Ethereum’s worth has been trending decrease over the previous couple of months and is but to indicate an indication of restoration.

Prior to now 24 hours alone, ETH dropped to a month-to-month low of simply over $2,300.

Technical Evaluation

By Edris Derakhshi

The Day by day Chart

Within the every day timeframe, the value has been dropping because the breakdown of the 200-day shifting common, which is situated across the $3,200 mark. The Relative Energy Index additionally demonstrates values beneath 50%, indicating that the momentum is clearly bearish.

Consequently, essentially the most possible state of affairs within the quick time period is for the market to drop towards the $2,100 help zone. General, so long as ETH is buying and selling beneath its 200-day shifting common, the market development may be thought-about bearish.

The 4-Hour Chart

The 4-hour chart of the ETH/USDT pair reveals a clearer image of the latest downtrend. After the value misplaced the $3,000 and the $2,700 help zones, it has been consolidated above the $2,100 degree.

Over the latest days, nonetheless, the asset has retested the $2,700 degree as soon as extra, however it has been rejected to the draw back. Contemplating the truth that the market is now creating decrease highs and lows, a drop again towards the $2,100 degree appears extremely possible within the upcoming days.

Sentiment Evaluation

By Edris Derakhshi

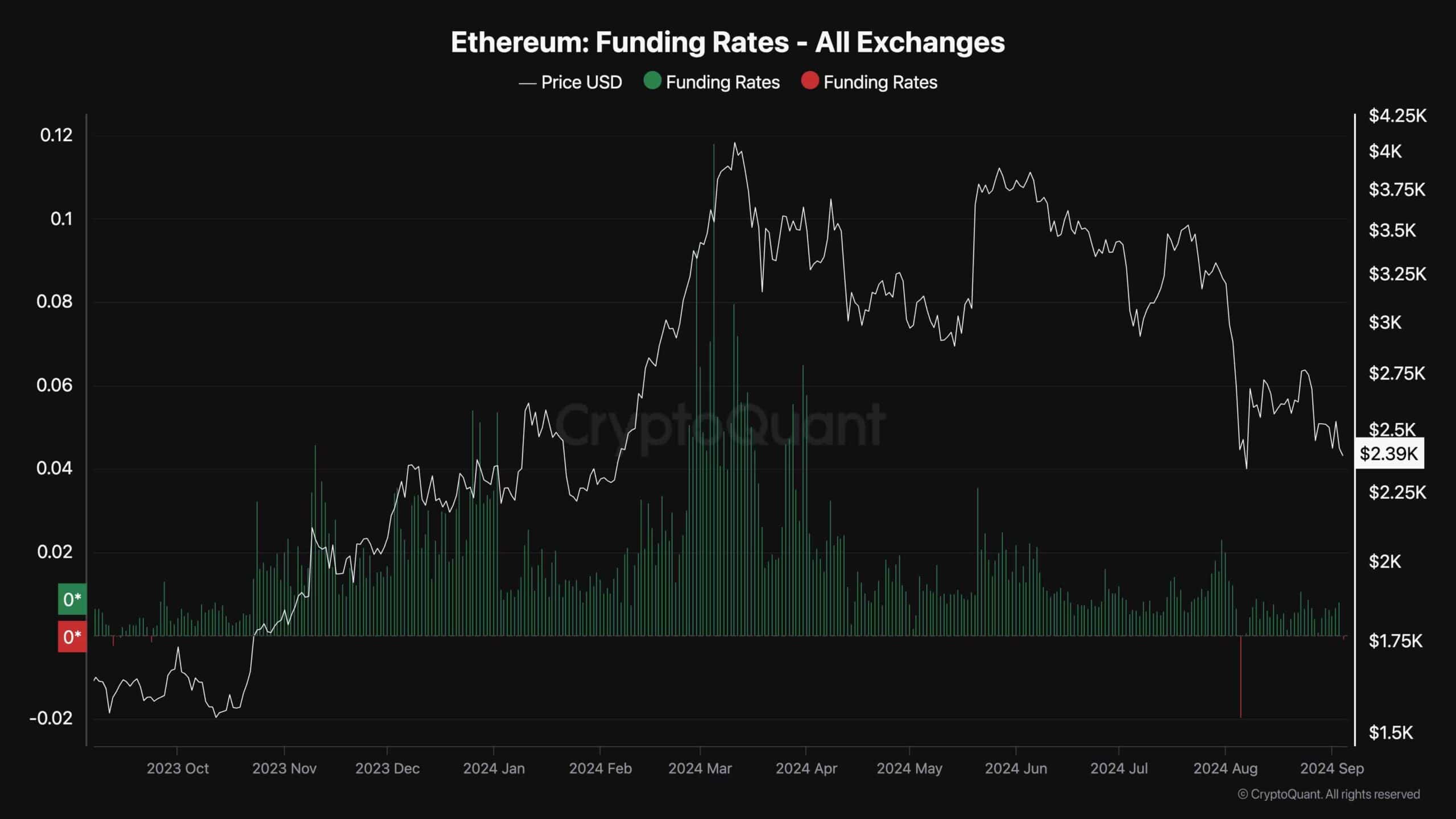

Ethereum Funding Charges

With the perpetual futures market having a big affect on the short-term worth motion of the crypto market, analyzing the combination sentiment of futures merchants may give some clues in regards to the future course.

This chart shows the ETH funding charges, visualizing whether or not the consumers or sellers are executing their orders extra aggressively (utilizing market orders) within the futures market.

Because the chart suggests, the funding charges have once more dropped beneath zero, which is a transparent signal of bearish sentiment. But, whereas not at all times an excellent signal, adverse funding charges are normally one of many preliminary indicators of market restoration, as they may result in quick liquidation cascades. Nevertheless, this extremely will depend on whether or not ample spot shopping for strain is current.