Crypto funding modified course in This autumn, with a lot bigger rounds including to the ultimate stability of the 12 months. Beforehand, a slowdown was seen amongst early-stage investments.

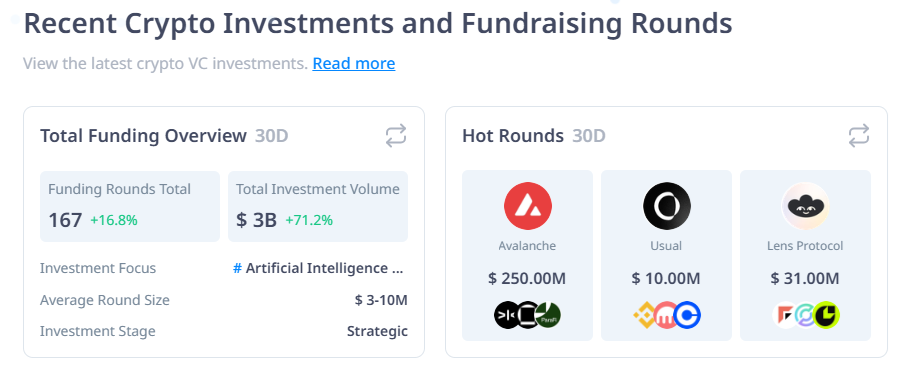

December’s VC funding reached the best ranges for This autumn, extending the pattern from October to November. VC funding enlargement coincided with ‘Uptober’ and essentially the most dramatic market restoration for the 12 months. December’s funding crossed the $3B mark, pushed by late-stage and OTC or undisclosed rounds. The month confirmed excessive development in comparison with December 2023, the place rounds have been capped at $1B.

Investments expanded by 72% from the earlier month, as large-scale non-public offers have been closed in December. | Supply: Cryptorank

Greater than 37.9% of all offers in December have been from undisclosed or unannounced classes. Nonetheless, round 30% of traders supported seed rounds, exhibiting confidence within the crypto market potential to help a brand new batch of startups. The final month of the 12 months closes a risky interval, the place funding ranged from a minimal of $640.75M in February, to December’s document, with a mean of $1B in month-to-month funding for a lot of the 12 months.

In December, VC funds set the document for the entire 12 months, as month-to-month funding returned to ranges not seen because the summer time of 2022. The present rounds focused advanced-stage tasks, surpassing the share of seed rounds.

Greater than 26% of all offers went to Ai tasks, with actions starting from rented GPU to chatbots.

VC-backed offers expanded whilst communities turned their liquidity to meme tokens. December was comparatively energetic for ICO and IDO companies, with $68.22M raised for the previous month, a slight lower from November.

December funding included high-rate offers and undisclosed OTC rounds

Funding quantity is up greater than 72% from the earlier month, bringing a robust near 2024. The largest deal for the month was a $250M non-public late-stage spherical for Avalanche.

December ended with 167 rounds in complete, with most offers within the early seed stage. Nonetheless, the big variety of $3M to $10M offers was offset by a number of outliers and offers that have been exterior to the crypto area. When it got here to small rounds, Animoca Manufacturers was nonetheless the chief with 109 offers previously 30 days. OKX Ventures adopted with 84 offers.

In December, the Tether cope with Rumble, valued at $775M, was counted towards complete funding, although it was not consultant of total VC sentiment. ALLO was one other deal that locked in $100M by way of debt financing, not constrained by VC’s readiness to take a position. CleanSpark and RIOT issued post-ICO debt. The previous month additionally noticed a number of OTC offers of undisclosed dimension in a year-end funding frenzy.

US funding drove VC funding in 2024

Many of the VC offers have been tied to US startups, and got here from US-based funds. One of many causes for the accelerated funding in November and December was the US election end result, which pointed to an upcoming crypto-friendly administration within the USA.

Different nations with an energetic VC local weather included Singapore, the UK, China, and the UAE. Germany was the chief amongst EU nations, with greater than $101M in offers for the previous 12 months.

The earlier years of regulatory oversight noticed the US Securities and Trade Fee basically punish crypto startups with protracted lawsuits, which discouraged funding.

Angel traders additionally set the pattern for selecting up AI tasks, adopted by DeFi, infrastructure, DEX, and one other try at funding NFT tasks. Some angel traders are additionally betting on L1 and L2 infrastructure, as there may be nonetheless competitors between chains.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap