Ethereum (ETH) seems to have discovered a strong ally in World Liberty Monetary (WLFI), a decentralized finance (DeFi) platform reportedly linked to U.S. President Donald Trump.

In a shopping for spree simply hours earlier than Trump’s inauguration ceremony, WLFI acquired $48 million value of ETH, drawing renewed consideration to the cryptocurrency.

The acquisition comes at a important time when Ethereum is striving to beat a interval of underperformance, doubtlessly marking a major turning level in its trajectory.

Amid this surge in exercise, market watchers are speculating on the place Ethereum may head subsequent because it rides a wave of renewed momentum.

At press time, Ethereum is buying and selling at $3,299.17, reflecting a 24-hour lack of 0.65%. Nevertheless, on a weekly foundation, the token has gained 2.8%, hinting at rising investor optimism.

AI predicts Ethereum value amid WLFI shopping for spree

To guage Ethereum’s potential trajectory, Finbold analyzed market developments and leveraged insights from OpenAI’s ChatGPT-4o mannequin to offer a clearer image of what lies forward for the cryptocurrency.

In keeping with a current Finbold analysis, ChatGPT is probably the most searched AI device on Google, growing its relevancy.

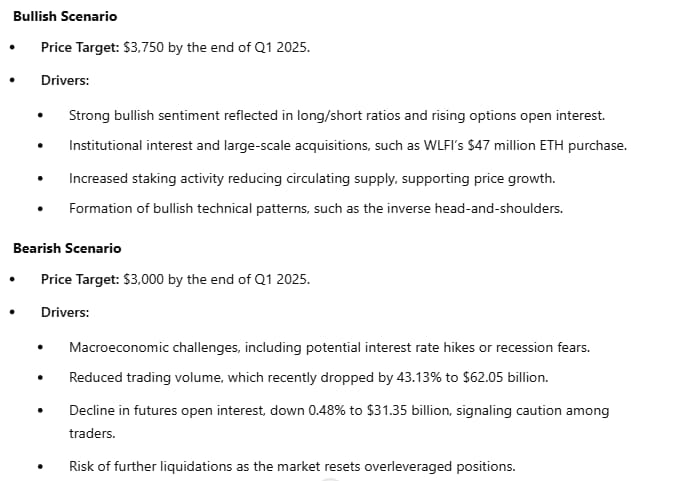

The AI mannequin suggests Ethereum may climb to $3,750 by the tip of Q1 2025 in a bullish situation pushed by robust market momentum. Nevertheless, in a bearish case marked by macroeconomic headwinds or tightening liquidity, the worth may retreat to $3,000.

Elements driving Ethereum’s value

World Liberty Monetary has emerged as a key catalyst for Ethereum’s current momentum.

On January 20, WLFI acquired 14,403 ETH value $48 million, growing its complete holdings to 58,853 ETH, in line with Arkham Intelligence.

The platform additionally made a major transfer throughout different belongings, buying $109 million in digital currencies, together with 177.26 Wrapped Bitcoin (WBTC) value roughly $18.8 million in simply hours.

Including to this bullish outlook, WLFI staked practically 5,000 ETH, value over $15 million, via Lido, signaling its long-term dedication to the Ethereum ecosystem.

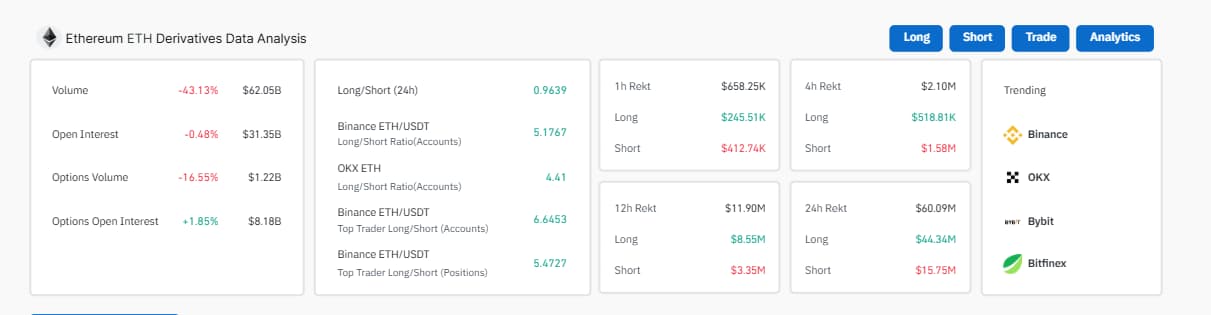

Derivatives information: A combined bag

Regardless of WLFI’s aggressive shopping for spree, Ethereum’s derivatives information paints a combined image. Lengthy/quick ratios on platforms like Binance level to robust bullish sentiment amongst merchants, with choices open curiosity climbing 1.85% to $8.18 billion.

Nevertheless, the market exhibits indicators of diminished exercise, with buying and selling quantity dropping by 43.13% to $62.05 billion and open curiosity barely declining by 0.48% to $31.35 billion.

Moreover, liquidations over the previous 24 hours, totaling $44.34 million in longs and $15.75 million in shorts, replicate a market that continues to be cautious, with current actions favoring a reset in overleveraged positions.

This mixture of optimism and diminished exercise means that whereas merchants present confidence, broader participation, and better volumes are wanted to maintain a bullish narrative.

In the meantime, technical evaluation signifies a bullish outlook, with Ethereum forming an inverse head-and-shoulders sample, a traditional sign for a possible breakout.

Including to this, Michael Saylor, the chief chairman of MicroStrategy and a distinguished Bitcoin advocate just lately admitted to being flawed about Ethereum’s worth proposition an announcement that additional fuels curiosity within the cryptocurrency.

Ethereum value outlook

Amid this backdrop, synthetic intelligence fashions predict Ethereum may hit $3,750 by the tip of Q1 2025, supported by WLFI’s sustained market exercise.

Nevertheless, the mannequin emphasizes the significance of elevated buying and selling volumes and broader market participation to take care of bullish momentum.

Conversely, in a bearish situation marked by macroeconomic headwinds or diminished liquidity, Ethereum may retrace to $3,000.

If WLFI’s actions encourage broader institutional adoption, Ethereum could also be poised for a major rally, with $3,750 as a near-term goal. For now, market members will intently watch whether or not Ethereum can capitalize on its newfound momentum.

Featured picture from Shutterstock