Spot Bitcoin exchange-traded funds in america skilled their third consecutive day of web outflows, whereas spot Ethereum ETFs additionally noticed a return to unfavourable flows.

Based on knowledge from SoSoValue, the 12 spot bitcoin exchange-traded funds recorded $71.73 million in web outflows on Aug. 29, marking the third consecutive day of outflows.

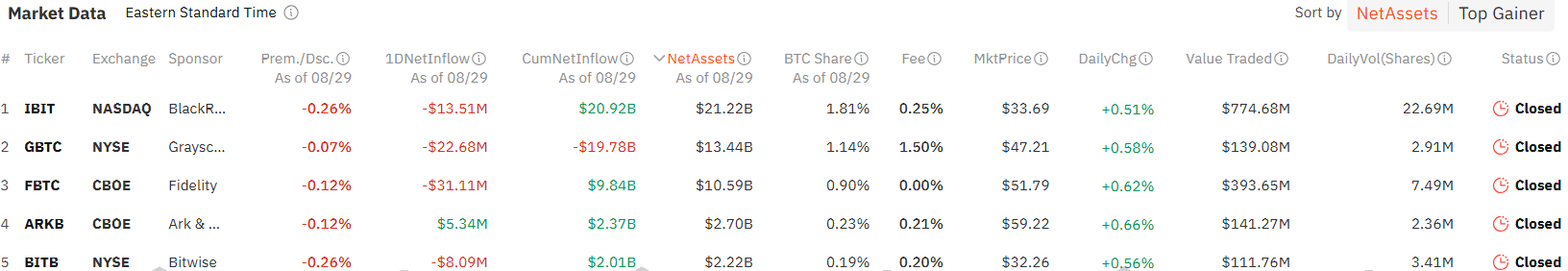

FIdelity’s FBTC led the lot, logging $31.1 million in outflows on the day — its highest recorded outflows since Aug. 6. Grayscale’s GBTC continued its outflow streak, with $22.7 million leaving the fund, pushing its whole outflows to this point to $19.78 billion.

Spot Bitcoin ETFs influx/outflow | Supply: SoSoValue

BlackRock’s IBIT, the biggest spot Bitcoin ETF by web property, recorded its first web outflows since Could 1, amounting to $13.5 million. Regardless of this, the fund’s whole web inflows stay at $20.91 billion.

Different funds, similar to Bitwise’s BITB and Valkyrie’s BRRR, noticed outflows of $8.1 million and $1.7 million, respectively. Ark and 21Shares’ ARKB was the one spot Bitcoin ETF to report web inflows, bringing in $5.3 million.

The entire each day buying and selling quantity for the 12 spot Bitcoin ETFs dropped to $1.64 billion on Aug. 29, down from $2.18 billion the day before today. On the time of writing, Bitcoin (BTC) was down 0.4% over the previous day, buying and selling at $59,342 per knowledge from crypto.information.

You may also like: Bitwise CIO: Bitcoin ETFs breaking data, gaining unprecedented institutional traction

In the meantime, the spot Ethereum ETFs within the U.S. returned to unfavourable flows, recording $1.77 million in web outflows on Aug. 29, following modest inflows of $5.84 million the day earlier than.

Grayscale’s ETHE was the one spot Ethereum ETF to report outflows, dropping $5.3 million, which was partially offset by $3.6 million in web inflows into the Grayscale Ethereum Mini Belief. The remaining seven spot Ether ETFs noticed no exercise on that day.

The entire buying and selling quantity for the 9 ETH ETFs fell to $95.91 million on Aug. 29 from $151.57 million on Aug. 28. On the time of publication, Ethereum (ETH) was additionally up 0.9%, exchanging arms at $2,529.

Learn extra: Spot BTC ETFs surpass $18b amid elevated investor confidence