Ethereum’s worth is at the moment trapped inside a major tight vary, bounded by the 100-day shifting common of $3364 and the 200-day shifting common of $3212.

A breakout from this vary will decide its upcoming trajectory.

By Shayan

The Each day Chart

An in depth examination of Ethereum’s every day chart reveals that following a rejection close to the essential $3.5K resistance area, the value has plummeted to a considerable help zone.

This vital help contains the 200-day shifting common of $3212, serving as a strong protection line for Ethereum consumers. However, the value is confined inside an important tight vary bounded by the 100-day shifting common of $3364 and the 200-day shifting common of $3212. A break above this space will convey adequate demand into the market, resulting in potential upward momentum within the worth.

Conversely, a break beneath the 200-day MA will sign a notable bearish pattern for the market, doubtlessly resulting in an impulsive decline towards the substantial and decisive $3K help zone.

The 4-Hour Chart

On the 4-hour chart, it’s evident that Ethereum skilled heightened promoting stress close to the essential resistance area of $3.5K, resulting in a break beneath $3.3K.

This has resulted in an impulsive bearish descent towards the essential $3K help area. However, following an impulsive transfer out there, a short lived stage of consolidation correction worth motion typically happens.

Accordingly, the value has entered a corrective stage, retracing again towards the damaged $3.3K threshold. This growth has resulted within the formation of an ascending wedge sample, indicating a bearish pattern continuation if breached from its decrease boundary. Therefore, if the value completes a pullback and declines beneath the wedge’s decrease boundary, a bearish continuation is predicted, aiming for the essential $2.8K help vary.

By Shayan

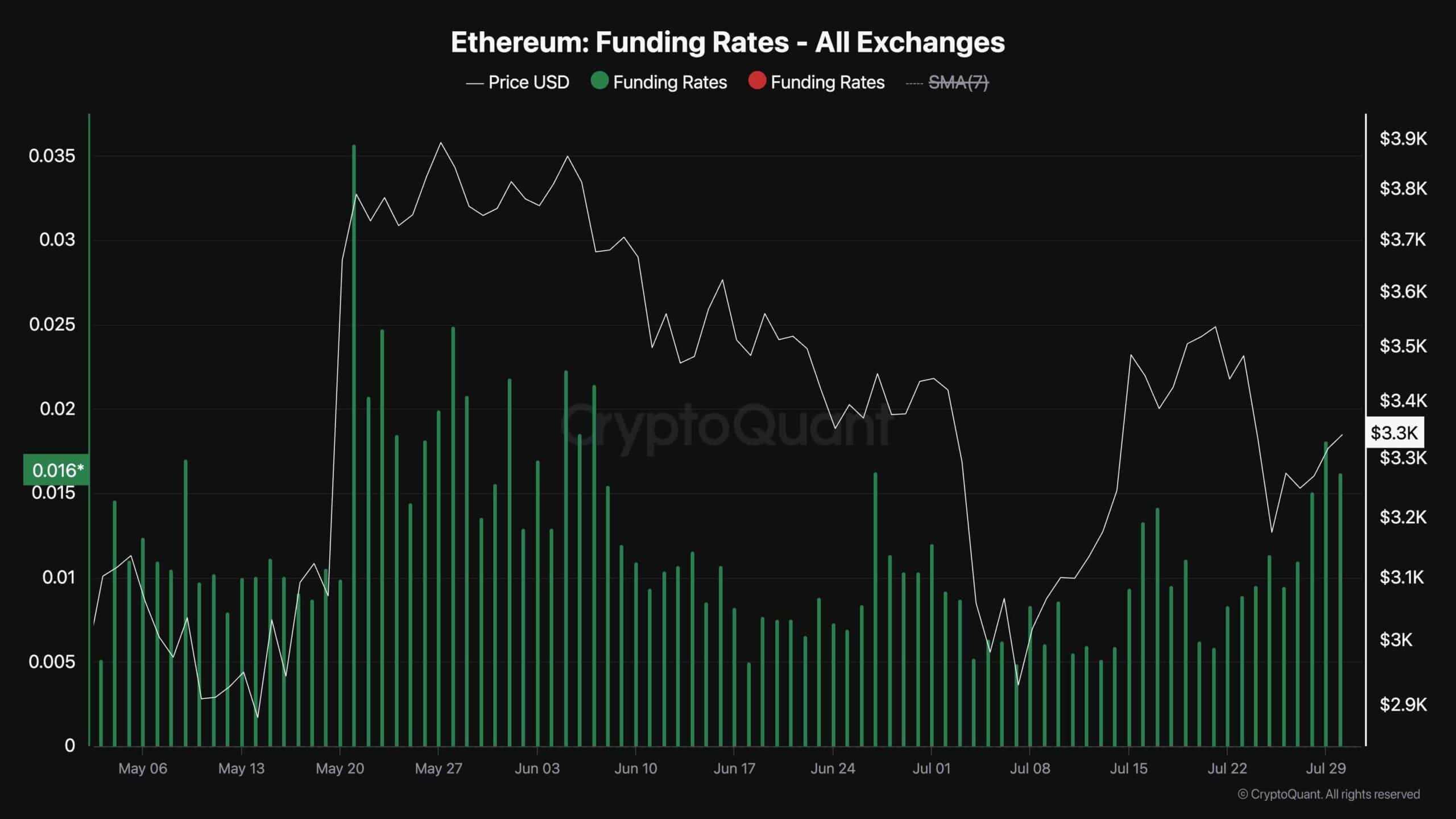

Whereas Ethereum’s worth has been trending down after failing to interrupt above the $3.5K stage and rally towards its all-time excessive, it’s helpful to evaluate the futures market sentiment.

The accompanying chart presents the Ethereum funding price metric, which measures whether or not consumers or sellers are extra aggressively executing their orders. Optimistic funding charges point out bullish sentiment, whereas adverse funding charges present bearish sentiment.

Because the chart demonstrates, the funding charges have been step by step growing for the reason that preliminary worth rejection from the $3.5K stage. The present funding price values point out that the futures market is now not overheated, and the value may lastly start one other sustainable rally greater if demand returns to the market.

In abstract, the funding price metric means that the market sentiment has been shifting in the direction of a extra balanced state. This shift, mixed with potential renewed demand, may pave the best way for Ethereum to embark on a brand new upward trajectory, aiming to interrupt by way of earlier resistance ranges and presumably setting the stage for a rally towards its all-time excessive.