European digital asset funding agency CoinShares reported monetary outcomes for the second quarter of 2024 right now (Tuesday), constructing on the momentum from Q1 and saying a particular dividend following the profitable restoration of its FTX declare.

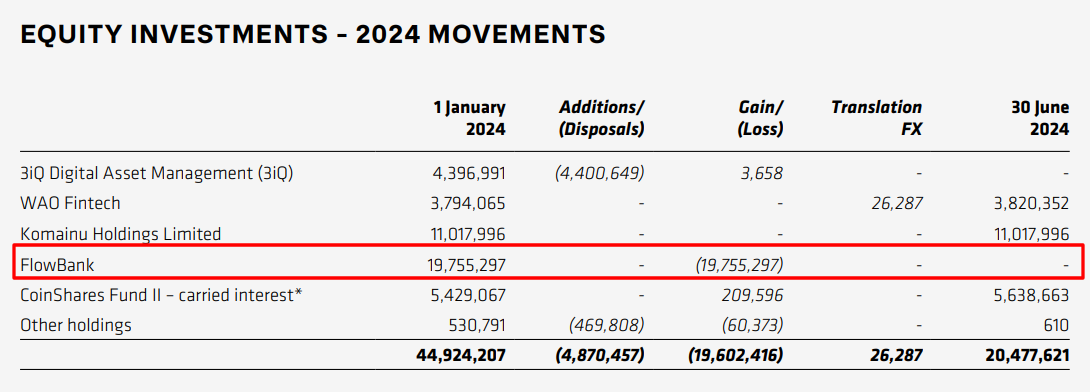

Nevertheless, the report signifies that FlowBank’s collapse negatively impacted the corporate’s “principal investments,” in the end consuming the overwhelming majority of complete revenues.

The corporate posted asset administration income of £22.5 million for Q2 2024, greater than doubling from £10.7 million in the identical interval final yr. Complete complete revenue surged to £25.8 million, up from £5.3 million in Q2 2023. Adjusted EBITDA additionally noticed vital progress, reaching £26.6 million in comparison with £11.4 million within the prior-year quarter.

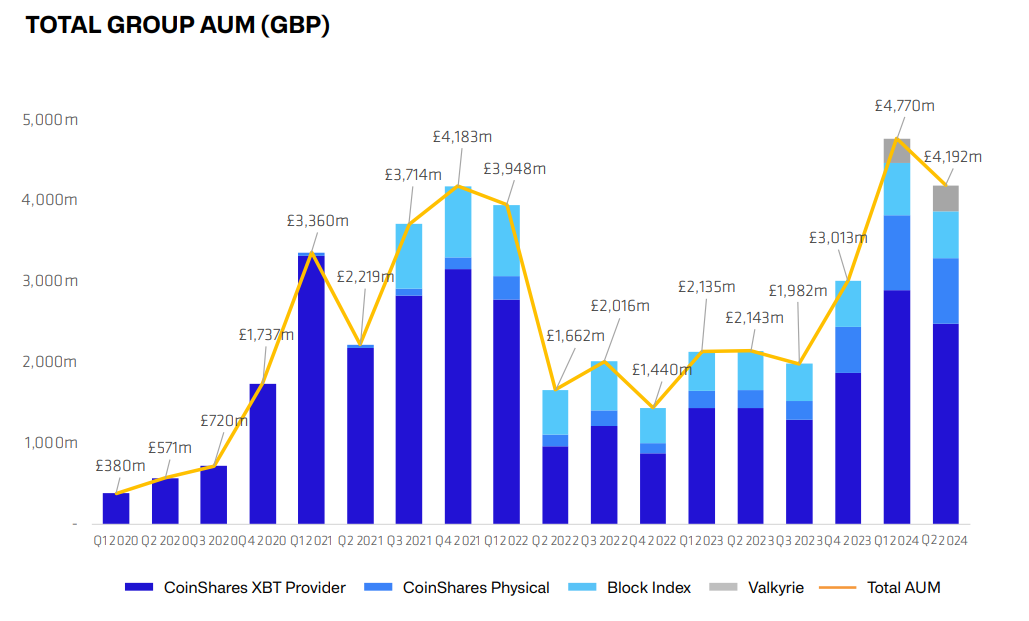

The full property underneath administration (AUM) of CoinShares on the finish of June amounted to £4.19 billion, down from the document stage of £4.8 billion reported within the earlier quarter. Nevertheless, these are nonetheless document values, exceeding the earlier data from the top of 2021.

“Our constant efficiency in Q2 demonstrates that our Q1 was not an outlier, however the results of continued efforts. This underscores the advantages from our restructuring and streamlining initiatives over the previous two years,” Jean-Marie Mognetti, CEO of CoinShares, commented on the outcomes.

Nevertheless, the corporate reported a fabric write-down in its “principal investments” portfolio because of the chapter of Swiss digital financial institution FlowBank SA, which it has elected to impair totally.

CoinShares and FlowBank

The corporate’s complete income consists of asset administration actions, income from cryptocurrency investments, and the aforementioned principal investments. This final class generated a lack of practically £25 million, consuming all of the income offered by AUM.

In mid-June, the corporate was knowledgeable that “the Swiss Monetary Market Supervisory Authority had opened chapter proceedings in opposition to FlowBank.” Just a few days later, the corporate determined “to completely impair its funding in FlowBank,” leading to an impairment cost of over £21.8 million.

The corporate’s asset administration enterprise consolidated its management place in Europe, with its European Bodily ETP platform recording its third-best quarter when it comes to web flows. In the US, CoinShares targeted on product improvement and advertising and marketing initiatives for its not too long ago acquired Valkyrie enterprise.

FTX Claims

On a optimistic notice, CoinShares accomplished the sale of its FTX declare on the finish of June, attaining a restoration charge of 116% web of dealer charges, translating to a return of £28.7 million. Following this restoration, the Board of Administrators has determined to pay a particular dividend to shareholders amounting to £24.3 million.

“CoinShares’ balanced technique goals to determine it as a novel and enticing long-term funding within the crypto listed market, whereas strengthening its place as a pacesetter in digital property,” added Mognetti. “The decision of the FTX state of affairs has been extremely favorable for CoinShares.”

The worth of the particular dividend represents 86% of the full funds obtained in respect of the sale. “It’s to be distributed with the forthcoming common dividend fee scheduled for 3 October 2024,” the report concluded.