Figuring out traits in DeFi requires analyzing exercise on decentralized exchanges (DEXs). These DEXs are the cornerstone of the DeFi market, on the heart of DeFi exercise, and the primary driving pressure of the sector. To know what drives DeFi, we have to take a look at the quantity, dealer exercise, and number of buying and selling pairs on DEXs.

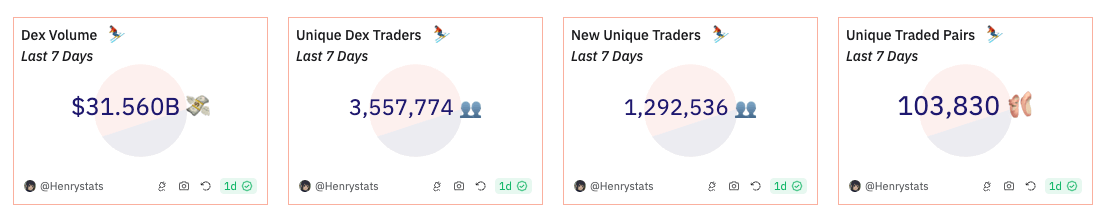

During the last seven days, the DEX market has seen important exercise, with a complete buying and selling quantity of $31.56 billion. In response to knowledge from Dune Analytics, there have been 103,830 distinctive traded pairs throughout this era, and the market welcomed roughly 1.292 million new merchants.

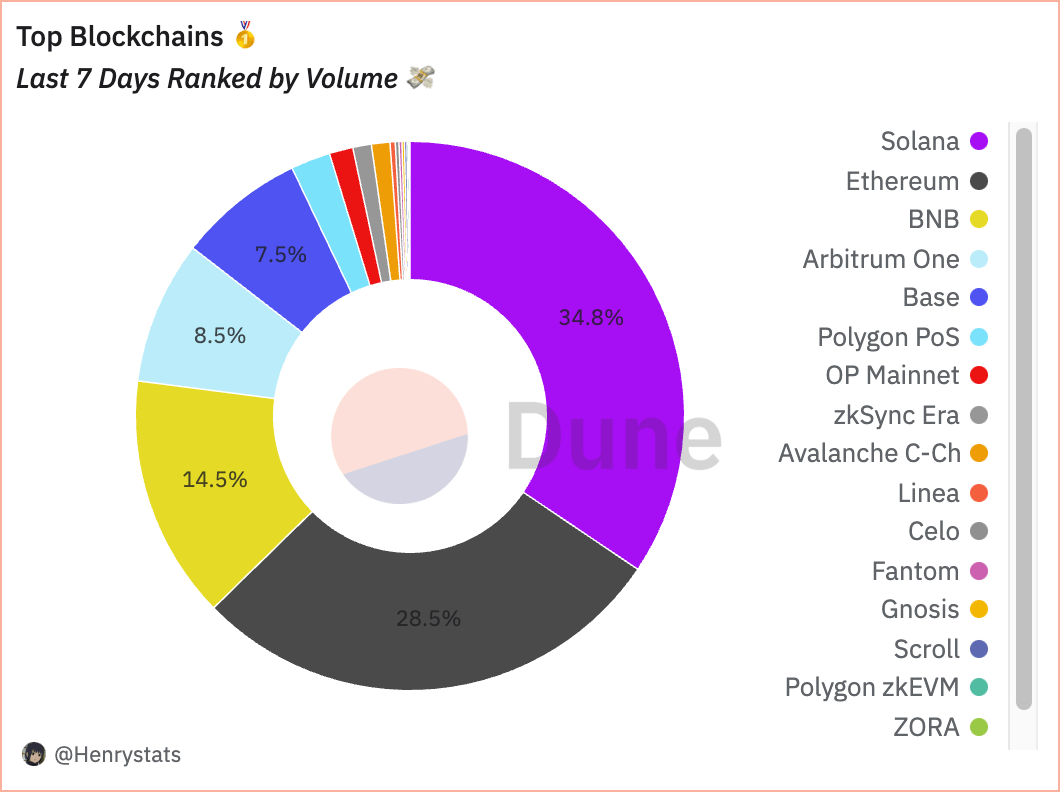

Probably the most attention-grabbing developments within the DeFi market is Solana, which has dethroned Ethereum and positioned itself because the de facto king of DeFi. With a complete buying and selling quantity of $10.98 billion during the last week, Solana accounts for 34.8% of all the DEX market quantity. This important market share is a testomony to Solana’s fast-growing ecosystem, which helps a variety of DEXs, from area of interest swap markets to outstanding gamers like Raydium.

