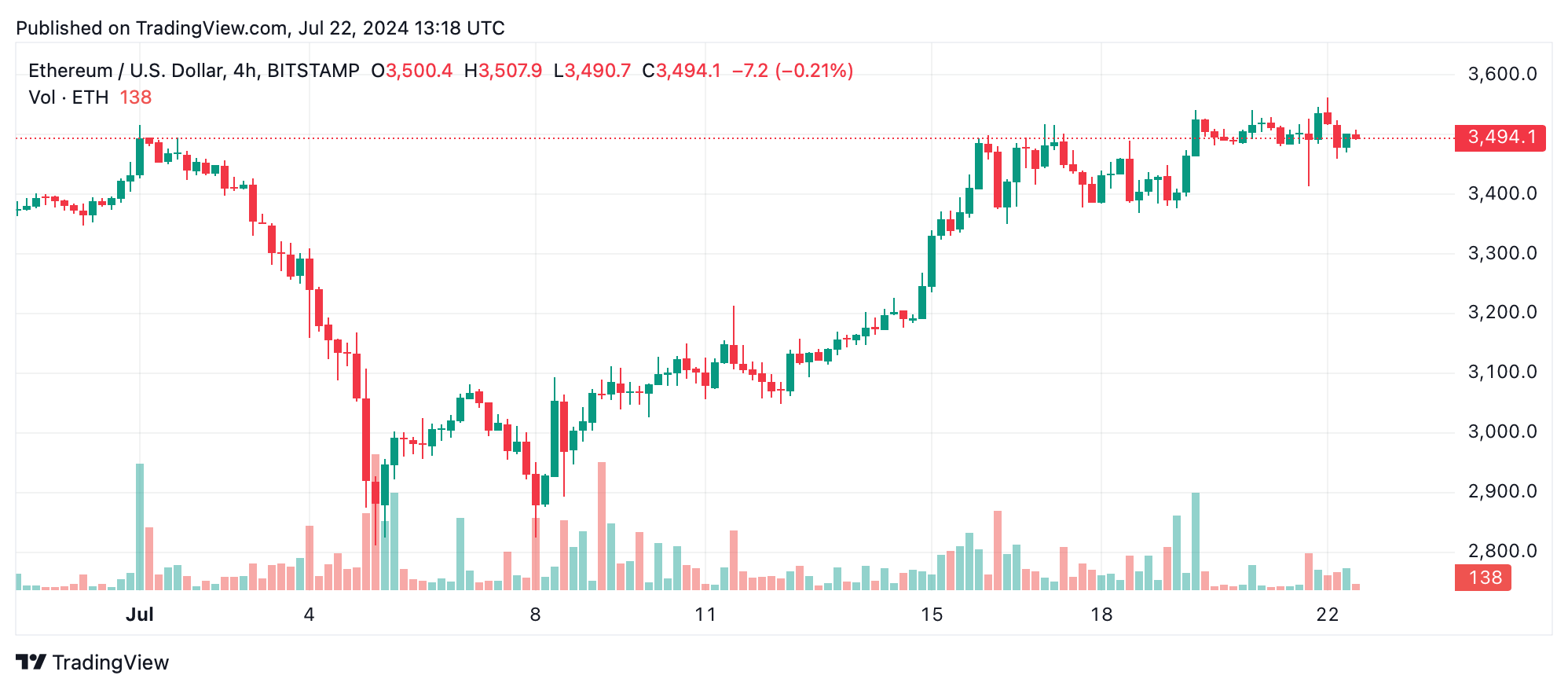

Ethereum’s value on July 22, 2024, stands at $3,497, displaying a dynamic interaction of market forces. The cryptocurrency’s current actions exhibit consolidation with a possible bullish resurgence.

Ethereum

The 1-hour ETH/USD chart reveals crucial help at $3,411 and resistance at $3,565. Ethereum’s value has been oscillating inside these boundaries, with noticeable quantity spikes at pivotal actions, indicating sturdy market curiosity and potential reversal factors. The current pattern shows a downward trajectory adopted by restoration, suggesting a tactical entry round $3,480-$3,500, anticipating a rebound in direction of the resistance degree of $3,565.

On the 4-hour chart, ethereum displays a broader help zone round $3,366 and resistance at $3,565. Excessive quantity throughout important value actions, particularly throughout current declines and recoveries, marks these ranges as essential. The value’s sharp drop adopted by a gradual restoration hints at a consolidation section.

The each day chart positions ethereum inside a help vary of $2,803 and a current excessive of $3,628. Vital quantity throughout main drops and subsequent recoveries underscores the significance of those ranges. Following a considerable decline, Ethereum’s regular restoration suggests a bullish short-to-medium-term outlook.

Inspecting the oscillators gives a blended sentiment. The relative energy index (RSI) at 58.8 indicators neutrality, whereas the Stochastic at 94.6 suggests bearish indicators. The commodity channel index (CCI) at 96.6 and the typical directional index (ADX) at 22.7 stay impartial. Conversely, the momentum oscillator at 363.9 signifies bearishness, whereas the transferring common convergence divergence (MACD) degree at 43.2 advocates bullish sentiment. This blended array of indicators displays market uncertainty, emphasizing the necessity for cautious optimism.

The transferring averages (MAs) exhibit a predominantly bullish sentiment. Brief-term averages, such because the 10-day exponential transferring common (EMA) and easy transferring common (SMA), place at $3,421 and $3,422, respectively, sign constructive actions. This bullish pattern extends throughout mid-term averages (20-day to 50-day), with EMAs and SMAs constantly indicating shopping for alternatives. Lengthy-term MAs (100-day and 200-day) additionally help a bullish outlook, with values considerably under present costs, reinforcing the general constructive market sentiment.

Bull Verdict:

Ethereum’s technical indicators counsel a bullish sentiment, with MAs predominantly signaling purchase alternatives and a powerful potential for value restoration and additional positive factors.

Bear Verdict:

Regardless of the constructive outlook from MAs, the blended indicators from oscillators and the present consolidation section warrant warning, indicating potential for downward motion if crucial help ranges fail to carry.