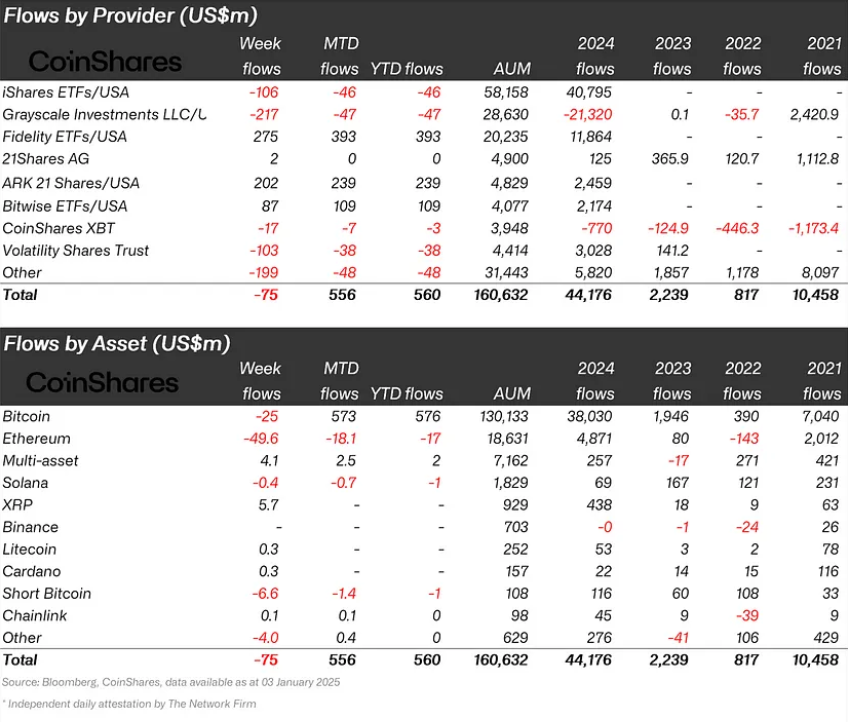

Inflows into digital asset funding merchandise hit a file $44.2 billion in 2024, led by U.S. spot-based ETFs, regardless of some market volatility, information exhibits.

The 12 months kicked off sturdy, with $585 million flowing into digital asset merchandise in the course of the first three days of 2025, based on information from European asset supervisor CoinShares. Nonetheless, for the complete week, which included the final two buying and selling days of 2024, there have been web outflows of $75 million.

CoinShares head of analysis James Butterfill says 2024 ended with a file $44.2 billion in inflows into digital asset merchandise, which is sort of 4 occasions greater than the “prior file set in 2021 which noticed $10.5 billion inflows.”

Crypto flows by asset kind and supplier | Supply: CoinShares

An enormous chunk of this surge got here from U.S. spot-based exchange-traded merchandise, which made up all the inflows, totaling $44.4 billion. Switzerland noticed some smaller inflows of $630 million, however giant outflows from Canada and Sweden — $707 million and $682 million, respectively — balanced issues out as buyers shifted to U.S. merchandise or took earnings.

You may also like: CoinShares launches instructional marketing campaign focusing on Swedish buyers

Bitcoin (BTC) continued to steer the pack, accumulating $38 billion, or 29% of whole property below administration. Even with rising costs, short-Bitcoin merchandise noticed smaller inflows of $108 million, down from $116 million in 2024, the info exhibits.

Ethereum (ETH) made a giant comeback in late 2024, with $4.8 billion in inflows, practically 2.5 occasions greater than in 2021 and 60 occasions greater than in 2023. It surpassed Solana (SOL), which noticed solely $69 million in inflows. Altcoins (excluding Ethereum) introduced in $813 million, accounting for 18% of whole property below administration in 2024.

Learn extra: Crypto funds hit by $1b outflows amid market volatility: CoinShares