Twelve cryptocurrencies will unlock almost $300 million in beforehand non-circulating provide this week, elevating issues as gross sales may intensify. Amongst these unlocks, three initiatives alone will launch over $220 million, to which merchants and traders ought to give particular consideration.

The cryptocurrency investing sport has modified prior to now few years, extremely weighted towards enterprise capitalists (VCs) and vesting contracts. With that, scheduled token unlocks gained elevated significance on this market’s dynamics as they will straight stress costs downwards.

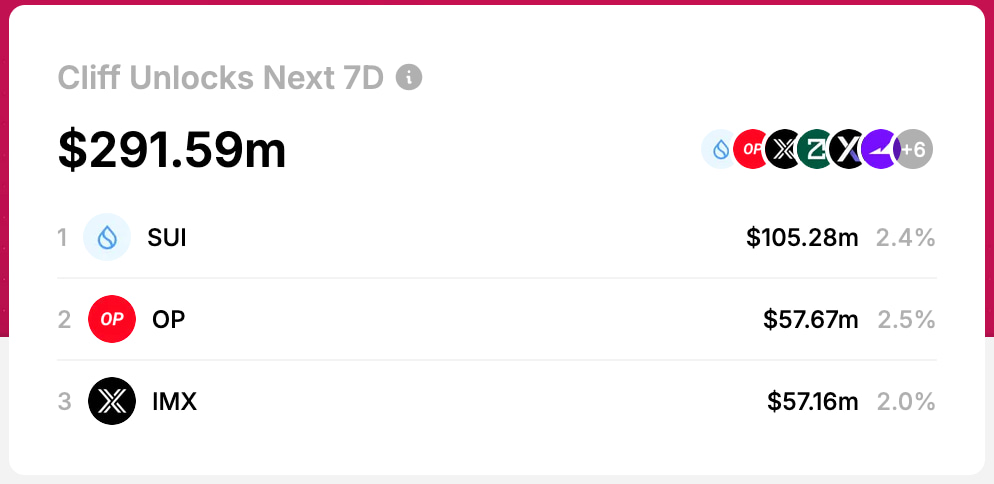

Within the subsequent seven days, twelve cryptocurrencies will unlock $291.59 million, of which 75% will come from three initiatives. Finbold retrieved this knowledge on September 29 from the TokenUnlocksApp platform, actively monitoring scheduled and linear unlocks.

Notably, the three most vital unlocks will occur on Sui (SUI), Optimism (OP), and ImmutableX (IMX). Every unlock represents 2% to 2.5% of their circulating provide, probably flooding the market with early traders’ exit liquidity.

Sui (SUI) to unlock over $105 million in October

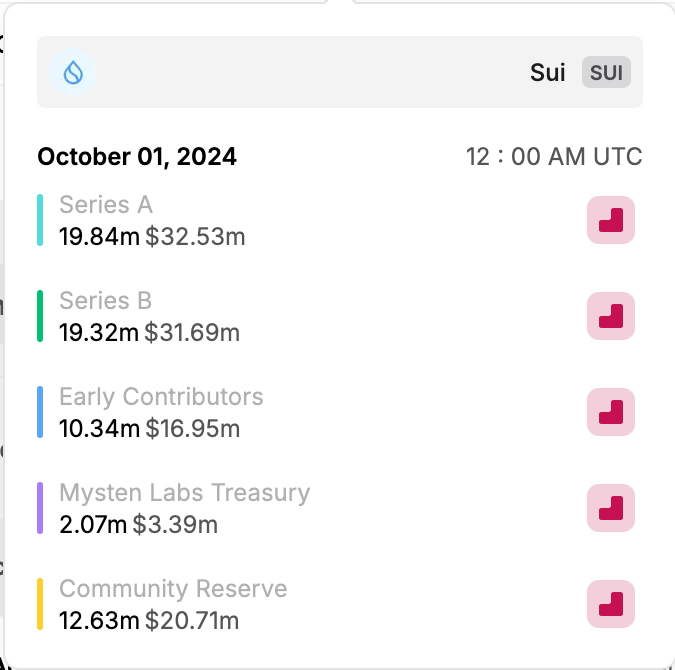

First, Sui contracts will unlock 64.20 million SUI on October 1, at the moment price $105.28 million, at $1.63. This quantity represents 36% of all unlocks this week and a couple of.4% of Sui’s circulating provide.

