Ethereum has lately skilled a surge in shopping for exercise, discovering sturdy assist on the crucial $3.5K degree, triggering a bullish rebound.

Regardless of this restoration, the $4K resistance stays a major barrier that ETH patrons intention to beat within the mid-term.

Technical Evaluation

By Shayan

The Every day Chart

Ethereum’s value motion has been characterised by a notable rebound after encountering assist on the decisive $3.5K degree. This area served as a pivotal accumulation zone, fostering elevated shopping for stress and a subsequent upward surge. As the value climbs, the $4K resistance emerges as a crucial psychological and technical barrier, requiring a decisive breakout to ascertain a sustained upward trajectory.

Presently, Ethereum is consolidating throughout the $3.5K-$4K vary, indicating a possible breakout in both path. A profitable breach of the $4K threshold might set the stage for a contemporary rally and affirm bullish sentiment. Conversely, a rejection at this degree might result in additional consolidation or retracement throughout the present vary.

The 4-Hour Chart

On the decrease timeframe, Ethereum’s decline discovered stable assist inside the important thing 0.5 ($3.2K)–0.618 ($3K) Fibonacci retracement ranges. This assist zone attracted substantial shopping for curiosity, halting the downtrend and sparking a bullish restoration.

The following accumulation section has transitioned right into a bullish spike, with Ethereum now eyeing the crucial $4K resistance. This degree, coinciding with a earlier vital swing excessive, is anticipated to be a powerful promoting stress zone.

Ethereum’s value motion on the $4K degree will decide its future trajectory. A profitable breakout above this resistance might result in a strong rally, whereas a failure may lead to extended consolidation or a possible retest of decrease assist ranges close to $3.5K.

Onchain Evaluation

By Shayan

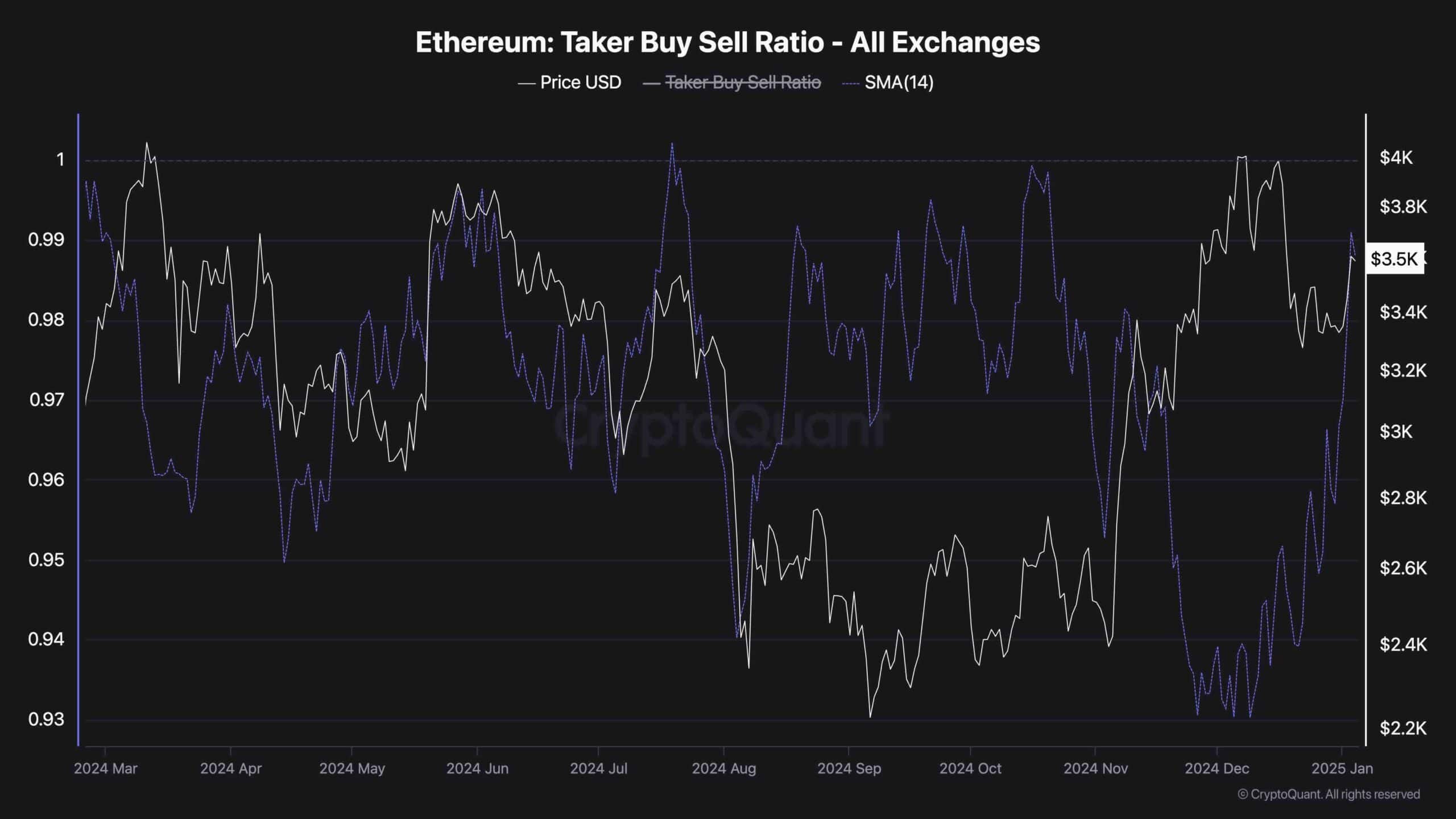

The Taker Purchase Promote Ratio, a pivotal metric for assessing sentiment within the futures market, gives insights into whether or not patrons or sellers are extra aggressive in executing market orders. Following Ethereum’s bullish rebound close to the $3K assist, this metric has exhibited a notable uptick, indicating a surge in market purchase orders throughout the futures market.

This pattern means that futures market contributors are more and more optimistic about Ethereum’s short-term value trajectory, anticipating the asset to push towards the $4K resistance.

Takers’ Purchase/Promote Ratio exceeding 1 means patrons are overwhelmingly dominant, typically aligning with the onset of a bullish pattern. The present information underscores this sentiment shift, reflecting heightened confidence amongst merchants and an expectation of continued upward momentum.