James Fickel is likely one of the world’s richest cryptocurrency traders, with an estimated millionaire crypto internet price of $400 million. The millionaire, nonetheless, has misplaced over $40 million in a sequence of decentralized finance (DeFi) leveraged trades since January 2024.

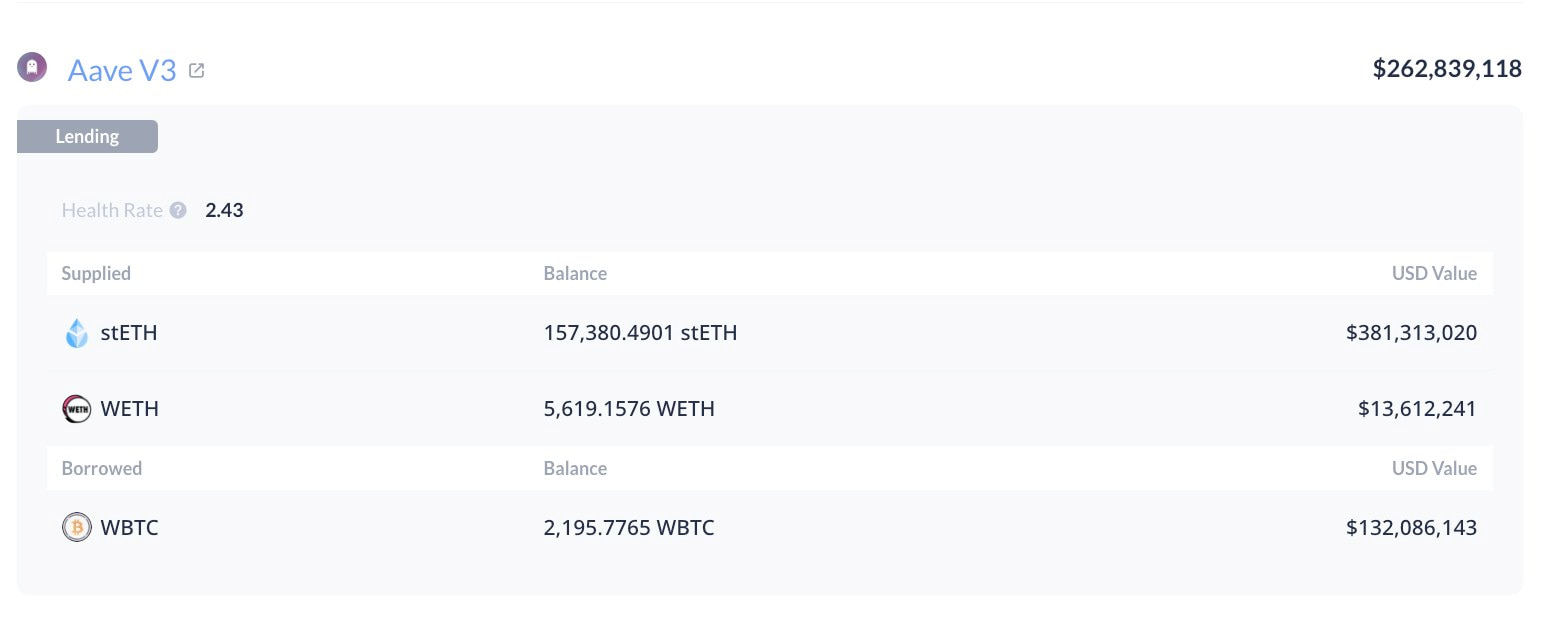

Specifically, James Fickel has opened lengthy Ethereum (ETH) positions towards Bitcoin (BTC) this 12 months, successfully shorting BTC with ETH. For that, the crypto millionaire has borrowed Wrapped Bitcoin (wBTC) on Aave, buying and selling it for Ethereum’s native token.

He borrowed 3,061 wBTC, price $172 million, exchanging it for 56,445 ETH from January 10 to July 1. On common, the ETH/BTC change price was 0.05424 wBTC per Ether, in response to a Lookonchain report.

Nonetheless, since August 7, the multi-millionaire crypto investor has been partially closing this place, repaying his debt at a loss. Total, James Fickel re-purchased 882 wBTC with $12 million in USDC and $39.9 million price of 16,000 ETH at a mean change price of 0.042 ETH/BTC.

The wBTC debt on Aave is now 2,196, price over $132 million, per the report, shedding $43.7 million.

James Fickel’s millionaire crypto internet price

Finbold retrieved knowledge from Arkham Intelligence on September 14 to entry James Fickel’s up to date crypto internet price following these trades.

As of this writing, the multi-millionaire investor holds practically $400 million in crypto tokens, largely made from ETH derivatives. This means Fickel is an lively DeFi person, specializing in the Ethereum ecosystem.

Apparently, this represents an over $46 million loss from his place since Finbold’s final report on Fickel’s trades in August.