In accordance with the schedule, Collection A and B non-public traders will obtain 39.16 million SUI, price $64.22 million. These entities are more likely to strategically promote the unlocked vesting contracts within the following days to understand the sooner funding.

The remaining 39% of all launched SUI this week will likely be distributed to “Early Contributors,” the Mysten Labs Treasury, and a group reserve managed by Mysten Labs.

Optimism (OP) and ImmutableX (IMX) unlocks this week

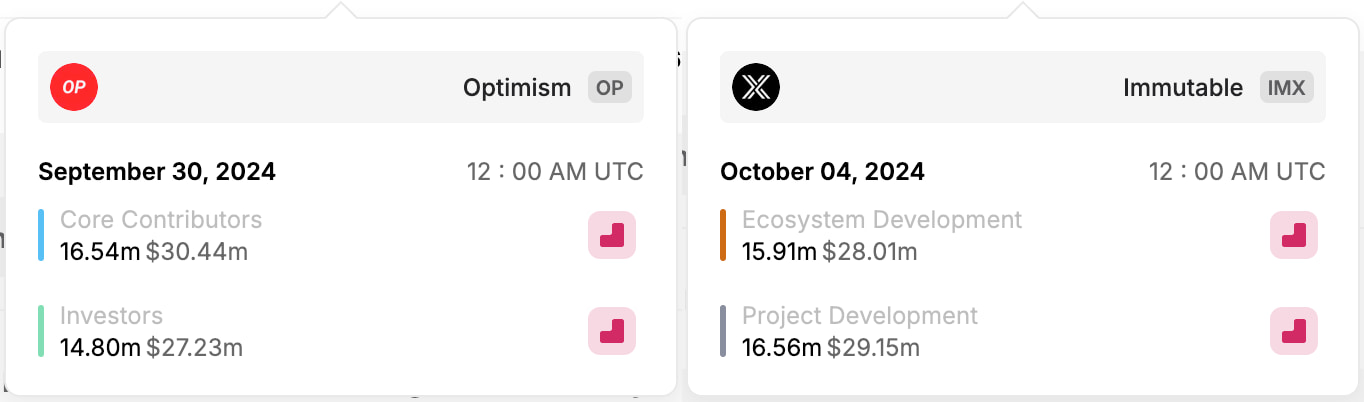

Subsequent, Optimism and ImmutableX will every unlock roughly $57 million of 31.34 million OP and 32.47 million IMX.

Optimism would be the first, with its unlock scheduled for September 30, whereas ImmutableX will do it on October 4. Each will distribute the tokens nearly equally between two subgroups every. Particularly, “Core Contributors” and “Traders” for Optimism, and “Ecosystem Growth” and “Mission Growth” for ImmutableX.

Total, cryptocurrency tokens have been used to fundraise startups and provides early traders straightforward exit liquidity. This can be a far completely different dynamic than first- and second-generation blockchains, which brings benefits and drawbacks.

Justin Bons, for instance, believes the crypto market is “dominated by predatory VCs,” as Finbold reported in June. The founder and CIO of Europe’s oldest cryptocurrency fund defined the way it utterly modified the sport of investing in cryptocurrencies.

So, whereas the exit liquidity is welcomed by extremely capitalized institutional gamers who can take part in non-public rounds, retail traders are largely punished by getting into initiatives with loads of incoming unlocks as they turn out to be the exit liquidity.

For this week, merchants and traders ought to intently monitor SUI, OP, and IMX, ideally avoiding huge exposures as gross sales happen.