Ethereum’s worth continues to defend $3,800 regardless of the cooling investor impetus forward of the subsequent US non-farm jobs information, and on-chain information evaluation reveals a uncommon bullish sign that might spark the subsequent rally.

Ethereum Worth Rally Cools Forward of US Inflation and Jobs Knowledge

The US Bureau of Labor Statistics is scheduled to publish the subsequent instalment of its month-to-month Non-Farm Jobs information on Friday Could 31. The Non-Farm Jobs is a key macroeconomic indicator that impacts how regulators and buyers view the route of change in inflation and total financial exercise.

Inside the present panorama, one other decline in Non-Farm jobs may push the Ate up a step in direction of reducing rates of interest, and vice versa.

Because the report attracts nearer, strategic crypto buyers have cooled their buying and selling exercise, tipping the Ethereum markets right into a consolidation part during the last 24-hours, hatling the week-long uptrend from the ETH ETF approval.

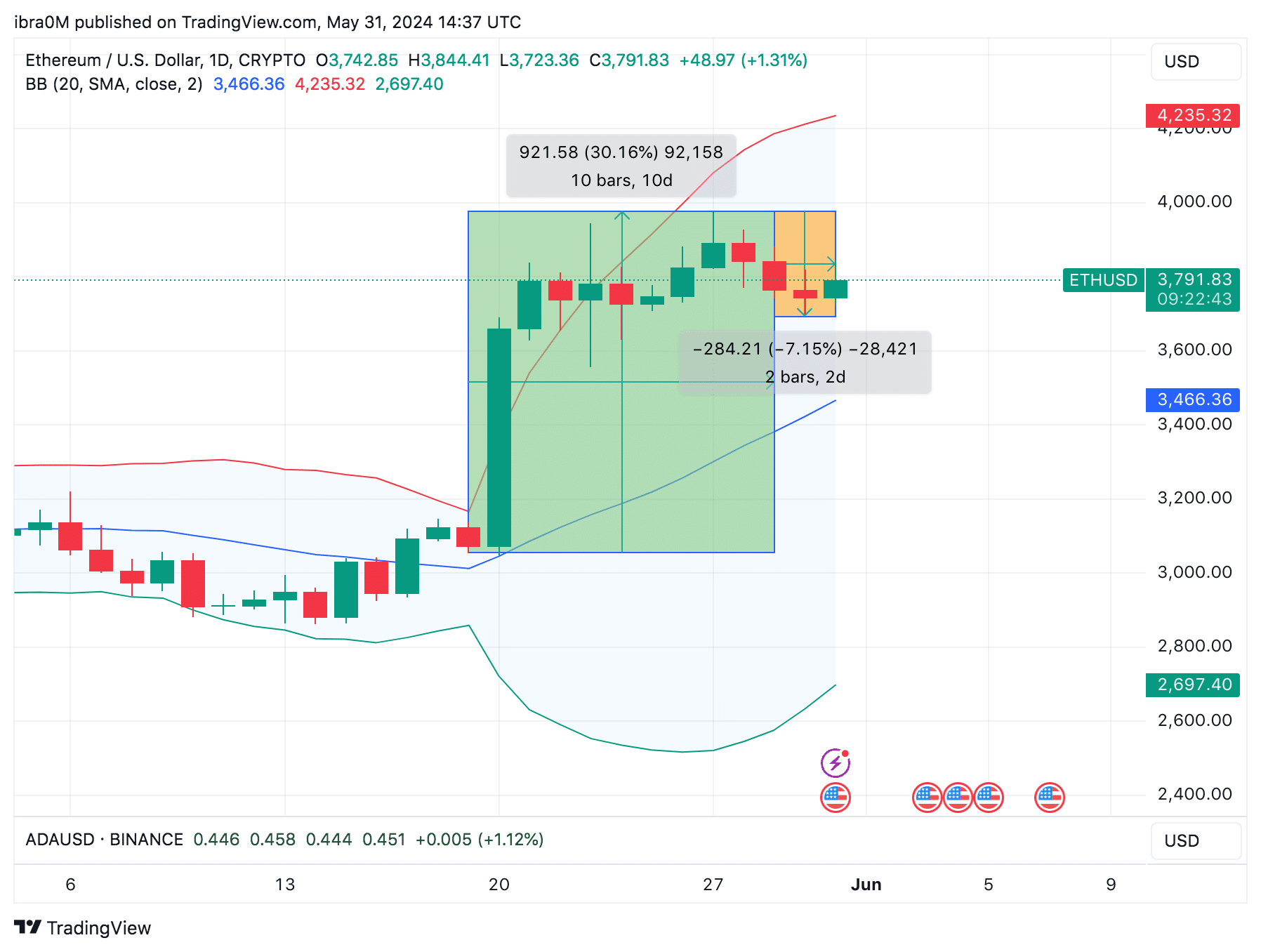

Ethereum Worth Motion ETHUSD

As seen above, between Could 21 and Could 29, Ethereum worth had raced right into a 30% rally, reaching a brand new monthly-peak of $3,974. However between Could 29 and Could 31, ETH worth has retraced 7%, reaching a weekly low of $3,698.

This means that the ETH post-ETF worth rally seems to have entered a recess as crypto buyers tackle subdued positions forward of the upcoming US macroeconomics indices information.

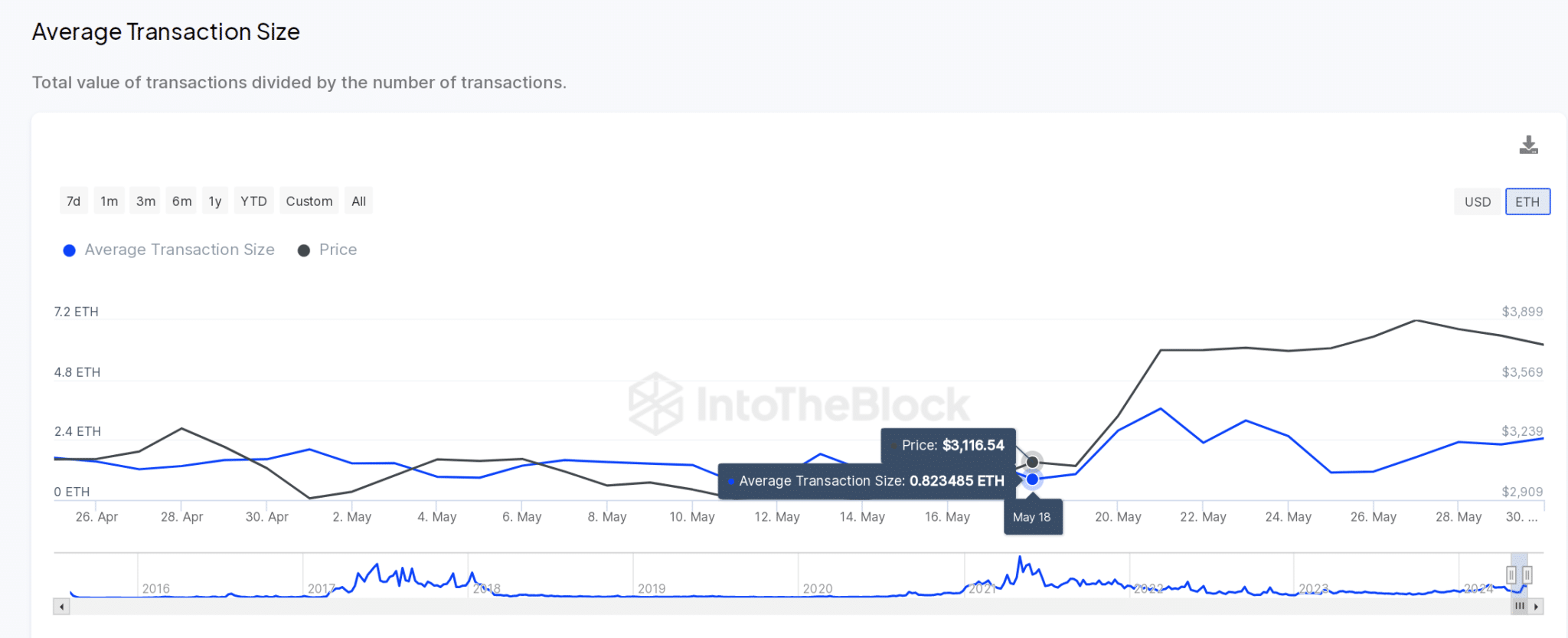

Nonetheless, taking a better take a look at the on-chain information, institutional buyers on the Ethereum community are nonetheless finishing up massive volumes of transactions behind the scenes.

