Pushed by constructive market sentiment, crypto funding merchandise noticed their largest inflows in weeks, knowledge from CoinShares exhibits.

Crypto funding merchandise attracted over $530 million in inflows final week, the very best in 5 weeks, as traders reacted to dovish alerts from Federal Reserve Chair Jerome Powell on the Jackson Gap Symposium, in accordance with a report by CoinShares head of analysis James Butterfill.

He famous that though buying and selling volumes have been decrease than in latest weeks, they “remained excessive, reaching $9 billion for the week” as Powell’s remarks, hinting at a possible rate of interest lower as early as September, spurred vital market exercise.

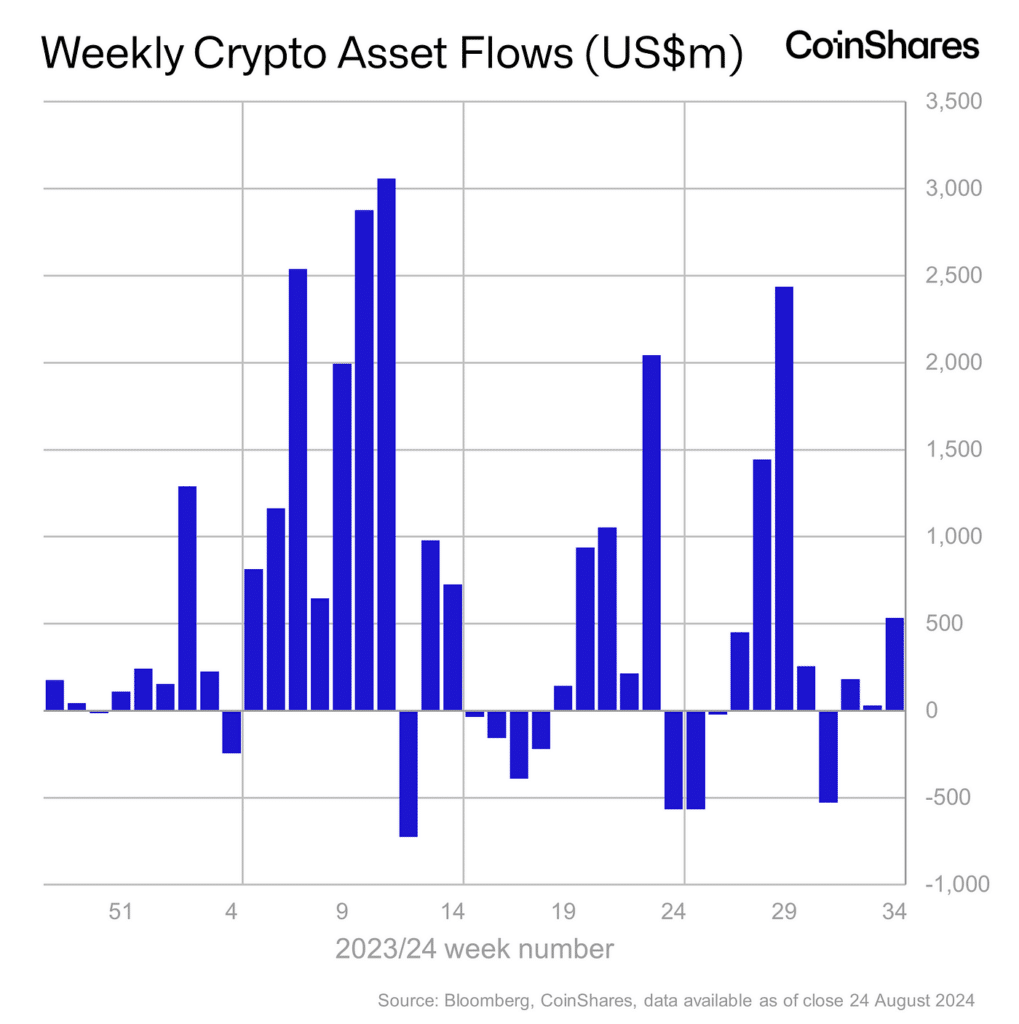

Weekly crypto funding merchandise’ flows | Supply: CoinShares

You may additionally like: Right here’s why Ethereum ETF inflows are lagging behind Bitcoin

Whereas the U.S. led the inflows with $498 million, Hong Kong and Switzerland additionally noticed positive factors of $16 million and $14 million, respectively. Butterfill added that Germany bucked the development with outflows totaling $9 million, leaving it as “one of many solely international locations with internet outflows year-to-date.”

Bitcoin (BTC) was the first beneficiary, with inflows of $543 million, underscoring its sensitivity to shifts in rate of interest expectations, with the majority of BTC inflows occurring on Friday, Aug. 23, instantly following Powell’s feedback, Butterfill added.

Though Ethereum (ETH) noticed contrasting actions with outflows of $36 million final week, new Ethereum ETFs have gained traction, attracting $3.1 billion in inflows over the previous month, the CoinShares head of analysis says, noting that these inflows have been “partially offset by outflows from the Grayscale Belief of $2.5 billion.”

Learn extra: Grayscale launches crypto funding trusts for SUI and TAO