Bitcoin’s rise and subsequent fall from its new ATH of $108,200 spurred fairly a little bit of market exercise. Final week’s value volatility led to spikes in each spot and derivatives buying and selling, with rising volumes and sky-high liquidations exhibiting the market’s aggressive response to the worth drop.

Taking a look at buying and selling volumes alone would possibly present a market in a fearful sell-off. Nevertheless, we will see that the response is restricted to the retail market when contemplating the modifications in OTC desk balances.

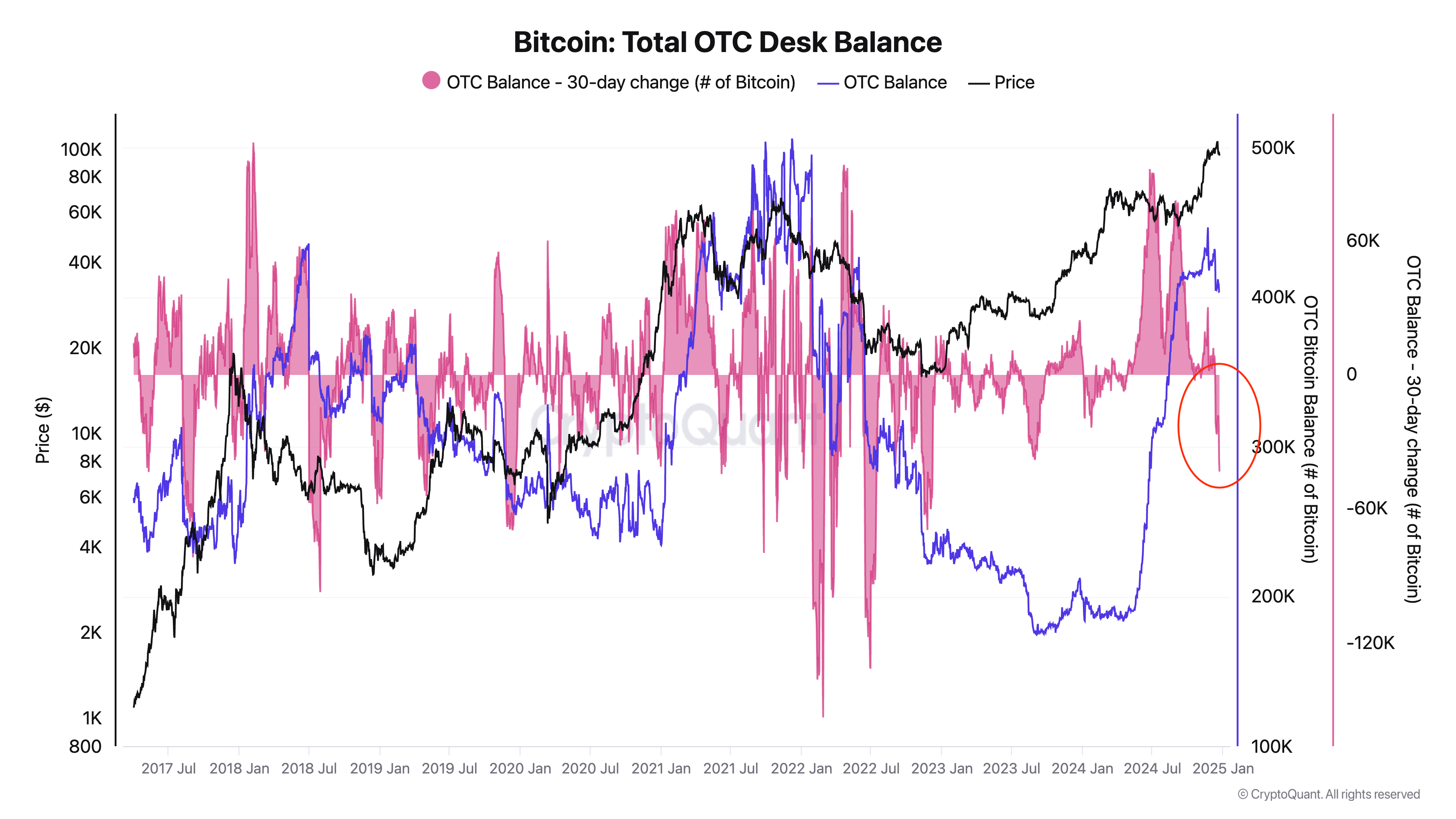

Knowledge from CryptoQuant confirmed that the OTC desk stability has seen vital outflows. OTC (over-the-counter) desks are platforms that facilitate giant trades immediately between patrons and sellers, bypassing public exchanges. Establishments and high-net-worth people usually use these desks to execute substantial trades with out inflicting vital market disruption. Adjustments in OTC balances can present perception into the conduct of those giant market individuals. When OTC balances lower, it usually alerts accumulation, as traders withdraw Bitcoin from these desks, usually for chilly storage or strategic functions. Conversely, growing balances point out fairly a little bit of BTC has been offered.

Nevertheless, estimating OTC balances comes with challenges. Not all OTC desks report their knowledge, and the motion of Bitcoin to and from these desks doesn’t at all times suggest fast shopping for or promoting exercise. Regardless of these limitations, OTC stability developments stay a beneficial metric for gauging the sentiment and methods of enormous market gamers.

This withdrawal of Bitcoin from OTC desks aligns with a broader narrative of accumulation by whales and establishments. A declining OTC stability, particularly when paired with a big destructive 30-day change, means that these gamers are transferring Bitcoin off platforms and sure into chilly storage. Such conduct usually signifies long-term accumulation methods, because it reduces liquidity in OTC markets and implies a tightening provide.

Most of this decline occurred whereas Bitcoin’s value dropped from $108,200 to $94,000. And whereas this led to panic amongst retail traders, the correction appears to have served as a major shopping for alternative for giant traders. Giant-scale traders could have strategically leveraged the falling value to build up Bitcoin at what they understand as a reduction. By withdrawing these property from OTC desks, they sign confidence in Bitcoin’s long-term worth regardless of short-term volatility.

A sustained discount in OTC desk balances can result in tightening provide, which may drive upward strain on Bitcoin’s value within the medium to long run. This impact could possibly be amplified if retail sentiment shifts again towards optimism when Bitcoin breaks the $100,000 stage, fueling demand in a market with constrained provide. Moreover, the exercise we’ve seen from establishments hints at strategic positioning forward of potential catalysts.

Institutional gamers appear to have used the worth drop as a possibility to build up, signaling confidence in Bitcoin’s long-term trajectory. With provide tightening and demand prone to enhance, Bitcoin’s present value ranges could signify a basis for future development.

The publish Drop in OTC balances exhibits giant traders are accumulating discounted Bitcoin appeared first on cryptoteprise.