NFT market Magic Eden sparked controversy on Friday after deciding to separate its domains between the US and different world areas. This transfer has raised issues amongst US customers about how these modifications would possibly have an effect on them.

In the meantime, the NFT sector continues to wrestle, with failure charges on the rise. A current report revealed that 96% of NFT initiatives have failed, highlighting the challenges the business faces.

Magic Eden’s Area Restructuring Stirs Considerations

The Solana-based NFT market Magic Eden introduced a website restructuring in a current publish on X (previously Twitter), outlining a break up between US and worldwide customers. Starting in September, US customers will entry the platform by magiceden.us, whereas others will use magiceden.io.

The worldwide area will deal with new options, whereas the US website will proceed providing the present service lineup. Nonetheless, core companies will stay constant throughout each platforms.

“Immediately we’re asserting the brand new magiceden.io for worldwide customers, plus magiceden.us, for customers in america. US will nonetheless have nice merchandise you understand and love whereas .IO will give us the flexibility to prepare dinner up (and sauté) much more options…,” learn the announcement.

Learn extra: 7 Greatest NFT Marketplaces You Ought to Know in 2024

Amidst the modifications, customers, significantly within the US, say that Magic Eden’s area restructuring is a transfer to keep away from a doable Wells Discover. This concern stems from the current regulatory assault on New York-based NFT market OpenSea.

In late August, the US Securities and Trade Fee (SEC) issued a Wells Discover towards OpenSea. As BeInCrypto reported, the regulator moved to categorise NFTs as securities, with {the marketplace}’s co-founder and CEO, Devin Finzer, pushing again.

Given OpenSea’s heft within the NFT market, stress has arisen within the house, prompting gamers like Magic Eden to restructure. Different customers within the US are involved a couple of doable clampdown on Magic Eden, therefore the transfer to separate companies.

“Precisely, like simply give it to us straight, why the smoke mirrors…if we’re imagined to have belief in these exchanges simply say, US regulators are coming for us, we’re bouncing out, make your selections accordingly,” one X person expressed.

Notably, the SEC continues to limit companies like airdrops, generally provided by NFT initiatives, within the US by classifying all digital property as securities. This was evident within the case involving Texas-based Beba LLC and the DeFi Training Fund (DEF).

In the meantime, amid regulation woes, scams, and different causes, the NFT growth is steadily dissipating. BeInCrypto reported that 96% of NFT initiatives are thought-about useless.

Learn extra: 10 Greatest NFT Advertising Companies To Promote Your Digital Artwork

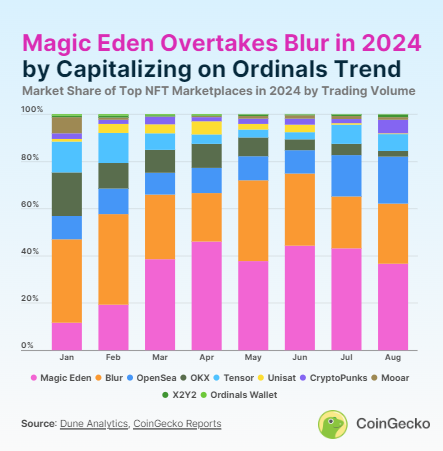

Regardless of dealing with backlash, Magic Eden stays a dominant pressure within the NFT market, just like OpenSea. In keeping with a current report from CoinGecko, Magic Eden holds 36.7% of the market share. In August alone, the platform recorded a month-to-month buying and selling quantity of $122.47 million.

Magic Eden Beats Blur NFT Market Buying and selling Quantity, Supply: CoinGecko

DappRadar knowledge reveals that after surpassing Blur in NFT buying and selling quantity by $108 million in Might, Magic Eden maintains the streak, with extra merchants on its platform than Blur. The success is vastly ascribed to Bitcoin Ordinals.