Ethereum (ETH), the second-largest cryptocurrency by market capitalization, continues to play a significant position within the blockchain ecosystem, serving as the muse for decentralized finance (DeFi), non-fungible tokens (NFTs), and numerous dApps. With its value lately encountering key resistance and assist ranges, merchants and traders are intently monitoring ETH’s trajectory. On this evaluation, we’ll study Ethereum’s value chart, specializing in technical indicators and key market patterns, to find out what might be subsequent for ETH within the brief to medium time period.

How has the Ethereum Worth Moved lately?

Ethereum is presently buying and selling at $3,217, with a 24-hour buying and selling quantity of $23.06 billion. The cryptocurrency has a market capitalization of $386.66 billion, commanding a market dominance of 11.38%. Over the previous 24 hours, the worth of ETH has dropped by 1.16%.

Ethereum achieved its all-time excessive value of $4,867.17 on November 10, 2021, whereas its all-time low of $0.420897 was recorded on October 21, 2015. Since reaching its peak, ETH’s lowest value has been $897.01 (cycle low), and its highest value since that cycle low was $4,094.18 (cycle excessive). The present market sentiment for Ethereum stays bearish, with the Concern & Greed Index indicating a worth of 70 (Greed).

The circulating provide of Ethereum stands at 120.49 million ETH, with a yearly inflation price of 0.26%, equating to a further 309,826 ETH created over the previous 12 months.

