Ethereum not too long ago discovered help at $2.1K following a major cascade and skilled a slight bullish rebound.

Nevertheless, the worth is now retracing in the direction of the wedge’s damaged decrease boundary, indicating a possible pullback completion. This transfer hints at a potential bearish continuation within the coming days.

By Shayan

The Every day Chart

A more in-depth take a look at ETH’s each day chart reveals that following a major market turmoil, the cryptocurrency broke beneath the wedge’s decrease boundary at $2.8K and skilled a notable cascade. However, the worth discovered help on the essential $2.1K help zone, resulting in a bullish reversal. Subsequently, shopping for stress emerged, resulting in a interval of slight bullish retracements towards a notable resistance threshold.

This threshold marks the beforehand damaged wedge’s decrease boundary, the place prevailing provide has the potential to halt upward momentum and reject the worth within the upcoming days.

But, if Ethereum is unable to reclaim this important resistance, a pullback will likely be accomplished, resulting in a possible bearish continuation aiming for vital help of $2.5K.

The 4-Hour Chart

On the 4-hour chart, ETH’s bullish revival is obvious. The value skilled a interval of upward retracements, marking increased highs and better lows.

Nevertheless, the cryptocurrency is now dealing with a formidable resistance area between the $2.6K and $2.8K Fibonacci ranges.

This vary serves as the principle goal for the corrective stage of the market, having the potential to reject the worth within the upcoming days. Then again, in the course of the current retracements, ETH has emerged inside a bearish continuation triangle sample, additional emphasizing the bearish continuation situation.

However, if the worth faces rejection and breaks beneath the triangle’s decrease boundary, the continuation of the bearish development towards $2.1K will change into imminent. Total, the motion within the upcoming days will likely be essential in figuring out Ethereum’s subsequent transfer, with present indicators favoring a bearish outlook.

By TradingRage

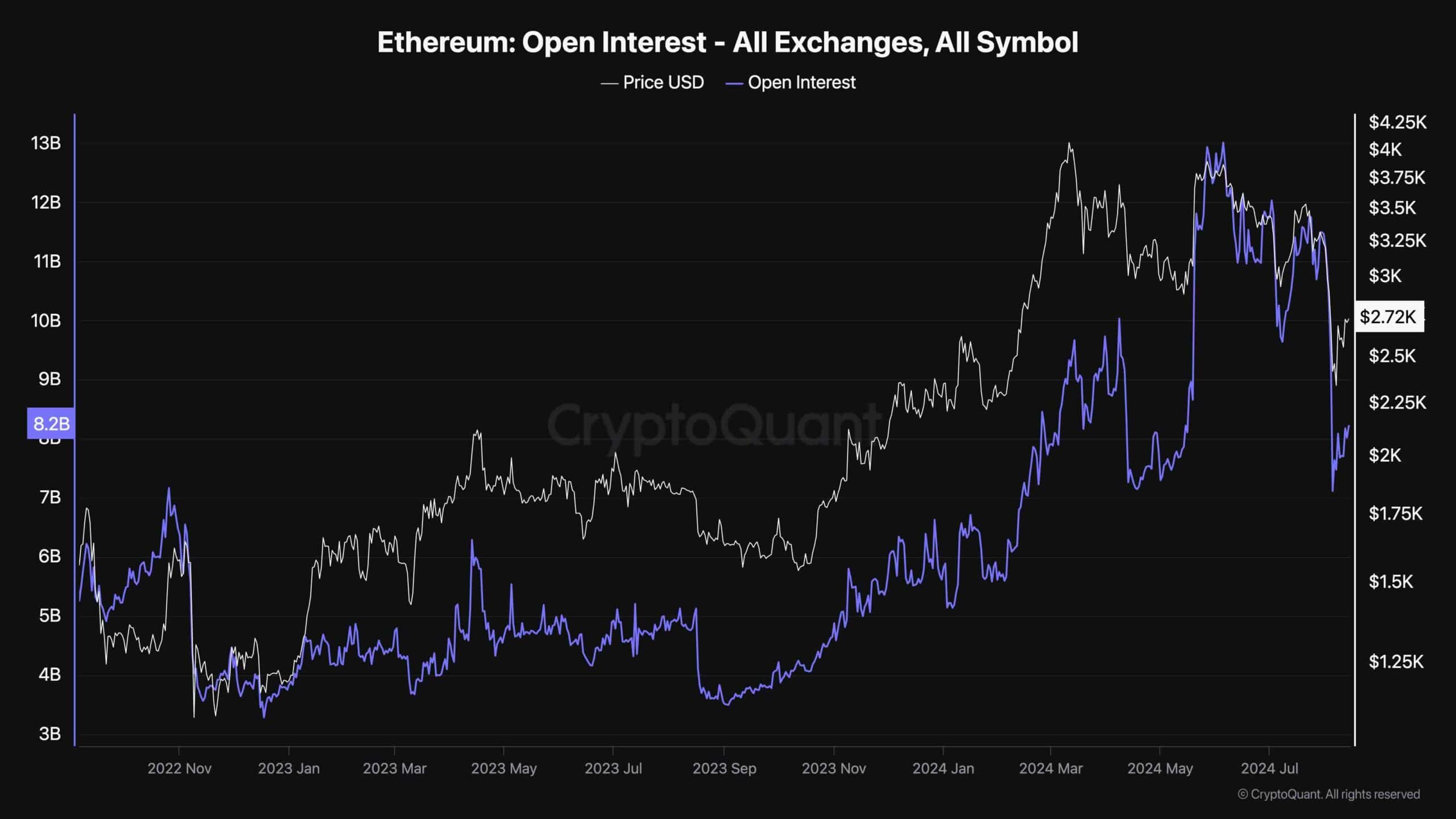

Following the current drop, many traders have suffered vital losses, particularly within the perpetual futures market. In consequence, analyzing the up to date state of the futures market could possibly be helpful for a greater understanding of present market dynamics.

This chart presents the Ethereum Open Curiosity metric, which measures the variety of open futures positions, each shorts and longs. Greater values are often related to extra volatility, whereas decrease OI principally results in higher worth stability.

Because the chart suggests, Open Curiosity has dropped considerably following the current worth decline, indicating a large variety of liquidations. If enough demand is current within the spot market, this may end up in a very good end result, because the market can expertise a extra sustainable uptrend