Ethereum’s worth has just lately skilled an enormous spike following the information of its ETF being accredited.

Whereas the pattern is bullish, there’s nonetheless one impediment left, because the asset has failed to beat the coveted $4,000 stage.

Technical Evaluation

By TradingRage

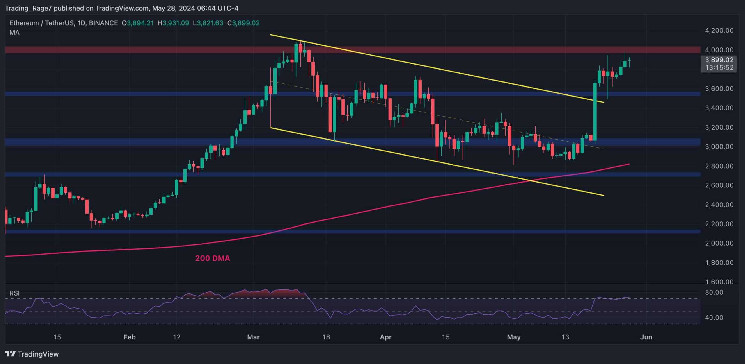

The Every day Chart

Because the each day chart demonstrates, Ethereum’s worth has been correcting in a big descending channel for the previous couple of months. But, the asset lastly broke the channel and the $3,600 resistance stage to the upside final week, following the ETF information.

The market is at the moment testing the $4,000 resistance zone, with the Relative Energy Index on the verge of coming into the overbought area. Whereas the RSI values are worrying, the market might nonetheless break above $4,000 within the brief time period earlier than experiencing a possible pullback.

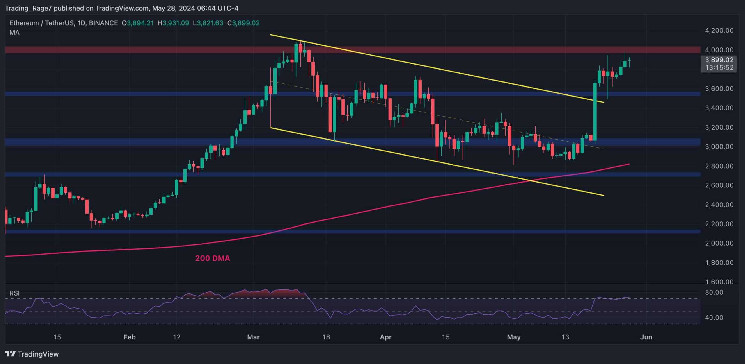

The 4-Hour Chart

On the 4-hour timeframe, it’s evident that the market has begun to rally ever since breaking above the channel’s midline and the $3,000 stage. Whereas the market has been creating increased highs and lows just lately, the RSI has been creating decrease highs, pointing to a possible bearish divergence.

But, so long as the RSI stays above 50%, the momentum shall be in favor of a bullish continuation, and the value might break above the $4,000 mark.

Sentiment Evaluation

By TradingRage

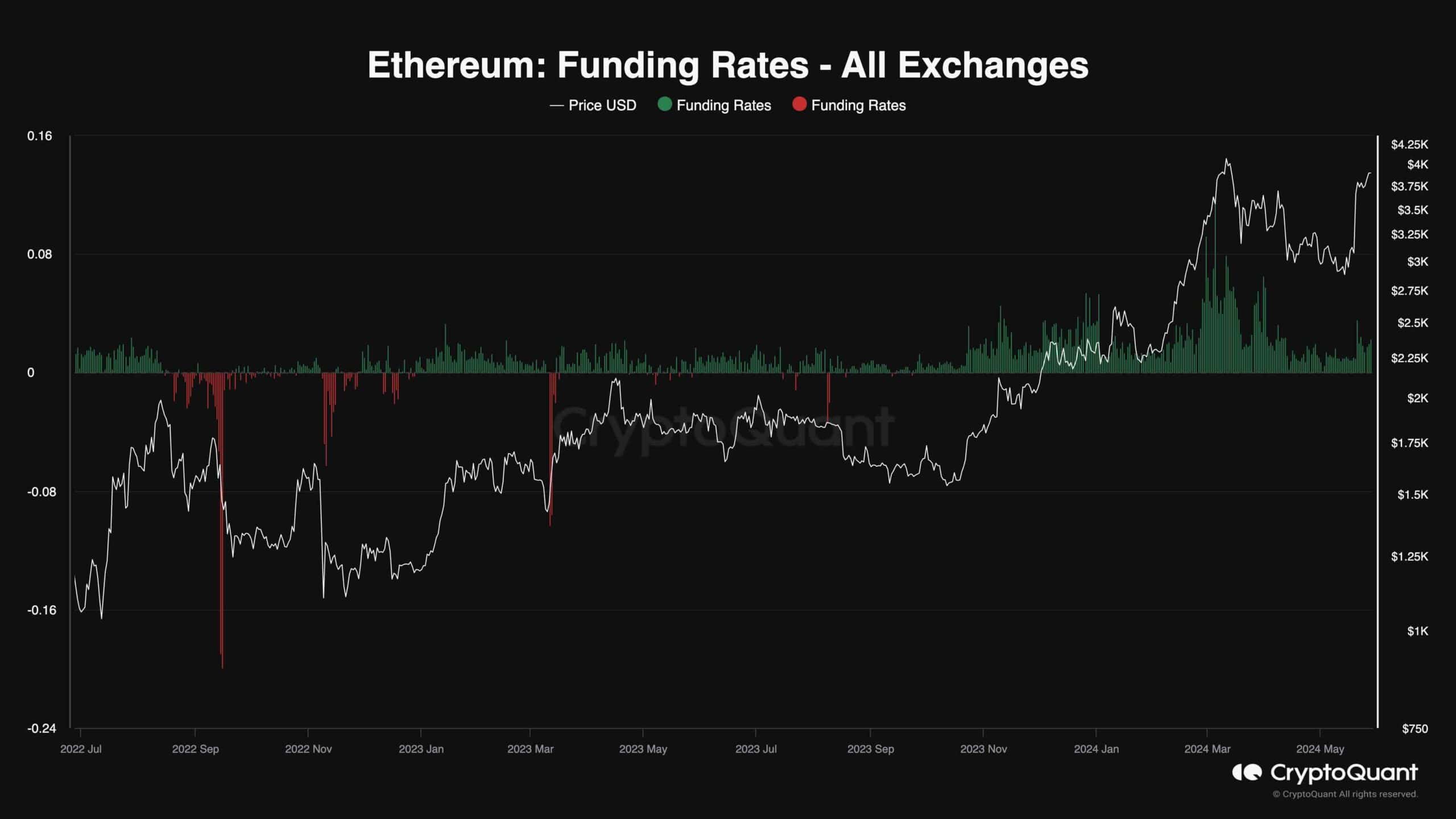

Funding Charges

Ethereum’s worth is at the moment rallying aggressively towards the current excessive of $4,000. Whereas it’s likelier than earlier than for ETH to interrupt above $4,000 and transfer towards a brand new all-time excessive, futures merchants appear pessimistic, and this isn’t a nasty signal.

This chart demonstrates the Ethereum funding charges. This metric is among the finest futures market sentiment analysis sources. Constructive values point out bullish sentiment and damaging ones are related to a bearish ambiance.

Whereas ETH’s worth is at the moment testing the $4,000 resistance stage, funding price values are considerably decrease than what they had been in March when the value was as soon as once more round $4,000. It is a good signal, indicating that the futures market isn’t overheated this time round, and there’s a decrease chance for an extended liquidation cascade in comparison with earlier than.