ETH Worth Prediction: Chart Evaluation

ETH/USD Each day Chart- TradingView

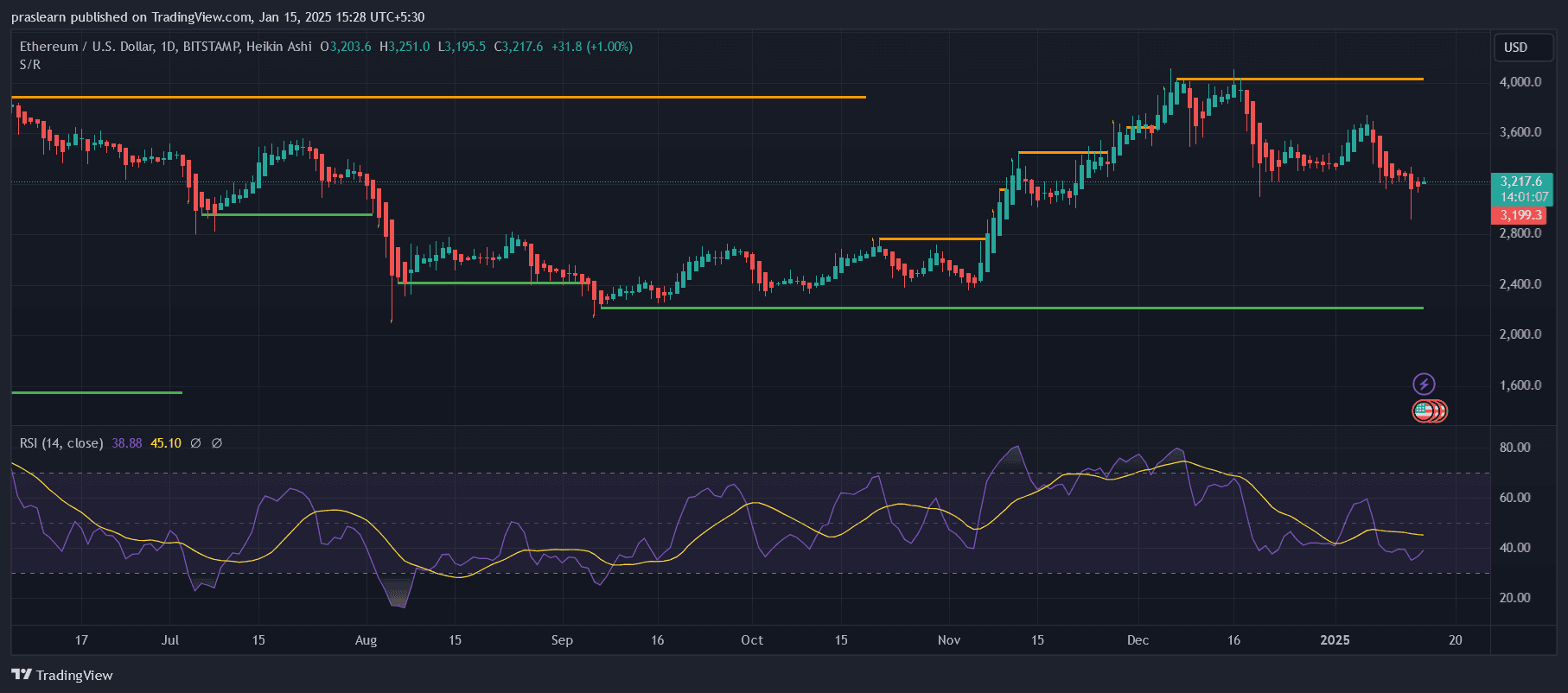

The each day chart reveals Ethereum buying and selling round $3,217, recovering marginally from its latest low of $3,199. ETH Worth motion has exhibited a transparent rejection close to the $4,000 resistance zone, marked by a horizontal orange line. Conversely, assist on the $2,800 stage (horizontal inexperienced line) has remained sturdy, forming an important ground for consumers.

Key Observations

Help and Resistance Ranges

- Resistance Zones: The value failed to interrupt above $4,000, reflecting robust vendor curiosity at this stage. This zone has acted as a important ceiling in the previous couple of months.

- Help Zones: The $2,800 mark has confirmed to be a dependable assist stage, offering a stable base for value restoration in earlier downtrends.

RSI Insights

- The Relative Energy Index (RSI) on the 14-day interval hovers at 38.88, indicating oversold circumstances. This implies that the latest sell-off could also be nearing exhaustion, probably paving the best way for a rebound.

- Nonetheless, RSI’s failure to cross above the midline (50) up to now displays weak bullish momentum, which may delay a robust restoration.

Development Momentum

- The value is presently beneath key transferring averages, signaling a bearish bias within the brief time period. This aligns with the lack to maintain beneficial properties above the $3,600-$3,800 vary.

- The Heikin Ashi candles present an absence of robust bullish momentum, with latest candles reflecting hesitation and bearish continuation.

What’s Subsequent for ETH?

- Bullish Situation If ETH sustains above the $3,200 stage and RSI begins to rise above 45, a possible breakout above $3,600 may happen. This transfer would probably goal the $4,000 resistance stage as soon as once more. A decisive breakout above $4,000 may sign renewed bullish energy, opening the trail to $4,200 and past.

- Bearish Situation Failure to keep up the $3,200 assist may push ETH again towards the $2,800 zone. If this assist is breached, additional draw back is feasible, with $2,400 being the following important stage of curiosity.

- Impartial Situation ETH may consolidate between $3,200 and $3,600 because the market digests latest value motion. This range-bound exercise might proceed till a robust basic or technical catalyst emerges.

Conclusion

Ethereum’s value presently sits at a pivotal juncture, with the market going through key assist at $3,200 and resistance at $4,000. Whereas the RSI signifies potential oversold circumstances, signaling an opportunity for restoration, general market momentum seems to lean bearish. Merchants ought to intently monitor ETH’s interplay with the $3,200 and $2,800 ranges within the coming days, in addition to broader market developments, together with Bitcoin’s motion.

ETH’s medium-term outlook hinges on breaking key resistance ranges to rekindle bullish sentiment or sustaining important helps to keep away from a deeper correction. Keep alert to updates within the macroeconomic surroundings and Ethereum’s ecosystem developments, as these will affect the worth trajectory considerably.