BLUE will probably be unveiled in July and can embody person incentives comparable to airdrops and buying and selling rewards.

The DEX additionally obtained an undisclosed quantity of funding from Movement Merchants forward of the token roll-out.

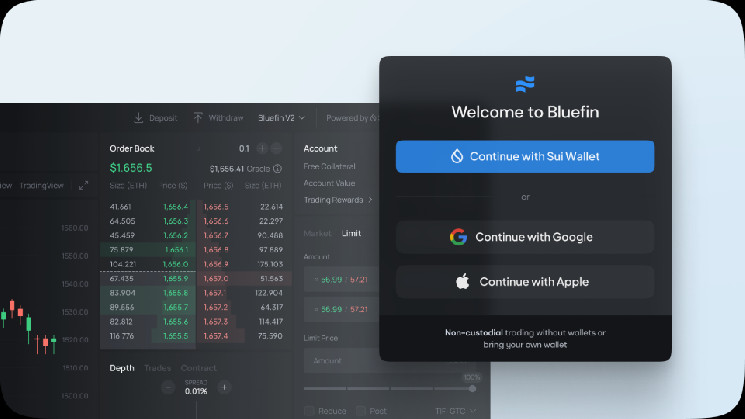

Decentralized orderbook change Bluefin will launch its governance token in July after securing whole of $17 million in funding since its inception in 2020.

The change – which lets customers commerce crypto perpetual swaps on the Sui community – additionally not too long ago obtained an undisclosed quantity of funding from buying and selling large Movement Merchants forward of the token unveiling. Bluefin will use the proceeds to increase past perpetual buying and selling and develop a decentralized monetary ecosystem, the agency mentioned in a press release to CoinDesk.

Bluefin claims to be a number one derivatives change within the Sui community and has captured over 70% market share with its perpetual buying and selling product. Its upcoming token, BLUE, will assist the agency decentralize decision-making processes whereas incentivizing customers and contributors.

“Our imaginative and prescient is to speed up the adoption of decentralized finance by bringing a sustainable, highly effective, and user-friendly change to the market.” Mentioned Zabi Mohebzada, co-founder of Bluefin.

Decentralized exchanges or DEXs grew to become standard through the crypto winter after some massive centralized platforms (CEXs), comparable to Sam Bankman-Fried’s FTX, imploded dramatically. DEXs are self-executing, that means they will coordinate the buying and selling of digital property between customers utilizing automated algorithms and forgo the human ingredient.

Perpetual swaps, distinctive to crypto, are monetary merchandise which can be primarily futures contracts with out an expiration date.

The BLUE token can have a most provide of 1 billion and an preliminary circulating provide of 116 million, in line with a tokenomics doc seen by CoinDesk. Buyers and Bluefin’s staff can have a three-year vesting interval with a lockup that can expire one yr after the preliminary roll-out subsequent month. It additionally plans to allocate 32.5% of the token for person incentives that can embody airdrops, buying and selling rewards, liquidity provisions and future development initiatives, in line with the doc.

The DEX can also be planning to start out an aggregator for buying and selling spot digital property and “Bluefin Professional,” which is able to provide cross-margin buying and selling and sooner executions.

Bluefin raised funds from main hedge funds, together with Brevan Howard Digital, Tower Analysis, Cumberland DRW, and Susquehanna Worldwide Group. The change mentioned it has seen greater than $25 billion in buying and selling quantity up to now this yr and month-to-month revenues exceeding $1 million.

Learn extra: Decentralized Change Bluefin’s New Model Goes Dwell on Sui Community