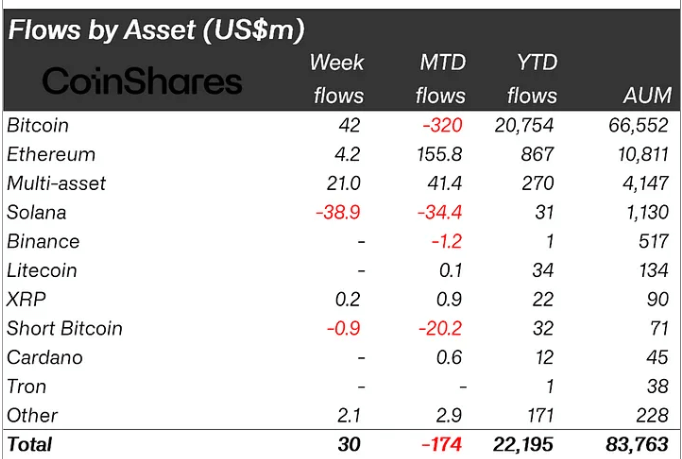

Crypto funding merchandise skilled a lukewarm efficiency final week, with modest inflows of $30 million, based on CoinShares weekly report.

The weekly buying and selling quantity for these merchandise additionally plummeted practically 50% from the earlier week, dropping to $7.6 billion.

James Butterfill, CoinShares‘ head of analysis, defined that these numbers have been the market’s response to current macroeconomic knowledge that implied the Fed was much less more likely to reduce rates of interest by 50 foundation factors in September.

Solana sees document outflows

Bitcoin regained its dominance, attracting $42 million in inflows. Nevertheless, its month-to-date movement stays detrimental, with a deficit of $320 million.

Equally, Ethereum continued its multi-week streak of inflows, drawing in a modest $4.2 million, bringing its complete month-to-month flows to just about $166 million.

Moreover, Multi-asset merchandise additionally noticed optimistic momentum, with $21 million in inflows. Different altcoins, together with XRP, reported positive factors as effectively.

Solana, nonetheless, confronted vital outflows, with traders pulling a document $39 million from the asset. This was largely resulting from declining community fundamentals and a pointy drop in memecoin buying and selling. Solana’s worth mirrored this bearish development, falling 6% over the previous week to $141.

In the meantime, Brief Bitcoin merchandise recorded practically $1 million in outflows, marking their second consecutive week of decline. This means that traders stay optimistic about Bitcoin’s short-term worth potential.

BlackRock usurps Grayscale

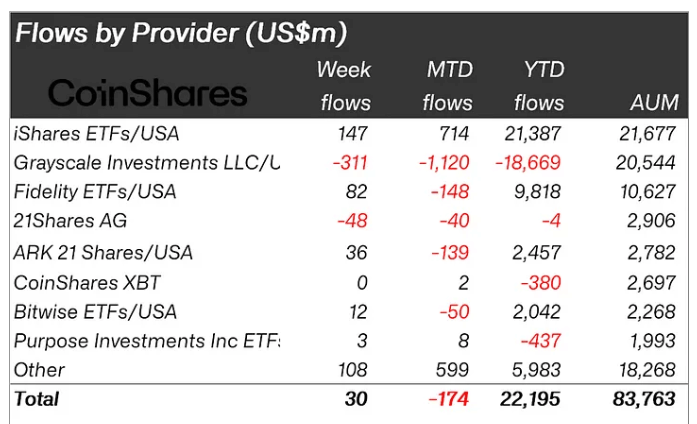

Butterfill additionally defined that the modest influx figures hid the truth that established ETP suppliers like Grayscale have been shedding market share to issuers of newer funding merchandise like BlackRock.

A more in-depth have a look at particular suppliers reveals a extra nuanced image. Grayscale, a well-established supplier of Bitcoin and Ethereum ETFs, noticed continued outflows final week, with over $300 million exiting its merchandise. This introduced its month-to-date flows to a detrimental of greater than $1 billion and dragged the overall worth of property beneath its administration to $20.5 billion.

In distinction, new entrants like BlackRock iShares and Constancy’s FBTC reported sturdy inflows. Notably, BlackRock’s ETF noticed inflows of $147 million final week, and its AUM has now risen to $21.677 billion, the very best within the sector.

Talked about on this article