- Ethereum’s alternate reserve elevated by 163K ETH prior to now 5 days.

- Ethereum has added over 4 million new holders prior to now three months.

- Ethereum might bounce close to $2,400 assist after transferring common resistance.

Ethereum (ETH) is down over 2% on Tuesday following a sign of promoting strain as a consequence of an uptick in its alternate reserve. Nevertheless, different on-chain metrics point out combined investor sentiment amid ETH’s worth consolidation.

Day by day digest market movers: ETH rising alternate reserve, new holders uptrend

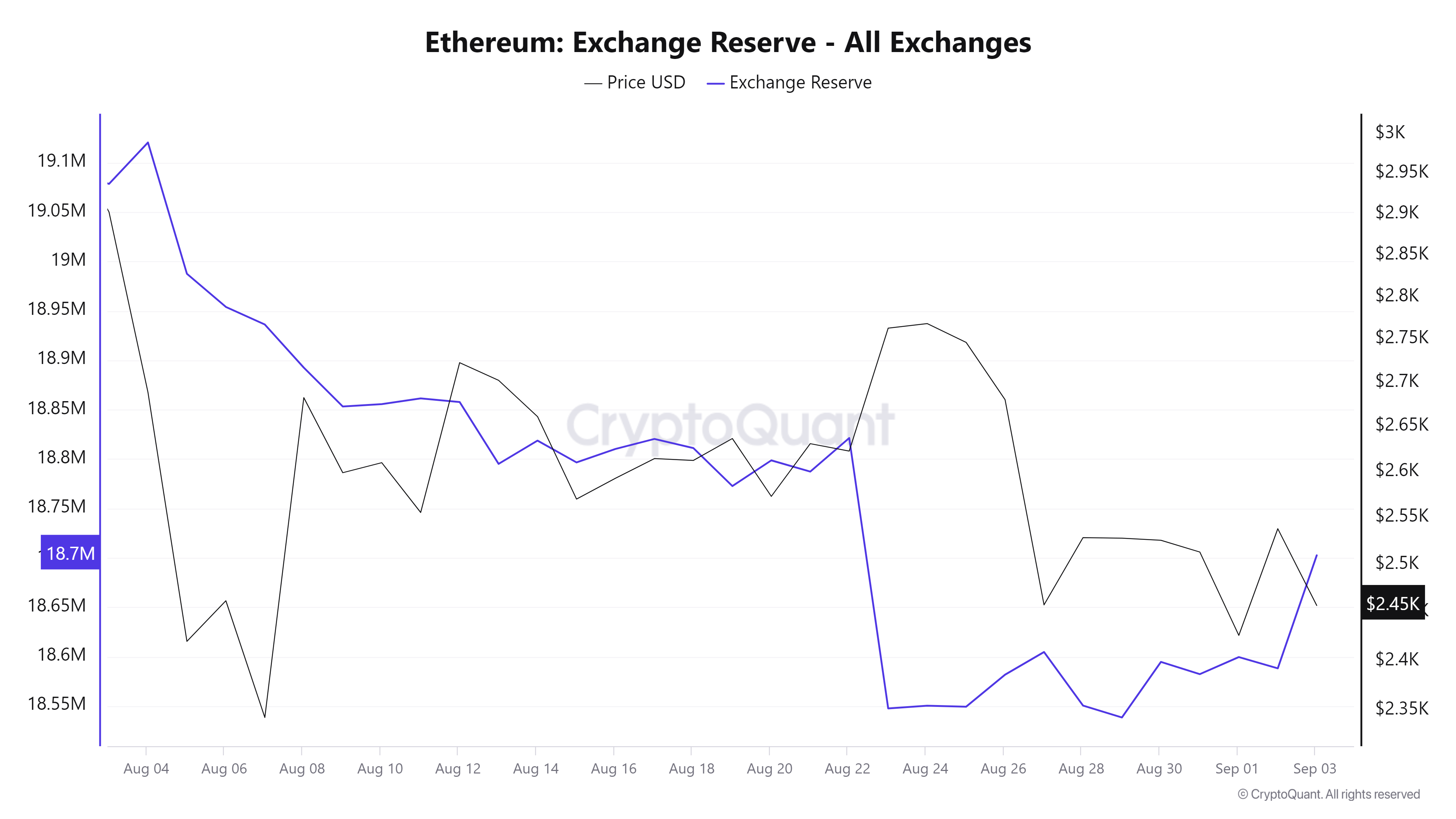

Since August 29, Ethereum’s alternate reserve has switched from a downtrend to an uptrend. Trade reserve is the full quantity of a cryptocurrency held in an alternate. A rise in an asset’s alternate reserve signifies larger promoting strain and vice versa for a lower.

In keeping with CryptoQuant’s knowledge, Ethereum’s alternate reserve elevated by about 163K ETH, value about $407.5 million, prior to now 5 days. Because of this, ETH could seemingly see short-term promoting strain till its alternate reserve begins declining once more.

