Regardless of declining crypto costs final month, centralized alternate volumes noticed an uptick in exercise.

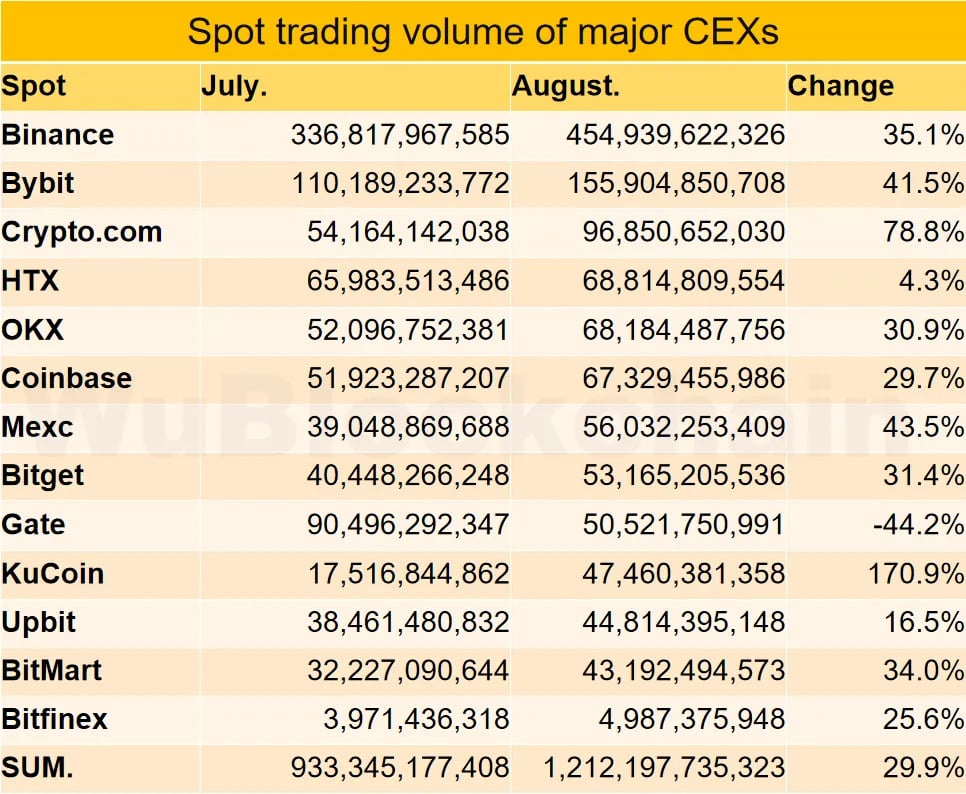

Information from centralized crypto exchanges confirmed a 30% month-on-month improve in August, at the same time as Bitcoin (BTC) and different digital belongings skilled a historic downtrend. August and September are sometimes bearish months for crypto, however decrease costs don’t essentially imply lowered buying and selling exercise, as the information confirms.

Binance and Bybit led the most important centralized alternate (CEX) pack, with will increase of 35% and 41%, respectively. Nonetheless, KuCoin, Crypto.com, and MEXC outperformed the bigger platforms. Crypto spot buying and selling volumes on these three platforms elevated by 171%, 79%, and 44%, respectively, as traders shuffled belongings and blockchain-based worth.

In the meantime, Gate noticed a 44% decline in exercise, whereas Justin Solar-backed HTX and South Korean big Upbit had the smallest will increase in buying and selling quantity.

CEX alternate quantity improve 30% MoM in August | Supply: WuBlockchain

You may also like: Bitcoin whale accumulation heats up forward of US CPI report

Why CEX quantity jumped when worth slumped

As crypto.information reported, a few of August’s CEX exercise included billions in Bitcoin outflows from platforms like Binance and Coinbase. Buyers withdrawing from crypto exchanges could also be thought to be a bullish signal.

The leap in CEX spot buying and selling quantity possible alerts optimism amongst digital asset traders. Officers on the U.S. Federal Reserve had been poised to introduce rate of interest cuts earlier than the top of this month, barring any drastic modifications or hawkish financial knowledge.

Diminished charges might incentivize traders to borrow extra money and allocate capital to belongings as threat urge for food will increase.

CoinBureau CEO Nic Puckrin instructed crypto.information by way of e-mail that the elevated liquidity might result in worth development for Bitcoin and different cryptocurrencies. Puckrin added that Bitcoin will possible paved the way, whereas altcoins like Ethereum (ETH) proceed to underperform relative to BTC. Bitcoin whales entered an accumulation spree forward of the anticipated Fed price cuts.

I’d say that the present market is positioned for a smooth September. I anticipate Bitcoin to proceed buying and selling in a spread certain vogue for the approaching few weeks. Altcoins are more likely to fall relative to Bitcoin subsequently resulting in a rise in Bitcoin dominance.

Learn extra: Spot Bitcoin ETFs finish 8-day outflows streak, Ether ETFs lose $5.2m