Ethereum worth recorded a blistering 4% surge over the weekend, because it reached a each day timeframe peak of $3,839 on June 3, bears face extra liquidation threat amid shrinking ETH provide.

Ethereum begins June 2024 with a 4% Uptick

Following the 30% worth upswing that greeted the Ethereum ETF approvals, many ETH holders entered a profit-taking frenzy within the final week of Might, reducing the month-to-month positive factors to 24%.

Nevertheless, because the sell-the-news wave cools off, ETH markets have begun to draw shopping for momentum in June.

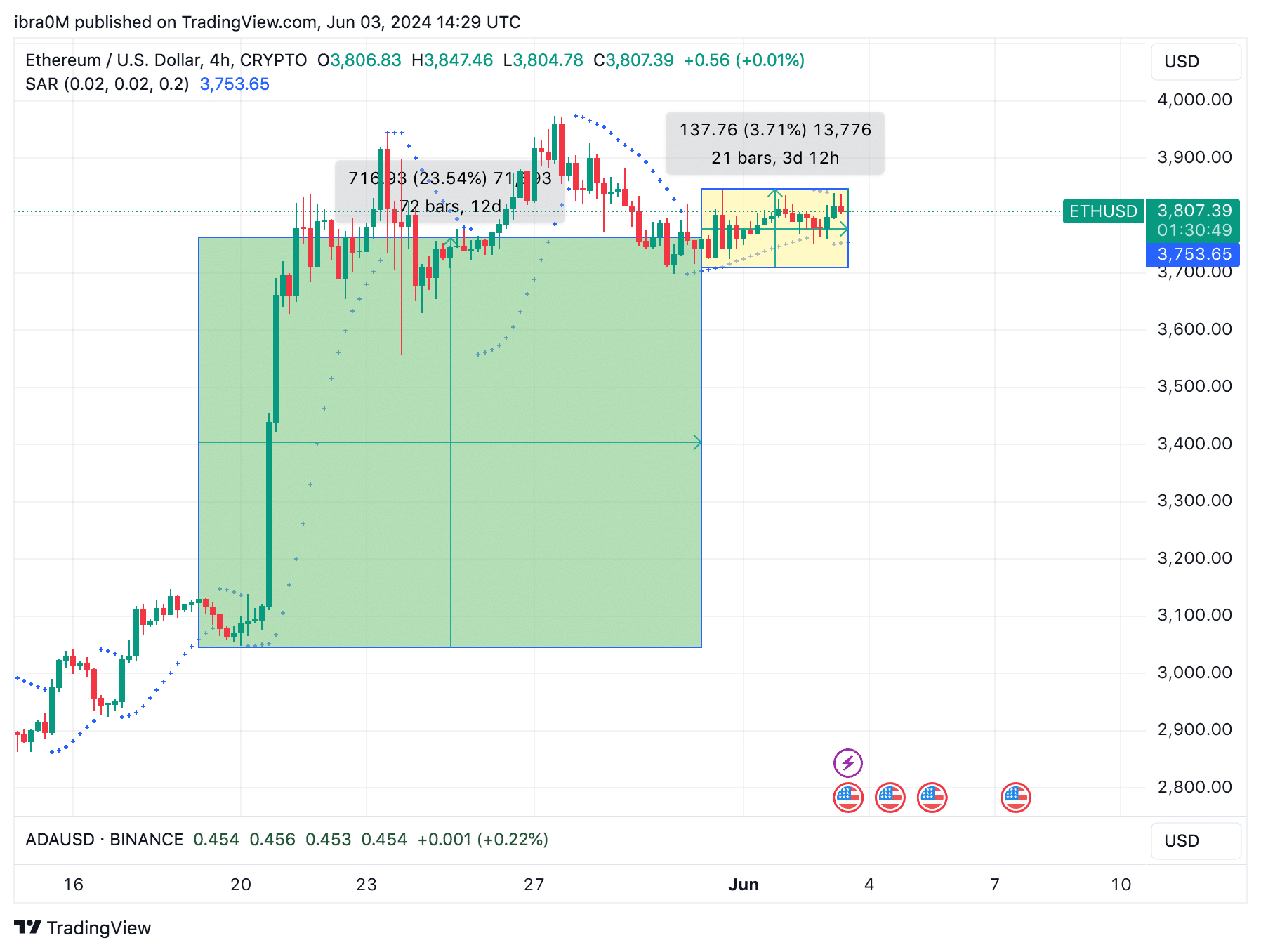

Ethereum Value Motion ETHUSD June 2024 | TradingView

As depicted within the yellow shaded space of the chart above, ETH worth has elevated by 3.7% throughout the first three days of June. A transfer that would set the tempo for the remainder of the month.

Whereas the official launch of the Ethereum ETFs nonetheless hangs within the steadiness, Ethereum continues to wrestle to seek out the following demand surge. Nevertheless, on-chain information exhibits that the shrinking provide of ETH cash throughout exchanges has put bulls within the driving seat as soon as once more.

Ethereum Trade Provide in Speedy Decline

Crypto buyers await the official launch of the recently-approved Ethereum ETFs. Instutitional buyers accross the US, together with Pension funds, Funding homes, Hedge funds, and many others are anticipated so as to add billions value of ETH to their portfolio within the coming weeks.

