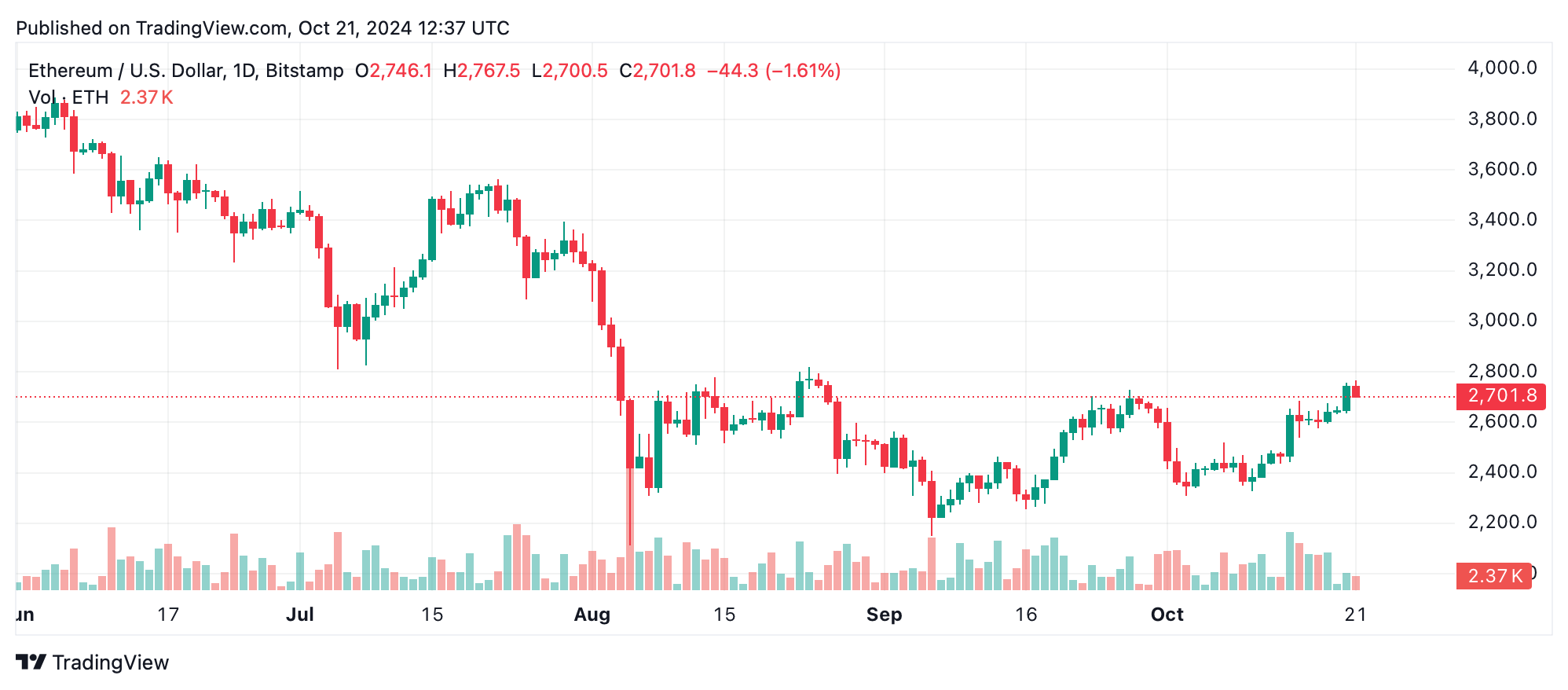

On Oct. 21, 2024, ethereum holds regular at $2,706, sticking inside a key buying and selling zone after not too long ago hitting a excessive of $2,769. Technical indicators throughout numerous timeframes paint a combined image, as oscillators recommend warning whereas transferring averages nonetheless level to a largely bullish pattern. As ether hovers between help and resistance, merchants ought to keep vigilant for any shifts in value motion.

Ethereum

Zooming in on the day by day chart, ethereum’s uptrend capped at $2,769 earlier than seeing a minor pullback. With the relative power index (RSI) sitting comfortably at 63.5, the market isn’t signaling overbought circumstances, although the potential for promoting strain will increase with any additional climb. Regardless of a drop after the current excessive, the 10-day and 20-day exponential transferring averages (EMAs) stay above the present value, reflecting ongoing constructive momentum.

ETH/USD day by day chart.

On the 4-hour chart, the worth correction turns into clearer, with a number of downturns forming after a brisk rally. This coincides with the Stochastic oscillator’s excessive studying of 91, hinting at an overbought state of affairs. But, ethereum is managing to search out help within the $2,640-$2,700 vary, aligning with the 30-period easy transferring common (SMA) for this timeframe. The discount in quantity throughout this pullback suggests the correction lacks a powerful promoting pressure, no less than for now.

ETH/USD 4-hour chart.

Within the 1-hour chart, a short-term dip is obvious as consecutive purple candles dragged the worth all the way down to $2,700. A small upswing hints at a potential stabilization try, however the superior oscillator stays impartial, indicating that additional indicators of a pattern reversal are nonetheless wanted. In the meantime, short-term transferring averages, just like the 10-period exponential transferring common (EMA), are offering help, reinforcing the consolidation sample.

Key technical ranges warrant shut consideration within the coming periods. The $2,640-$2,700 vary is a vital help zone, backed by a number of transferring averages. On the opposite aspect, the current peak of $2,769 stands as a essential resistance level. A bullish breakout past this degree may pave the way in which for extra positive aspects, whereas a failure to keep up help may push the worth down towards $2,550.

Bull Verdict:

The general technical image leans bullish, supported by a number of transferring averages signaling purchase circumstances and the worth holding key help zones. If ethereum maintains help close to $2,640-$2,700 and positive aspects momentum from oscillators turning constructive, a breakout above $2,769 may pave the way in which for additional positive aspects.

Bear Verdict:

Whereas the pattern stays technically constructive, warning is warranted. The excessive readings on sure oscillators and the lack of bullish momentum at current highs trace at potential exhaustion. A decisive break beneath $2,635 per ether, paired with promote indicators from oscillators, may usher in a deeper correction towards the $2,550 degree or decrease.