Regardless of a slight lower of 4.49% in quantity over the interval, Solana continues to guide when it comes to energetic merchants, internet hosting 2.542 million customers. That is considerably larger than another blockchain and considerably larger than the 470,704 customers Ethereum has seen over the previous week. Such a excessive discrepancy between Solana and Ethereum’s variety of customers highlights Solana’s enchantment as a most well-liked buying and selling platform. The blockchain additionally supported 50,707 energetic pairs, the best available in the market, which exhibits its customers’ numerous vary of buying and selling choices.

| Blockchain | Quantity (USD) | % of Complete Quantity | Change Over Interval | Energetic Merchants | Energetic Pairs |

|---|---|---|---|---|---|

| Solana | $10.98B | 34.8% | -4.49% | 2.542M | 50,707 |

| Ethereum | $9.01B | 28.5% | -27.05% | 470,704 | 15,568 |

| BNB | $4.56B | 14.5% | +0.71% | 1M | 45,249 |

| Arbitrum One | $2.67B | 8.5% | -28.04% | 336,072 | 2,952 |

| Base | $2.36B | 7.5% | -29.39% | 672,196 | 16,495 |

With $9.01 billion in quantity, Ethereum trails carefully behind Solana and holds 28.5% of the market. The amount decreased by 27.05% over the previous week, which could not be a notable oscillation for a smaller blockchain however is particularly important given Etehreum’s foundational position in DeFi. Nevertheless, with 470,704 energetic merchants and 15,568 energetic pairs, the blockchain stays a key hub for DEX exercise regardless of the lower.

Binance’s BNB ranks third in quantity with $4.56 billion, making up 14.5% of the overall market. This represents a slight enhance of 0.71%, showcasing resilience amidst market downturns. With 1 million energetic merchants and 45,249 energetic pairs, the BNB chain continues to be a most well-liked selection for numerous merchants. Nevertheless, the comparatively small quantity relative to the variety of customers exhibits that these merchants could be dealing in decrease quantity trades than on Ethereum.

With a quantity of $2.67 billion, Arbitrum captures 8.5% of the market. The amount drop of 28.04% may replicate shifting consumer preferences or broader market traits. Nonetheless, the 336,072 energetic merchants it noticed up to now week present that fairly a little bit of worth continues to be being generated. Base is a notable up-and-comer in DeFi, with $2.36 billion in quantity and seven.5% of the market share. Regardless of a lower of 29.39% in quantity, Base helps a comparatively excessive variety of energetic merchants at 672,196, indicating sturdy consumer engagement.

