Ethereum’s worth is holding regular in a key zone immediately, buying and selling between $3,056 to $3,083 over the previous hour. With a mixture of impartial oscillators and largely optimistic shifting averages, the market sentiment appears divided, giving merchants an important second to guage methods throughout varied timeframes.

Ethereum

Lately, ethereum (ETH) encountered a dip, discovering assist at $3,044.5 and resistance at $3,163. Promoting exercise picked up noticeably, fueling bearish vibes. A bearish engulfing candle round $3,080 hints at short-term promoting stress. Nevertheless, merchants would possibly spot a brief shopping for alternative if the worth bounces off $3,044.5 and types bullish candlestick patterns. Coming into between $3,045 and $3,050, aiming for income at $3,100, might be worthwhile—with a cautious stop-loss set under $3,030.

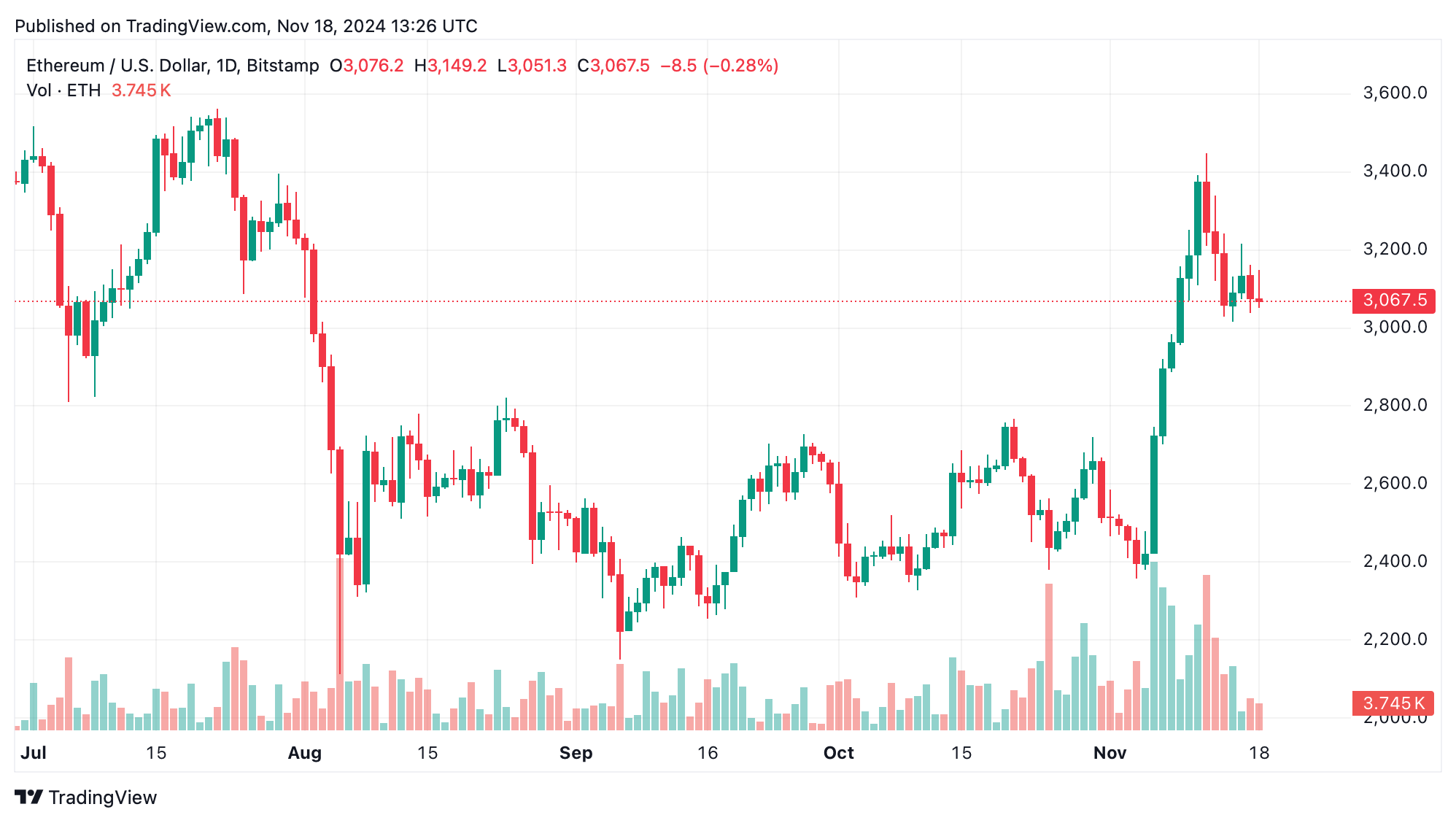

ETH/USD every day chart by way of Bitstamp on Nov. 18, 2024.

