So far as expressions of crypto mentality go, leverage and prediction markets are about as pure as they arrive.

Fortunately, protocols at the moment are marrying the 2 — enabling merchants to ramp up bets on Polymarket outcomes utilizing borrowed crypto capital.

Onchain perp platform D8X, which runs on Polygon zkEVM, X Layer and Arbitrum, is the newest. It launched 5 leveraged orderbook markets based mostly on Polymarket information, D8X advised Blockworks solely. Improvement of the markets was first made public in July.

D8X itself is a white-label engine for managing perpetual futures markets onchain. Whereas the Switzerland-based crew behind the protocol, Quantena AG, provides a lite front-end, D8X is meant to be the technological and liquidity spine that drives perp DEX apps constructed by others, just like the Synthetix worth prop.

4 front-ends presently use the D8X engine, which as of at present contains the brand new leveraged prediction orderbooks: that Trump or Harris will win the US election, that Walz would be the DNC VP nominee, that the 49ers will win the following Tremendous Bowl and that Inside Out 2 would be the highest grossing film of 2024.

To mitigate danger, leverage, charges and slippage are all dynamically scaled to the state of the underlying Polymarket. Nearer odds means decrease leverage limits, because the market is at its riskiest for the protocol when bettors are cut up 50/50. Charges additionally function on the identical precept.

So, a Trump win traded for $0.484 — nearly even odds — which transformed to 2x most leverage throughout a stay demo of the market on OCTOFI earlier this morning. 1x leverage would’ve price 26.65% in charges, going as much as 39.12% for 2x leverage.

Learn extra: Unpacking a possible Polymarket ‘ban’

Polymarket in the meantime costs bets for Inside Out 2 grossing essentially the most of any movie this yr at $0.88, making it a heavy favourite. Leverage on D8X for that market went as much as 2.6x, with charges of solely 7.94%. (D8X, like Polymarket, will not be obtainable to US-based customers, in addition to for customers in different restricted jurisdictions.)

