USA: Lenient $125M Superb on Ripple Sparked Market Restoration

Ethereum, just like the broader crypto market, began the week on a downtrend, with a pointy market crash on Monday, August 5, pulling ETH to a multi-month low of $2,110.

Nevertheless, on August 7, the U.S. court docket’s resolution to impose a comparatively lenient $125 million nice on Ripple marked a major turning level. The decision of Ripple’s extended authorized battle with the SEC had been a serious overhang for the market.

The perceived authorized readability from US regulators instilled renewed confidence in buyers, triggering a swift restoration in Ethereum’s value, which rapidly rallied again in direction of $2,600. Though ETH initially confronted resistance at this stage, general market sentiment shifted to a extra optimistic outlook.

Brazil: Solana ETFs Approval Anticipated to Deepen Crypto and ETH Adoption

On August 8, Ethereum acquired a further enhance when Brazil accepted the primary Solana ETFs. This transfer, signaling rising institutional curiosity within the cryptocurrency market, is anticipated to deepen crypto adoption in Brazil, one in every of Latin America’s largest economies.

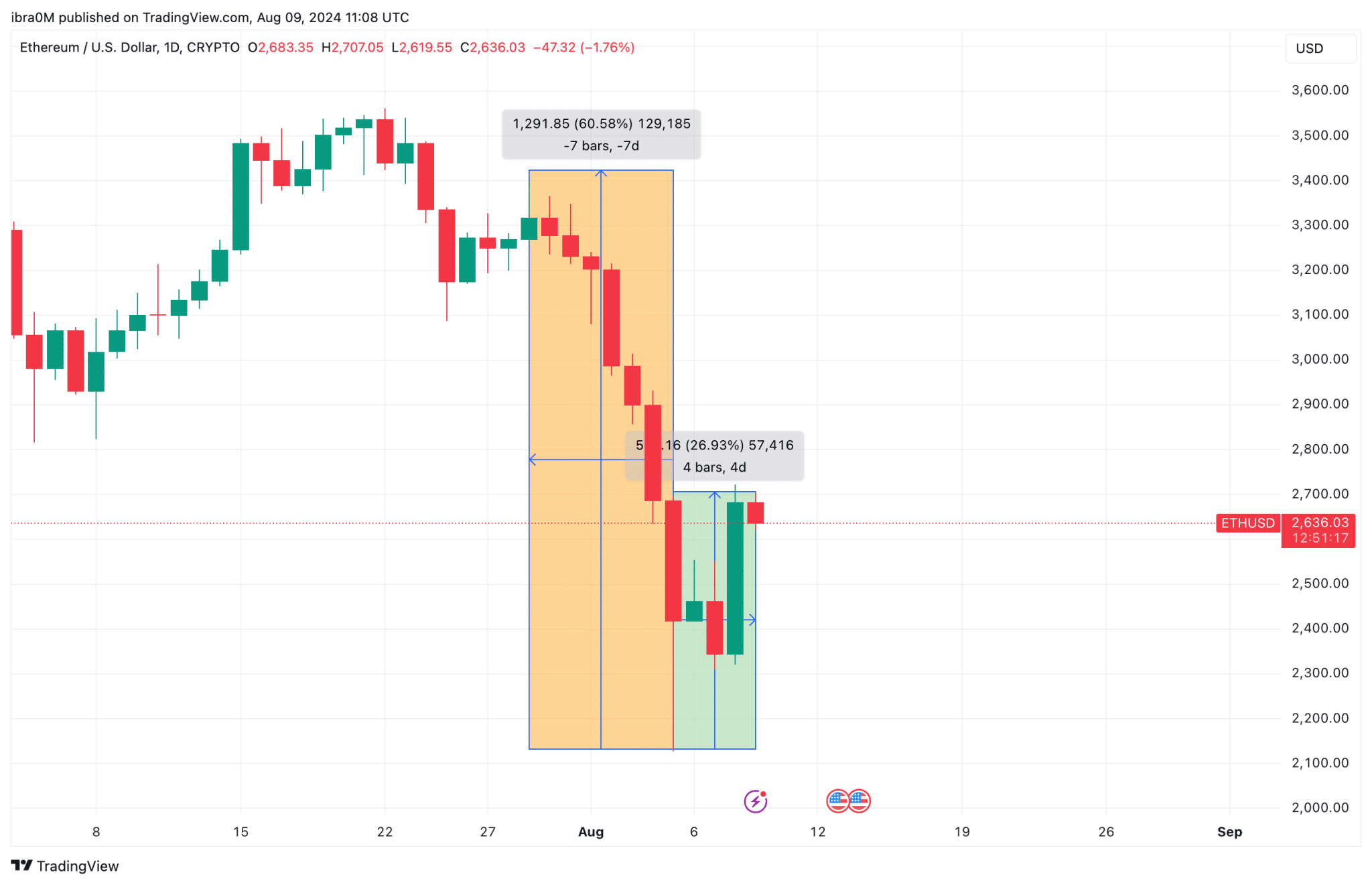

Ethereum Worth Motion ETHUSD | TradingView

Brazil’s monetary markets additional embraces blockchain expertise, the affect on Ethereum’s value was evident. The chart above reveals the way it propelled ETH above the $2,600 stage for the primary time since market crash on Monday.