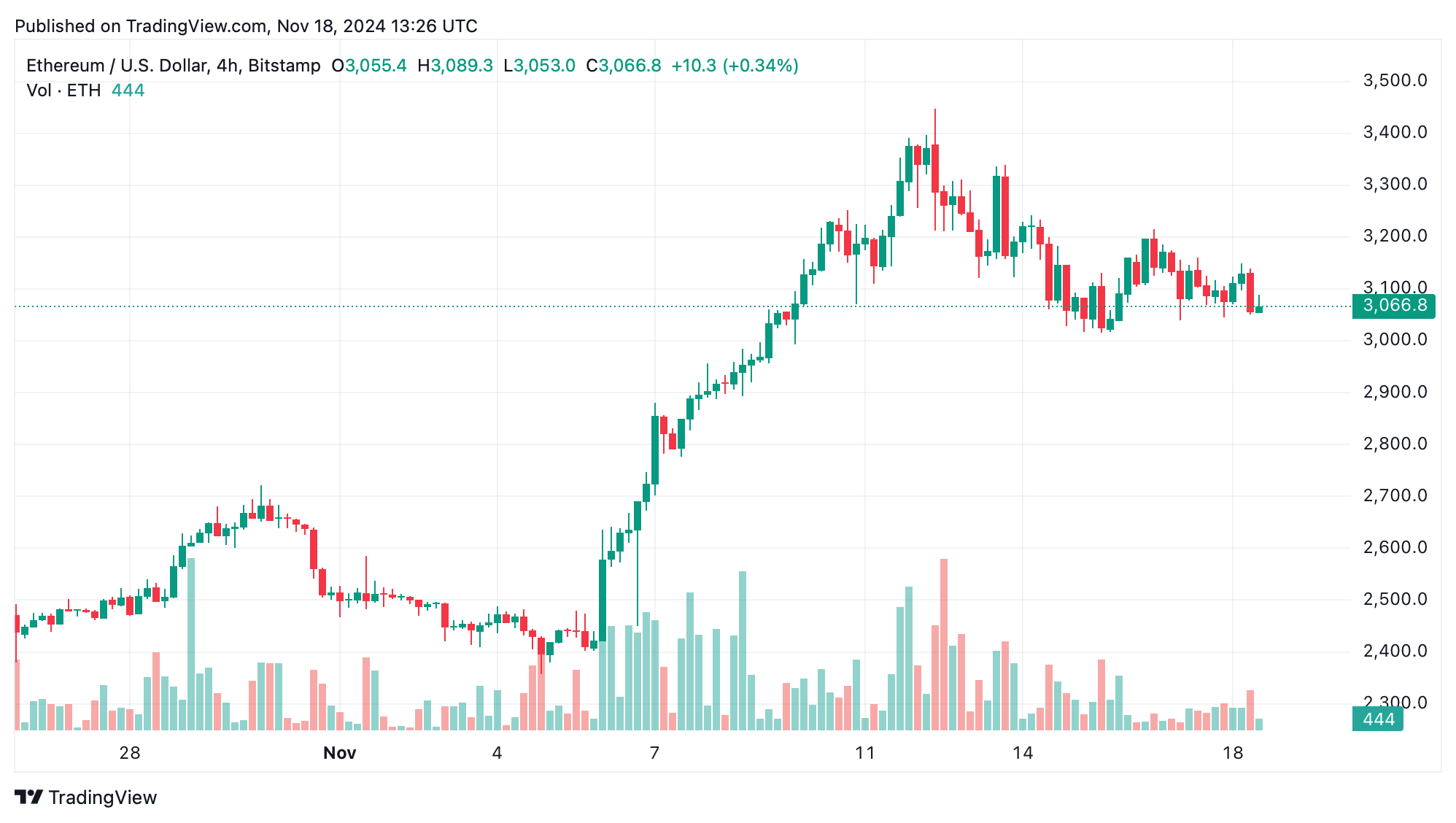

On the 4-hour chart, ethereum is exhibiting a downward development with decrease highs and lows, underpinned by assist at $3,014.5 and resistance starting from $3,150 to $3,200. Robust promoting exercise confirms resistance at $3,200. A breakout above $3,150 might flip the tide, but when assist at $3,015 fails, decrease ranges are more likely to be examined. Threat-averse merchants would possibly await clearer alerts earlier than making strikes, maintaining stop-losses tight amid the volatility.

ETH/USD 4-hour chart by way of Bitstamp on Nov. 18, 2024.

Ethereum skilled a powerful climb from $2,355.6 to $3,451.8, adopted by a interval of consolidation close to $3,100. The lack to clear the $3,200 to $3,300 resistance zone led to a wholesome pullback. Help between $3,000 and $3,050 stays essential. A drop under $3,000 may push costs towards $2,800, whereas a strong protection may lay the groundwork for an additional climb towards $3,450.

ETH/USD 1-hour chart by way of Bitstamp on Nov. 18, 2024.

Indicators current a combined bag: the relative power index (RSI) at 60.2 and the Stochastic at 67.6 factors to a impartial stance, signaling a tug-of-war between patrons and sellers. In the meantime, the shifting common convergence divergence (MACD) at 151.5 leans bullish, although the momentum oscillator at 116.3 displays bearish tendencies. This mix means that merchants ought to search sturdy affirmation earlier than making strikes.

Longer-term shifting averages (MAs) reveal a constructive development. The 50-period exponential shifting common (EMA) at $2,765.0 and the 200-period EMA at $2,798.8 point out shopping for alternatives, whereas the short-term easy shifting common (SMA) at $3,156.9 reveals bearish divergence. Merchants can use these insights to craft entry and exit plans aligned with their chosen timeframes.

Bull Verdict:

Ethereum stays poised for potential upward momentum if it holds key assist ranges round $3,044.5 and manages to reclaim resistance zones above $3,150. With bullish indicators from the MACD and longer-term EMAs signaling shopping for alternatives, a rebound may set the stage for an additional rally focusing on $3,450. Merchants with an optimistic outlook might discover this a promising setup to capitalize on near-term market alternatives.

Bear Verdict:

The market faces heightened danger as ethereum struggles to keep up essential assist ranges close to $3,015. Elevated promoting stress, bearish chart patterns, and short-term SMA divergence recommend the potential for additional declines. If assist at $3,000 offers means, the worth may slip towards $2,800, leaving cautious merchants to await stronger indicators of stabilization earlier than contemplating entries.