ETH Trade Reserve

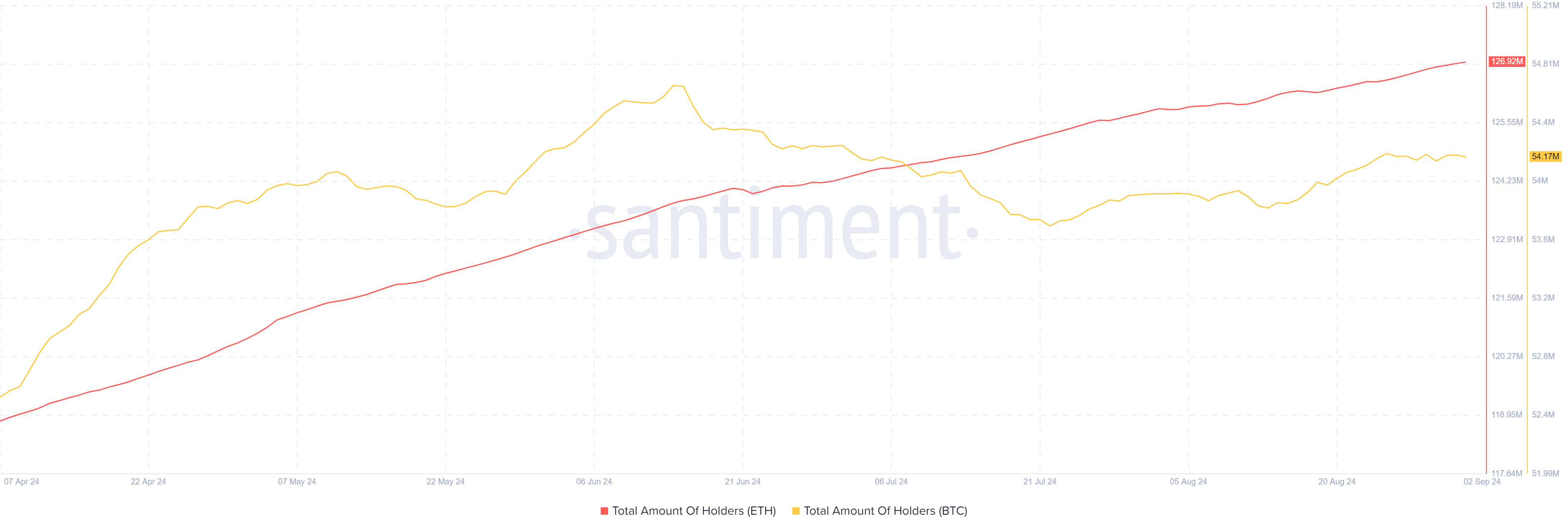

In the meantime, regardless of Ethereum’s worth lag, its whole variety of holders has been in an uptrend, including over 4 million new non-empty wallets prior to now three months, per Santiment knowledge. This takes the full variety of ETH holders to almost 127 million, which means new market contributors could also be betting on an ETH worth improve in the long run. Compared, BTC’s whole holders declined by 50K throughout the identical interval.

ETH vs BTC Complete Holders

Whereas the Ethereum holders’ rely is rising, whale exercise inside the community has declined significantly from its peak throughout the market rally in early March. In keeping with Santiment’s knowledge, Ethereum’s whale transaction rely declined from over 115K whale transactions between March 13-19 to 31.8K between August 21 and 27 — solely about one-quarter of the March whale transaction rely.

The decline is evidenced by the lowered volatility of ETH prior to now few months, with the one exception being the market surge on Might 20 and the crash on August 5. Whale exercise usually peaks when volatility will increase, famous Santiment analysts.

ETH technical evaluation: Ethereum might bounce round key assist degree

Ethereum is buying and selling round $2,450 on Tuesday, down 2.5% on the day. Previously 24 hours, ETH has seen liquidations value $26.94 million, with lengthy and brief liquidations accounting for $22.13 million and $4.81 million, respectively.

On the 4-hour chart, ETH’s upward transfer was restricted by a convergence of the 200-day, 100-day and 50-day Easy Shifting Averages (SMA) within the European buying and selling session. Because of this, ETH is trying a transfer downward inside a key rectangle with assist and resistance ranges at $2,400 and $2,817, resepectively.

ETH/USDT 4-hour chart

ETH could bounce across the $2,400 assist degree and stage one other transfer up, however solely after probably liquidating positions value $40.8 million on the $2,424 degree, per Coinglass knowledge.

A transfer exterior the important thing rectangle will seemingly decide ETH’s subsequent worth development. A breach of the $2,400 assist degree might ship ETH towards $2,111. A profitable breakout above the $2,817 degree and SMA resistance will see ETH rally towards $3,237.

The Relative Power Index (RSI) and Stochastic Oscillator’s (Stoch) %Ok line are trending under their midlines, indicating a short-term bearish outlook.