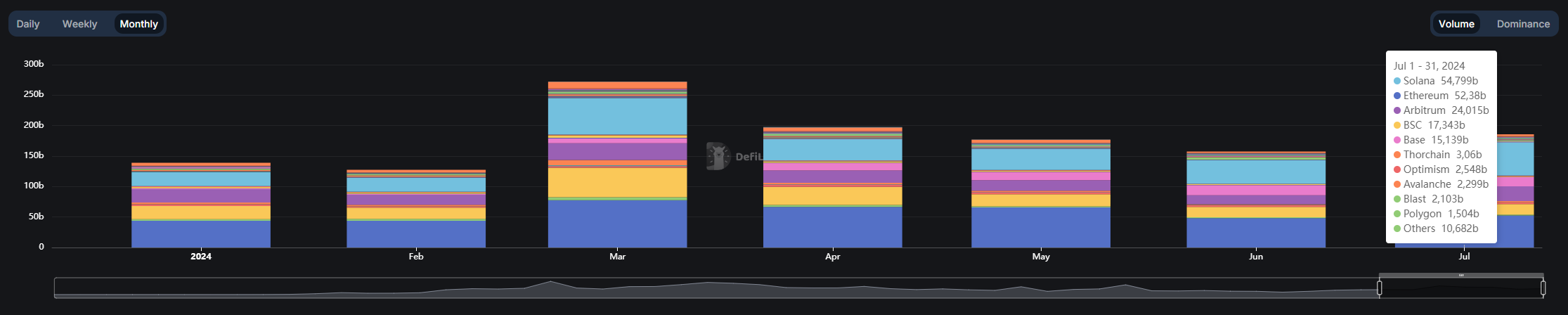

Decentralized exchanges (DEX) gained traction in July by nearing $186 billion in month-to-month buying and selling quantity, 18% up from June. That is the primary time since March that DEX month-to-month volumes have risen.

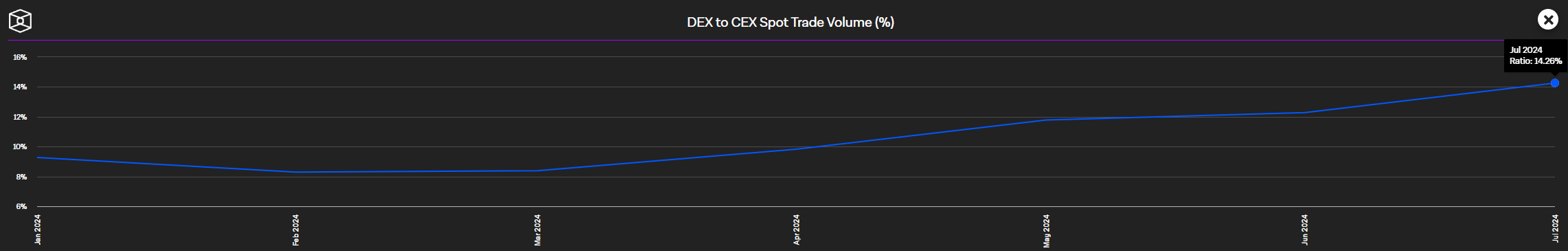

Notably, the ratio of buying and selling quantity on DEX in comparison with centralized exchanges reached an all-time excessive at 14.26%, in accordance to information from The Block. The regular progress on this ratio highlights the demand for extra decentralized and clear platforms for crypto buying and selling.

Solana-based DEX registered the most important buying and selling quantity final month, nearing $55 billion and rising 41% since June. That is the primary time Solana has surpassed Ethereum in month-to-month buying and selling quantity, as Ethereum-based DEX amounted to $52.4 billion.

Regardless of Solana’s vital progress in buying and selling exercise, Arbitrum confirmed the most important progress in July by leaping 61% and surpassing $24 billion in buying and selling quantity. In the meantime, Base and Binance Good Chain maintained their June buying and selling quantity ranges, registering $15.1 billion and $17.3 billion in exercise, respectively.

Furthermore, Avalanche reclaimed a spot among the many largest blockchains by buying and selling quantity final month reaching $2.3 billion. In June, Avalanche misplaced floor to the Linea ecosystem and stood out of the highest 10 blockchains in month-to-month buying and selling quantity.

The decentralized exchanges for derivatives buying and selling (perp DEX) additionally noticed 22.4% progress in July, surpassing $252 billion in buying and selling quantity. Blast not solely maintained its dominance within the perp DEX sector however grew 21% in July, surpassing $57 billion in month-to-month quantity for the primary time.

Base and Starknet registered probably the most vital progress actions among the many perp DEX in July, rising 89.5% and 103%, respectively.