The chart signifies that ETH not too long ago skilled a major drop of roughly 60.58%, as marked by the big orange rectangular field. This transfer spanned over 7 days, inflicting the value to plummet from round $3,000 to a low of $2,619.55.

Nevertheless, the following inexperienced rectangular field reveals a partial restoration of about 26.93% over 4 days, suggesting that the market is perhaps discovering some shopping for curiosity.

Russia Legalizes Crypto Mining: Sending ETH In the direction of $2,700

Probably the most important catalyst got here on August 8, when Russian President Vladimir Putin signed into legislation the legalization of cryptocurrency mining. This transfer is a part of Russia’s broader technique to cut back reliance on the U.S. greenback in worldwide commerce and align with the BRICS bloc’s ambitions.

Though the laws is ready to take impact in November 2024, the perceived regulatory framework on crypto mining has lifted investor confidence throughout the markets.

The announcement had a direct affect on Ethereum’s value, driving it to a peak of $2,707, marking a 26.93% improve from the August 5 low. This surge displays each the strategic significance of Russia’s resolution and the worldwide market’s response to a extra regulated and safe surroundings for cryptocurrency operations.

Nevertheless, wanting forward, we see that speculative merchants at the moment are betting on a chronic ETH value rally.

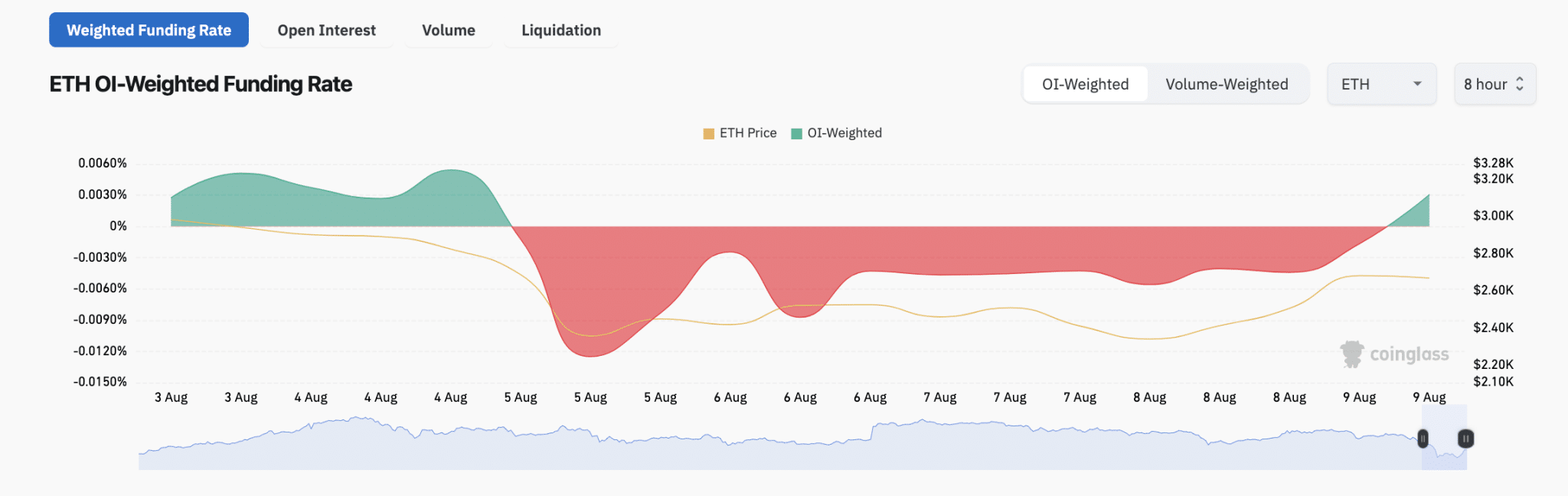

Ethereum Worth vs ETH Funding Charge | Coinglass

On August 9, Ethereum’s funding price shifted into optimistic territortories round 0.00031%, signaling a change in dealer sentiment. After a number of days of adverse funding charges, which indicated that quick positions had been paying lengthy positions, the latest transfer above zero means that lengthy positions at the moment are in management.

This optimistic change within the funding price signifies that merchants are reacting favorably to the newest developments, together with Russia’s legalization of crypto mining.

The rise within the funding price usually correlates with bullish value motion, because it displays a rising willingness amongst merchants to pay a premium for lengthy positions.

If this pattern continues, it might present additional upward momentum for Ethereum, reinforcing the latest value features and doubtlessly driving ETH nearer to the $3,000 mark. This renewed optimism amongst merchants, mixed with optimistic information from international markets, could possibly be a robust indicator that Ethereum is poised for additional development within the close to time period.

ETH Worth Forecast: $3,000 Breakout in Focus?