In addition to being a millionaire crypto investor with this huge place on Ethereum, James Fickel can be a long life entrepreneur. He’s the founding father of the Amaranth Basis, a long life and neuroscience analysis agency that research ageing options.

ETH/BTC worth evaluation

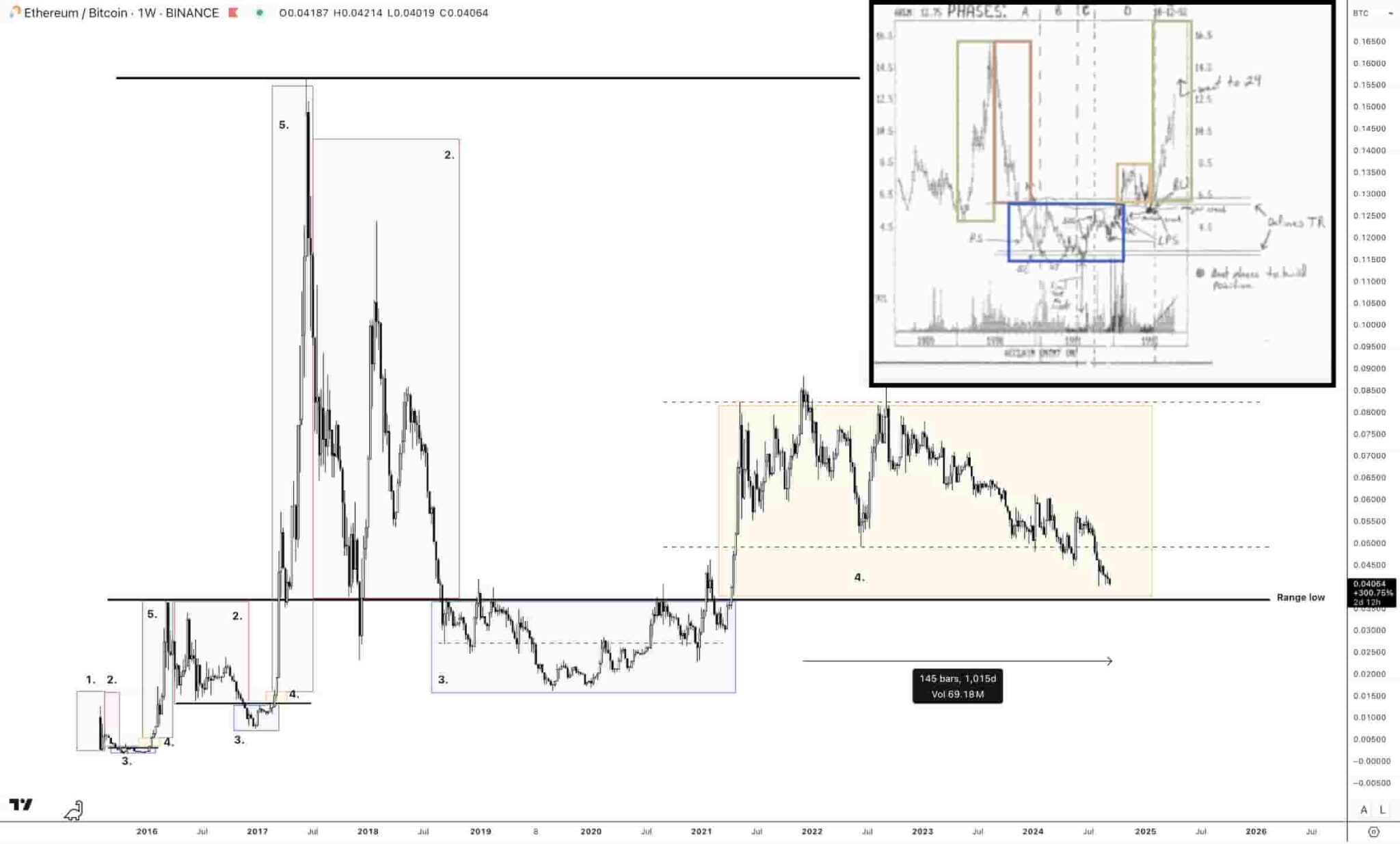

Within the meantime, the ETH/BTC pair trades at round 0.04064, ranging in what an analyst believes is assist. CryptoAmsterdan highlighted a key accumulation zone in ETH towards BTC, near the pair’s lows after an enormous downtrend.

“That is additionally what I’m in search of on this cycle. ETH | BTC is at a degree of alternative it hasn’t seen since reclaiming it in early 2019.”

– CryptoAmsterdan

In abstract, the dealer believes Ethereum will quickly surge in a parabolic rally towards the main cryptocurrency. Ought to this occur, the millionaire James Fickel would have capitulated from his crypto place on the worst attainable second.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger