The worldwide adoption of cryptocurrencies has reached a brand new milestone in 2024, with a report by Triple-A revealing a surge to 562 million house owners — a 34% enhance from 2023.

This spectacular progress signifies the increasing attain of digital currencies, now owned by roughly 6.8% of the worldwide inhabitants.

International Developments in Cryptocurrency Adoption

Asia leads the surge with a 21.8% enhance in possession, rising from 268.2 million to 326.8 million. North America follows with a 38.6% rise, from 52.1 million to 72.2 million. South America skilled probably the most dramatic progress, with possession hovering by 116.5%, from 25.5 million to 55.2 million.

Europe and Africa additionally noticed substantial will increase. Europe rose from 30.7 million to 49.2 million, a 60.3% enhance. Africa grew from 40.1 million to 43.5 million, an 8.5% rise. Oceania’s curiosity in cryptocurrencies greater than doubled, from 1.4 million to three.0 million, a 114.3% enhance.

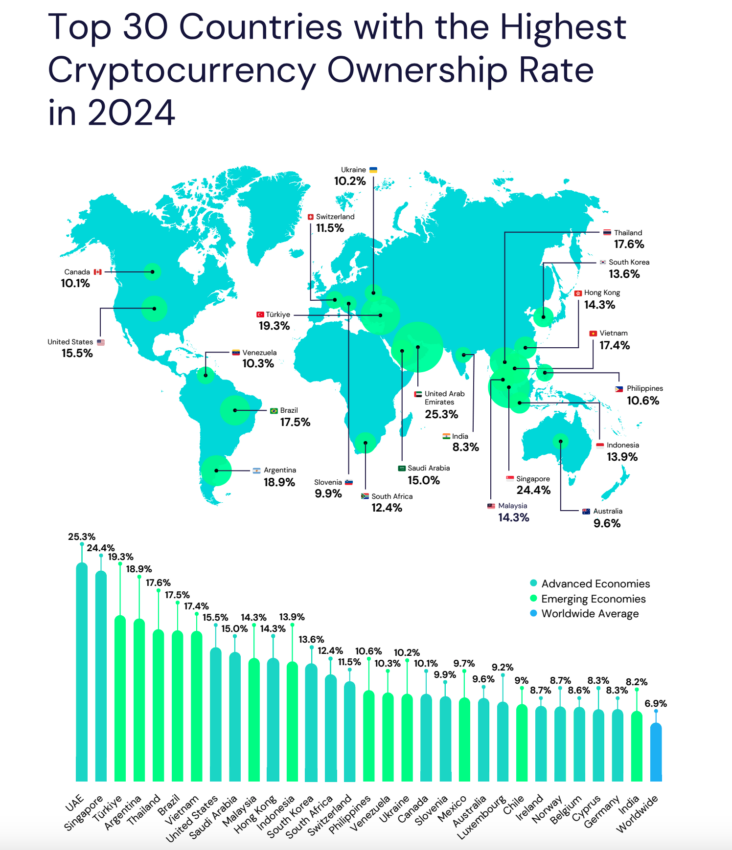

Prime 30 Nations with the Highest Cryptocurrency Possession Fee. Supply: Triple-a

The report additionally highlights the demographic composition of cryptocurrency house owners. The most important group falls inside the 25-34 age vary, comprising 34% of the full. The 35-44 age group follows carefully at 31%. Moreover, the gender hole stays notable, with 61% of householders being male and 39% feminine.

“The rise in cryptocurrency adoption in 2024 is greater than only a quantity; it exhibits a giant shift in how folks world wide deal with cash, pushed by a want for a brand new and environment friendly strategy to transfer cash throughout the globe,” Eric Barbier, CEO of Triple-A, feedback.

Regulatory our bodies just like the Financial Authority of Singapore (MAS) and the European Union have set clear tips, boosting market integrity and investor confidence. This regulatory readability performs a vital function within the rising cryptocurrency adoption.

Learn extra: Crypto Regulation: What Are the Advantages and Drawbacks?

“Clear regulation, funding, schooling, world collaboration, and a deep understanding of the ability of digital currencies are essential in driving and strengthening the symbiosis between fashionable and conventional fee methods,” Barbier states.

Regulatory frameworks are evolving, and technological developments are making cryptocurrencies extra accessible, driving the pattern of accelerating possession. This ongoing progress exhibits no indicators of slowing down and signifies a promising future for digital property’ integration into mainstream monetary practices.