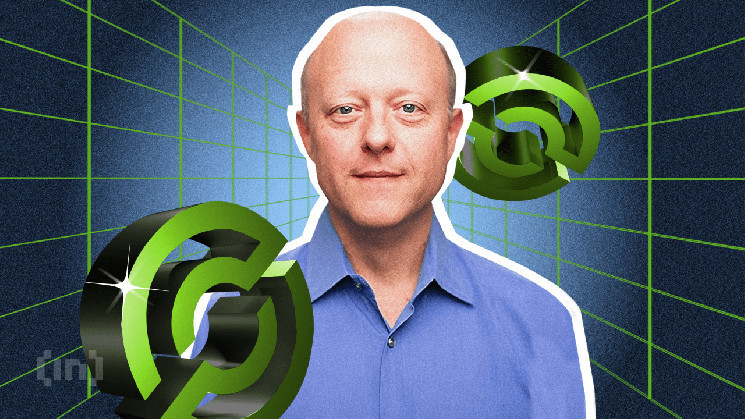

Jeremy Allaire, CEO of Circle, the issuer of the USDC stablecoin, introduced new partnerships with trade giants throughout his go to to Brazil.

Allaire famous that the adoption of cryptocurrencies and stablecoins continues to be in its early levels.

Circle Formally Enters Brazil, BTG Pactual Will Difficulty USDC

Throughout his go to to Brazil, Circle’s chairman signed a partnership with BTG Pactual. This implies one in every of Latin America’s largest funding banks will now supply USDC to the market by the native banking system.

“BTG can be our direct liquidity accomplice for the minting [registration within the blockchain] of USDC 24 hours a day, seven days per week. Because of this on a retail and institutional degree, firms and buyers will be capable to nearly immediately difficulty and obtain USDC in Brazil utilizing the actual within the native banking system,” Allaire mentioned.

The manager with over 20 years of expertise acknowledged that the partnership with BTG “represents an amazing milestone.”

“We’re nonetheless within the early levels and originally of the broader use of digital {dollars}, we’re originally of the broader use of blockchain within the monetary system,” he acknowledged.

Learn extra: Prime 12 Crypto Firms to Watch in 2024

Allaire instructed a small group of journalists in São Paulo that he’s actually excited to see wider adoption by finish customers. He expressed enthusiasm in regards to the rising variety of monetary establishments, fintechs, and cost firms getting access to this infrastructure in Brazil. Whereas these partnerships are necessary, he famous that Brazil has a a lot bigger general variety of monetary establishments and fintechs.

“We wish to develop this and I feel now we’ve got the actual infrastructure, the monetary infrastructure, we’ve got the important thing companions that may actually develop this. I feel it’s actually the start and it’s about enabling, you allow 1000’s of establishments right here in Brazil to have the ability to use this infrastructure,” Circle CEO commented.

BTG CEO Roberto Sallouti acknowledged in the course of the Circle assembly that blockchain is probably going the longer term path for the institutional and monetary methods. Jeremy Allaire echoed this sentiment in his dialogue with reporters. The CEO highlighted the success of the Central Financial institution’s PIX system, which now has over 160 million customers. He famous that Brazil, with leaders like Roberto Campos Neto, has a progressive strategy to advancing monetary expertise and initiatives like Drex.

“We’re dedicated to creating a optimistic affect on the Brazilian market and partnering with key stakeholders to allow firms to take part within the world financial system extra simply and effectively. There are numerous highly effective alternatives on the horizon when Brazil’s superior fintech ecosystem converges with the world’s most accessible greenback platform,” Circle co-founder mentioned.

Brazil Will Develop into a Main Crypto Participant

Jeremy Allaire defined that Circle initially launched USDC in Singapore as a consequence of robust Asian demand. However, he now sees Brazil as a serious world participant.

“Folks know that Asia is a big hub for this exercise, however once we take a look at different markets, we take a look at Brazil,” he acknowledged.

In line with Allaire, the proactive stance of Brazilian regulators, such because the Central Financial institution, has attracted Circle’s consideration. In addition to partnering with BTG, Circle has additionally teamed up with Nubank and Mercado Bitcoin.

When requested if the USA lags behind Brazil in digital foreign money adoption, Jeremy Allaire famous that the US has the biggest monetary system on the earth and essentially the most to lose from inaction. Nevertheless, he additionally talked about that the US authorities may want to attend “till issues are extra developed earlier than taking the following steps.”

Learn extra: Crypto Regulation: What Are the Advantages and Drawbacks?

“This can be a slow-moving pattern. However on the identical time, there was a selected surroundings round fintech innovation. And I take into account Circle to be one in every of them. They have been constructed underneath an American regulatory regime, and so there was lots of progress,” Allaire famous.

Relating to the US presidential race, Jeremy Allaire talked about Donald Trump, noting that the Republican candidate typically helps cryptocurrencies. Circle CEO additionally identified that Trump opposes the digital greenback (CBDC).

“No matter who wins the presidential election in the USA, we’re going to see extra constructive, bipartisan work to manage the sector. There could also be some variations of opinion right here or there, however I feel the final path is, regardless, in the direction of good regulation,” he concluded.