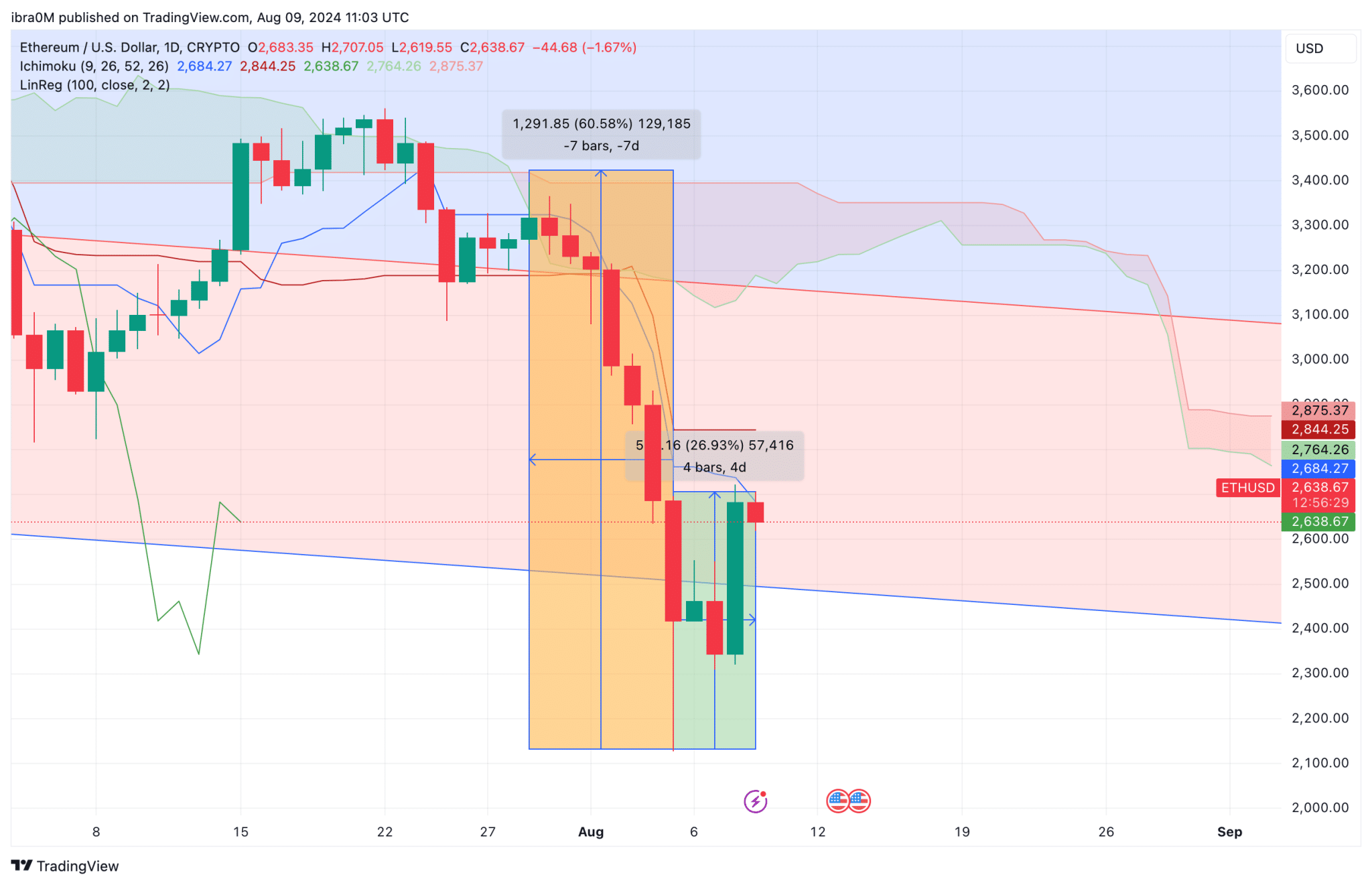

The present technical setup for Ethereum (ETH) suggests a possible rebound because the market recovers from a latest steep decline. Regardless of the continuing restoration, ETH faces instant resistance on the $2,764.26 stage, which aligns with the higher boundary of the restoration field and coincides with the 26-period Ichimoku baseline (purple line).

Ethereum Worth Forecast ETHUSD | TradingView

A profitable breach of this stage might see the value goal the following resistance at $2,844.25, marked by the blue Linear Regression channel, and doubtlessly transfer towards the psychological $3,000 mark, the place the Ichimoku cloud (red-shaded space) might act as a barrier.

On the draw back, key assist lies on the latest low of $2,619.55, adopted by the decrease boundary of the Linear Regression channel round $2,500. A failure to carry above these ranges would possibly set off one other bearish wave, pushing ETH in direction of the $2,400 zone.

Whereas the near-term outlook seems cautiously bullish, with the $3,000 goal in focus, ETH should overcome a number of resistance ranges to verify a sustained upward trajectory. A failure to interrupt above $2,764.26 might maintain the bears in management.