Current on-chain actions of ETH cash throughout exchanges counsel that present ETH holders have began making bullish strikes to front-run the constructive influence of the ETF inflows.

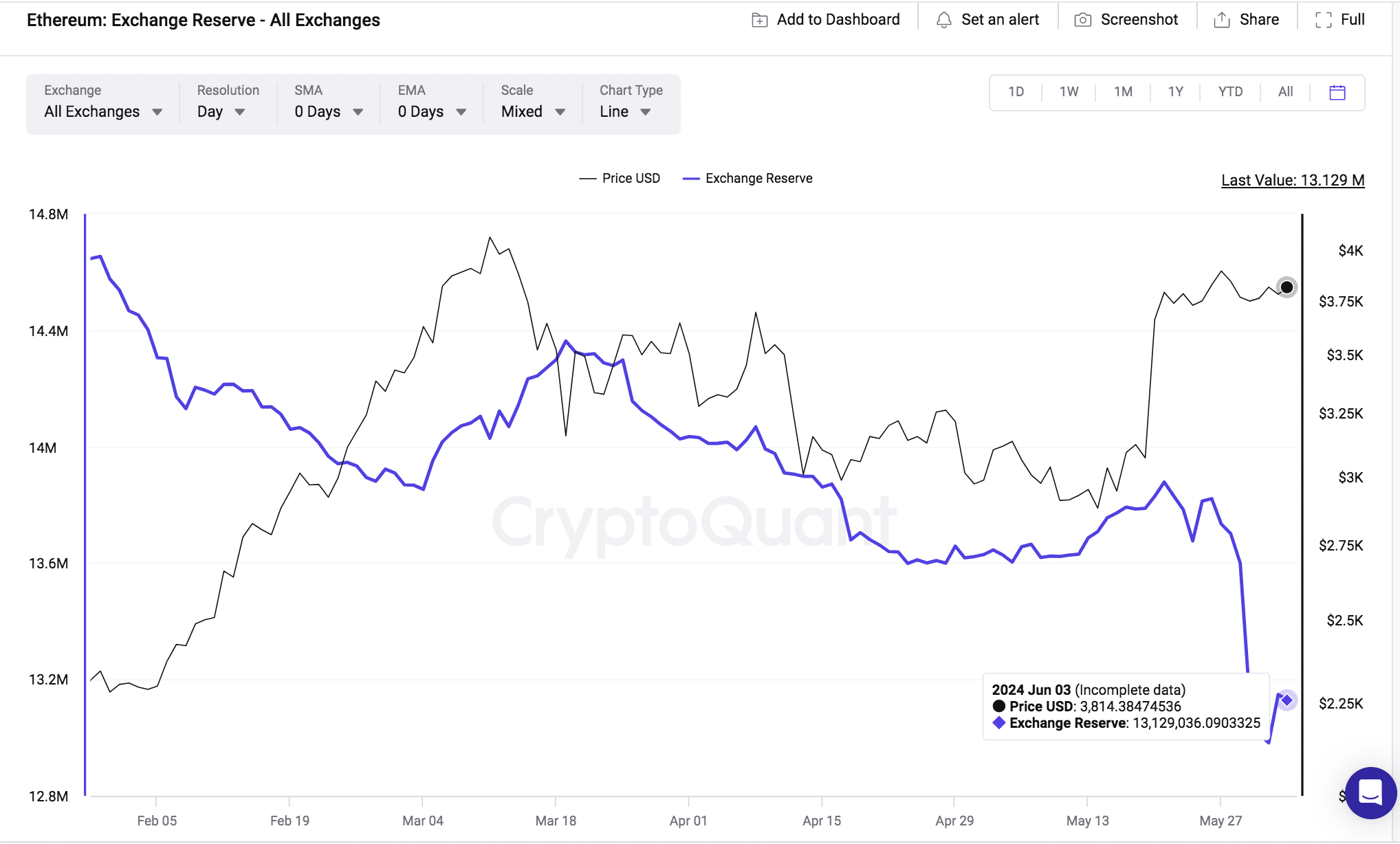

A significant indication of this Cryptoquant’s Trade Reserves chart, which exhibits the real-time adjustments in ETH balances held throughout exchange-hosted wallets and buying and selling platforms.

Ethereum Value vs ETH Trade Reserves | CryptoQuant

There was a substantial decline within the provide of ETH deposits on exchanges since Might 21. The chart above exhibits that buyers held 13.9 million ETH on exchanges as of Might 21. However on the time of writing on June 3, the Ethereum trade provide has now dropped to 13.1 million ETH.

This means that Ethereum holders have shifted over 800,000 ETH from trade provide into long-term storage choices and staking contracts within the 14 buying and selling days between Might 21 and June 3, 2024.

When there’s a dramatic decline in trade provide, it creates a bullish buzz across the underlying asset for 2 most important causes. Firstly, it implies that present buyers need to maintain out for long-term positive factors reasonably than exploit short-term buying and selling alternatives on exchanges.

Extra importantly, these 800,000 ETH trade outflows imply that over $3 billion value of ETH has been pulled from the short-term market provide throughout the final two weeks alone.

This places Ethereum’s worth in a major place to stage a parabolic breakout above $4,200 through the subsequent wave of demand surge.

Asides from the ETF inflows, the upcoming US Non-Farm Payrolls report scheduled for June 7, is one other key market occasion that would influence Ethereum worth motion within the June 2024.