Ethereum’s worth has failed to interrupt above the $4,000 resistance degree as soon as extra and is but to create a brand new all-time excessive.

Nevertheless, the market is exhibiting resilience in comparison with different cash in the course of the present correction part.

Technical Evaluation

By TradingRage

The Each day Chart

Because the each day timeframe exhibits, ETH’s worth has dropped again to $3,500 after getting rejected from the $4,000 resistance degree as soon as once more. Presently, the $3,500 mark is holding and stopping the worth from an additional decline towards $3,000.

But, if the $3,500 degree is damaged to the draw back, the market will almost certainly transfer rapidly towards the $3,000 help zone and the 200-day transferring common close by.

These coinciding parts would make the $3,500 degree key, and the worth’s response to it could possible resolve how the market will transfer within the coming months.

The 4-Hour Chart

The value has been hovering across the $3,500 degree within the 4-hour timeframe. A classical chart sample has additionally been forming round this zone, which the worth has failed to interrupt to both facet.

So, the path of the upcoming transfer depends upon the path of the potential breakout from this sample.

The RSI additionally oscillates round 50%, so not a lot could be drawn from it, because it exhibits that the momentum is roughly in equilibrium.

Sentiment Evaluation

By TradingRage

Open Curiosity

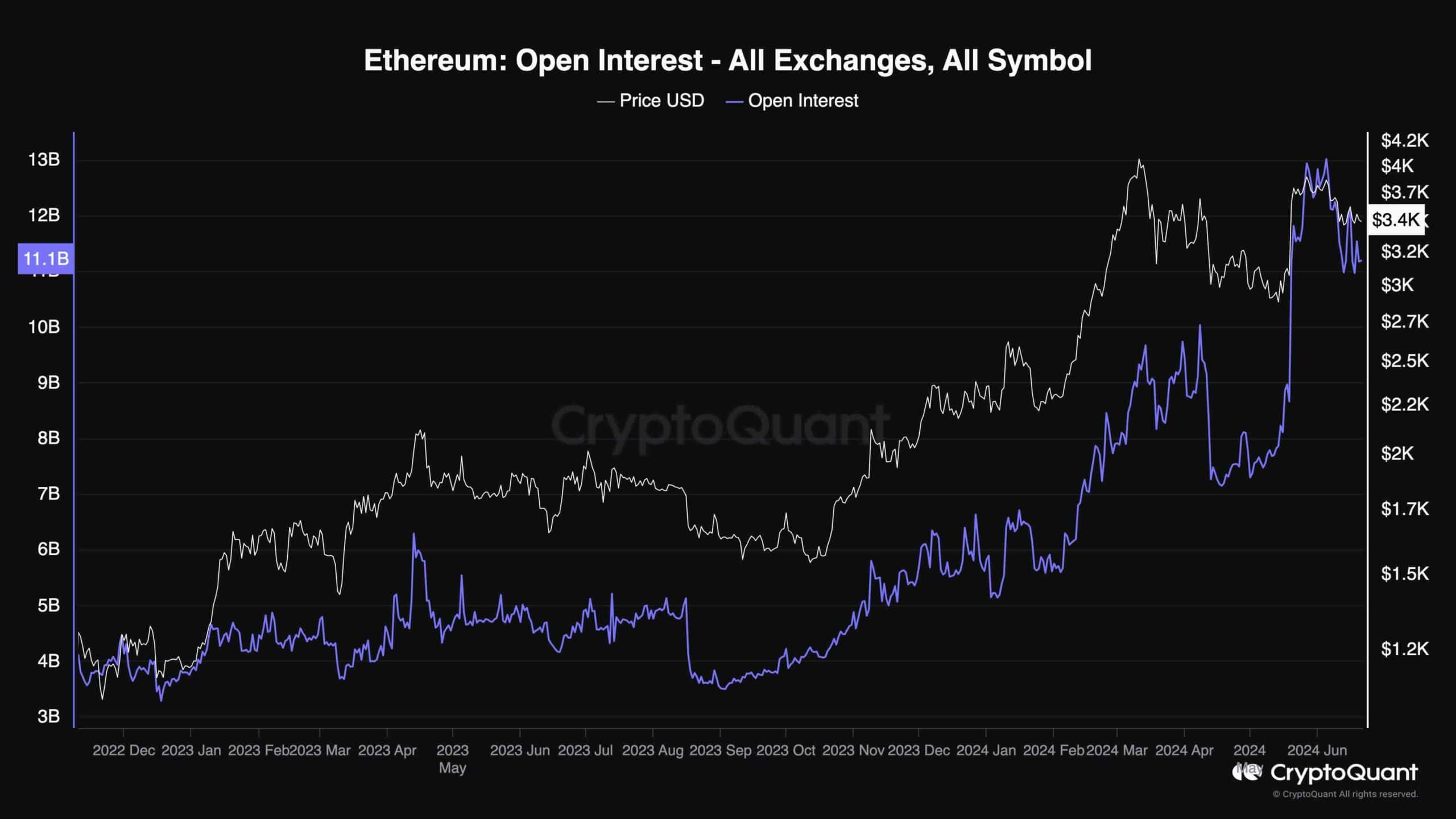

This chart demonstrates the Ethereum open curiosity on all exchanges, which is the worth of all futures contracts. Excessive values usually result in volatility as a consequence of potential liquidation cascades.

Since ETH’s worth has recovered from the $3,000 help degree, the Open curiosity has massively spiked from round 7 Billion to nearly 13 Billion.

This improve has in all probability led to the latest restoration, as a few of these over-leveraged positions have been liquidated and have utilized promoting strain in the marketplace. In the meantime, extra downsides are doable, because the Open Curiosity continues to be a lot greater than in March when ETH was buying and selling across the identical costs.