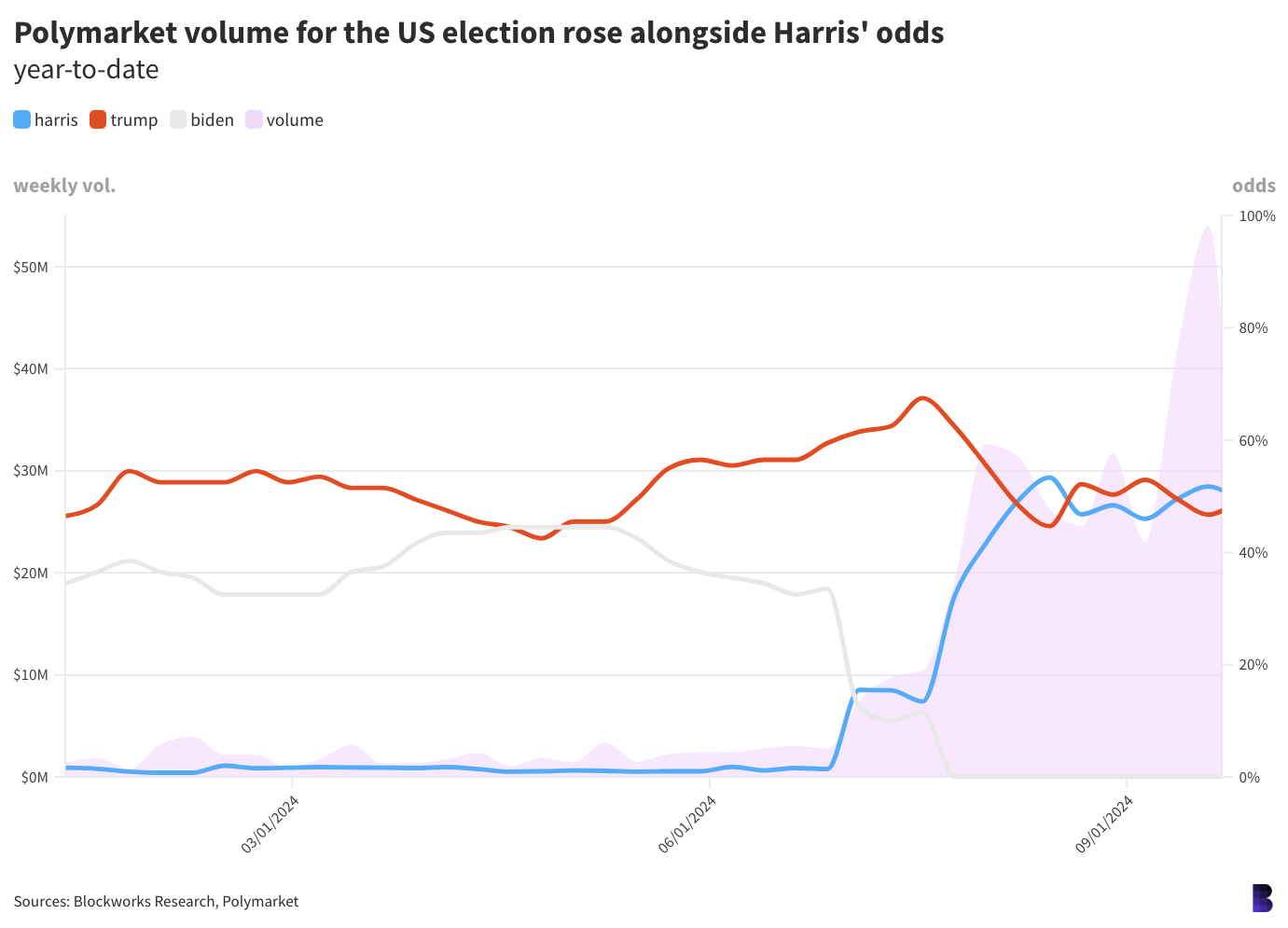

Trump and Harris have been virtually neck-and-neck on Polymarket for the reason that begin of August

The aim for D8X, co-founder Caspar Sauter advised Blockworks, is to construct “incorruptible monetary machines” that can be utilized by anybody — even centralized entities like banks and different conventional monetary establishments.

Sauter defined that over the long-term, a white-label mannequin makes numerous sense. It helps Web3 firms to retain their customers, as they’ll supply new merchandise with out sinking growth prices into constructing from scratch.

“But in addition, in Switzerland, you had basically all retail-focused banks enter crypto spot markets over the previous yr, besides the very huge ones like UBS — state-owned banks now retail spot buying and selling. The identical evolution naturally results in additionally providing derivatives,” Sauter stated.

“All these gamers, they use white-label merchandise, so we predict that having a decentralized white-label providing is basically essential, as a result of in any other case all of them find yourself white-labeling a Binance-type of setup, which isn’t actually what we wish.”

As for D8X’s push to construct on high of Polymarket, that maybe displays an curiosity in increasing the underlying social dynamics of prediction markets.

“A very long time again, I was an economist, and I did numerous educational analysis on the time — I like what Polymarket has constructed: markets that flesh out the views of individuals,” Sauter stated. “It’s very efficient to disclose what folks actually suppose, since you’re really betting. That’s stunning, and constructing on high of Polymarket was a no brainer.”

SynFutures, one other derivatives protocol, launched its personal leveraged markets on the US election final result final week, whereas dYdX is reportedly seeking to do the identical later this yr. Injective equally launched leveraged prediction markets this week, whereas Wintermute has lately dabbled in prediction market tokens.

A minimum of within the case of SynFutures’ markets, uptake has been comparatively sluggish, with solely $141 in quantity over the previous 24 hours for a Trump win, in comparison with over $5.1 million for the precise US election market on Polymarket.

However Polymarket weekly volumes hit document highs final month, at nearly $473 million, and so they’re on observe to submit comparable numbers in September. I’d look ahead to the speed of leveraged bets to rise main into November.

Polymarket is now thought-about a uncommon killer crypto app, after betting on the US election with USDC turned out to be an actual “a-ha” second within the wider tradition.

Maybe including leverage to the combination can do the identical for DeFi.

A modified model of this text first appeared within the day by day Empire e-newsletter. Subscribe right here so that you don’t miss tomorrow’s version.