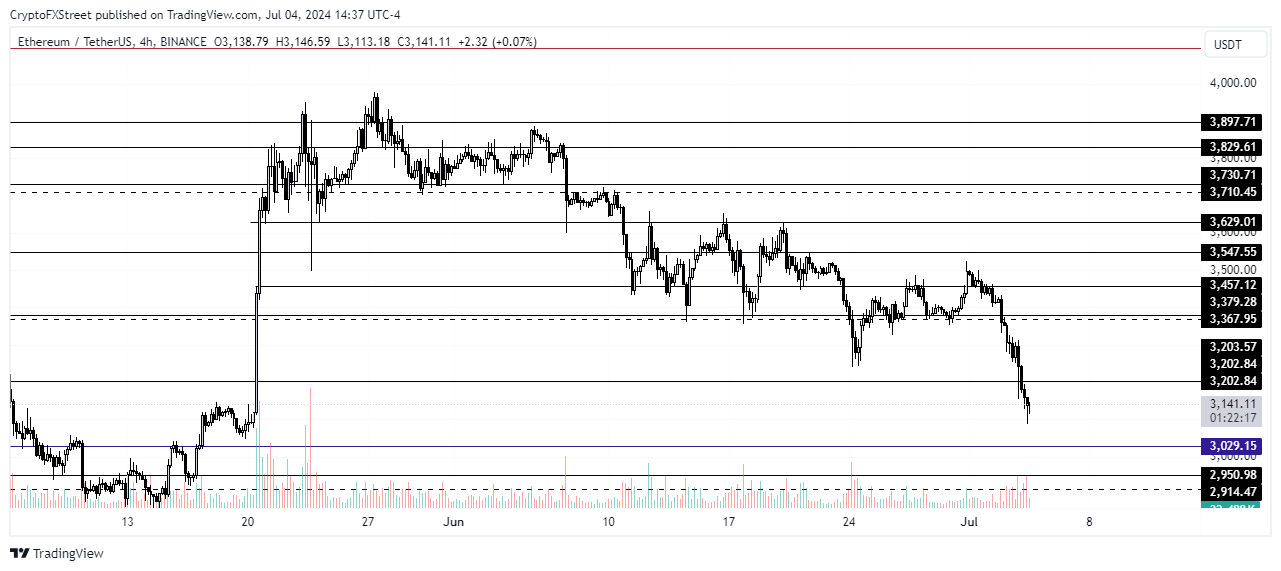

Ethereum is buying and selling round $3,132 on Thursday, down greater than 5% on the day. The decline worn out greater than $90.81 million price of lengthy positions from the market, bringing the entire ETH liquidations to $102.48 million previously 24 hours.

ETH has now breached the $3,203 key help degree, strengthening its bearish outlook. With the transfer, ETH has absolutely balanced the market inefficiency from itsprice spike following information of the SEC’s U-turn on spot ETH ETFs.

ETH/USDT 4-hour chart

ETH might take a look at the $3,029 help degree within the subsequent few hours. A bounce from this degree will cool the bearish momentum. Nonetheless, a transfer beneath it could see ETH looking for help across the $2,852 worth degree.

Previously 24 hours, Ethereum’s futures open curiosity (OI) throughout high exchanges declined by virtually 5%. Open curiosity is the variety of excellent contracts in a derivatives market which can be but to be settled.

Whereas the transfer signified wider threat aversion from merchants, Ethereum’s CME OI was an outlier, rising virtually 1% within the final 24 hours. This means that US buyers could also be barely bullish regardless of declining costs on account of expectations of spot ETH ETFs’ launch.

One other key perception is that spot ETH ETFs might expertise spectacular flows utilizing the rising ETH CME OI as a proxy to measure buyers’ sentiment. Consequently, ETH might take bears abruptly and rally previous its yearly excessive, invalidating the bearish thesis.