Bitcoin’s (BTC) value seems to be in a precarious scenario as main stakeholders, sometimes called crypto whales, have reportedly paused their shopping for actions.

This halt in purchases has sparked issues about Bitcoin’s future valuation, notably as technical patterns point out a bearish pattern. Traditionally, such traits have been related to extended downswings or intervals of consolidation.

Crypto Whales Step Again as Bitcoin Turns Bearish

Latest information from Lookonchain means that establishments have stepped again from Bitcoin purchases, coinciding with a 1.44% decline in Bitcoin’s worth over the previous 24 hours. At the moment, Bitcoin is buying and selling round $58,300, a drop from final Monday’s excessive above $61,900.

The current value decline under the $60,000 mark appears to have impacted establishments’ curiosity in Bitcoin.

“Establishments appear to have briefly stopped shopping for, and the value of BTC dropped 4.5% at present! We observed that establishments stopped receiving USDT from Tether’s Treasury and transferring it to exchanges 2 days in the past,” Lookonchain said.

Moreover, stablecoin deposits to Tether’s Treasury have declined, and an outflow of 1.3 billion USDT has been made to exchanges for the reason that August 5 crypto market crash, indicating diminished shopping for strain and a extra cautious method from buyers.

Amid these issues, buying and selling veteran Peter Brandt identified that Bitcoin might have witnessed a pattern reversal from bullish to bearish. The analyst noticed a “loss of life cross” on the weekly chart between the 8 and 19 easy shifting averages (SMA).

Though this isn’t at all times a dependable predictor of future value, it suggests the start of a downtrend.

Bitcoin Weekly Chart. Supply: Commerce Navigator

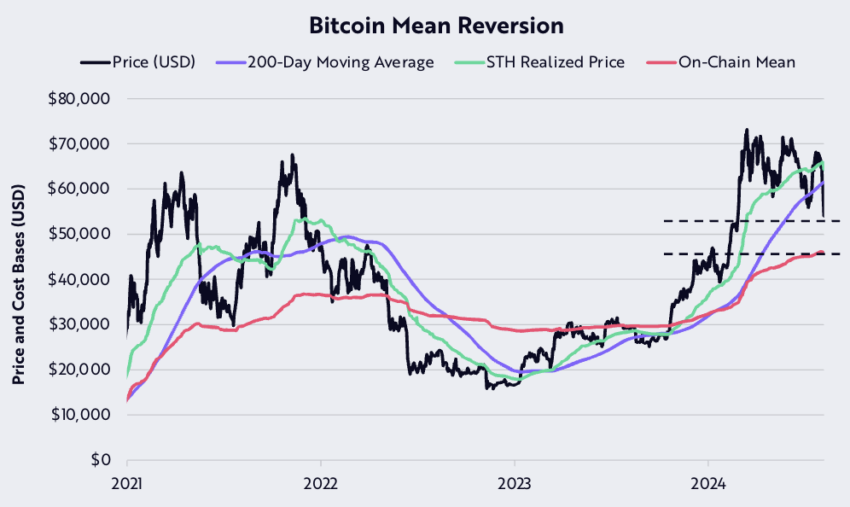

Curiously, David Puell, a Analysis Affiliate at ARK Make investments, supplied insights into Bitcoin’s crucial assist ranges within the occasion of a value correction.

“Bitcoin’s most necessary value helps are at $52,000 and $46,000, the latter confirmed by its on-chain imply, the pink line on the chart,” Puell defined.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Bitcoin Imply Reversion. Supply: Ark Make investments

In abstract, Bitcoin’s present technical situations, marked by the pause in institutional shopping for and the emergence of a loss of life cross, recommend a cautious outlook within the brief time period. With crucial assist ranges recognized and market sentiment leaning in direction of danger off, the approaching weeks shall be pivotal in figuring out whether or not Bitcoin can stabilize or if additional declines are on the horizon.