As depicted beneath, IntoTheBlock’s Common Transaction measurement supplies insights into the speed at which buyers are conducting massive investments on a blockchain community.

Ethereum Worth vs. ETH Common Transaction Measurement

As seen above, Ethereum common transaction measurement stood at 1.03 ETH as of Could 19. Nonetheless because the Ethereum ETF approval the determine had continued to extend significantly.

On the time of writing on Could 31, Ethereum’s common transaction measurement has now reached 2.46 ETH, reflecting a 240% enhance throughout the final two weeks.

Usually, a 240% enhance in common transaction measurement is a key bullish sign for a couple of causes. Firstly, it alerts improved sentiment and bullish conviction, as buyers at the moment are prepared to carry out increased worth transactions.

Extra so, these increased worth transactions additionally indicator a big progress in market liquidity, which potential new entrants may discover enticing.

Ethereum (ETH) Worth Forecast: Is the $4,500 goal viable?

Ethereum worth is struggling to defend the $3,800 help on the time of writing on Could 31. Nonetheless, if the US. Non-Farm Jobs information yield a optimistic market response, the 240% surge in transactions may set the stage for ETH worth to interrupt above $4,500 in June 2024.

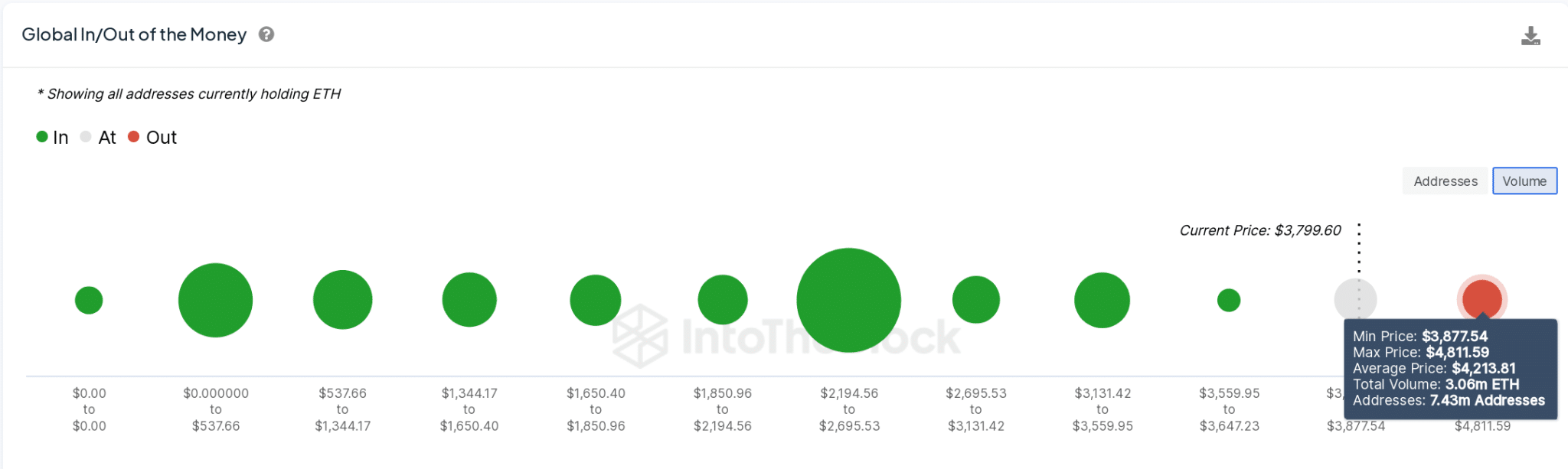

Nonetheless, trying on the historic buy-in developments, Ethereum worth may face a significant resistance on the $4,200 throughout the subsequent part of the rally.

Ethereum ETH Worth Forecast

As seen above, 7.43 million lively ETH holders had acquired 3.06 million ETH on the common worth of $4,213. ETH worth may battle to interrupt out of that resistance cluster, in the event that they choose to take earnings early.

But when Ethereum worth can stage a decisive breakout above $4,200, bulls can anticipate new peaks above $4,500.

On the draw back, if ETH fails to defend the $3,700 help degree, a decline in direction of $3,560 could possibly be on the playing cards.