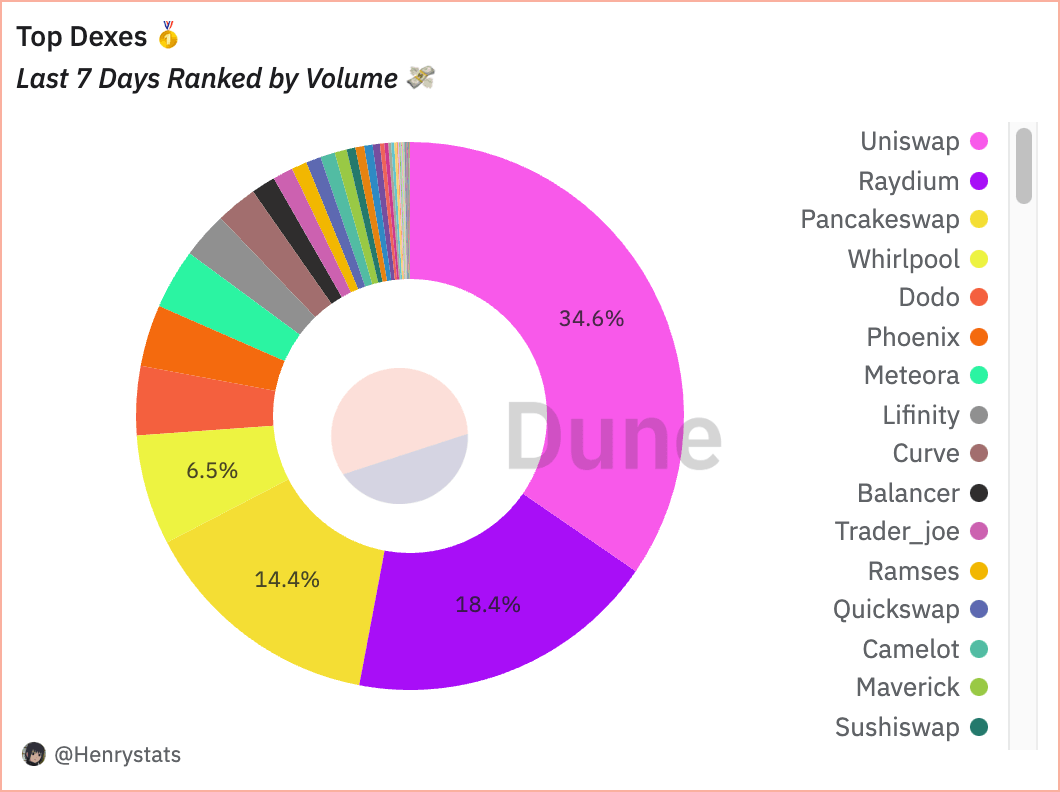

Concerning DEXs, Uniswap leads the market with a 7-day quantity of $10.91 billion, constituting 34.6% of the overall market quantity. It maintains a excessive variety of energetic merchants at 1.456 million and helps 30,683 energetic pairs regardless of a 28.93% drop in quantity over the previous week. The lower in quantity might be attributed to broader market circumstances, however its substantial dealer base suggests enduring loyalty and belief within the platform.

| DEX | Quantity (USD) | % of Complete Quantity | Change Over Interval | Energetic Merchants | Energetic Pairs |

|---|---|---|---|---|---|

| Uniswap | $10.91B | 34.6% | -28.93% | 1.456M | 30,683 |

| Raydium | $5.80B | 18.4% | +11.76% | 2.309M | 46,905 |

| PancakeSwap | $4.54B | 14.4% | -0.63% | 1.172M | 43,239 |

| Whirlpool | $2.05B | 6.5% | -4.68% | 514,709 | 1,963 |

Working on the Solana blockchain, Raydium has proven spectacular development with a quantity of $5.80 billion, marking an 11.76% enhance. With 2.309 million energetic merchants and 46,905 energetic pairs, Raydium is a essential participant in Solana’s dominance, offering customers with a wide selection of buying and selling choices and contributing considerably to the quantity on the blockchain.

The main DEX on BNB, Pancakeswap, noticed a buying and selling quantity of $4.54 billion, with a marginal lower of 0.63% up to now seven days. With 1.172 million energetic merchants and 43,239 energetic pairs, Pancakeswap stays a major pressure within the DeFi house. Its quantity stability suggests a resilient platform that continues to draw a gradual stream of customers.

The big variety of merchants and energetic pairs exhibits that the DeFi market is very liquid, and merchants have a variety of choices. Solana’s dominance over the market exhibits customers choose platforms that supply pace and low transaction prices regardless of occasional outages and hiccups.

The numerous drops in quantity we’ve seen throughout blockchains and even particular person DEXs are contrasted by resilience in platforms resembling Pancakeswap and BNB, exhibiting that pockets of stability kind available in the market even throughout excessive volatility.

The publish DeFi panorama shifts as Solana dethrones Ethereum in buying and selling quantity appeared first on cryptoteprise.