Over the previous seven months, information from cryptoquant.com reveals a staggering $26 billion value of bitcoin and ethereum has been pulled from centralized crypto exchanges. Throughout the identical interval, buying and selling platforms have seen an inflow of $9.1 billion ERC20-based tethers since Jan. 1.

Bitcoin and Ethereum Shortage Grows as $26 Billion Leaves Centralized Change

Bitcoin is turning into tougher to return by this yr. Whereas traders are busy withdrawing the main digital asset from centralized exchanges, miners are additionally seeing their reserves dwindle. Information from cryptoquant.com reveals that miners have offloaded 29,377 BTC, with their reserves dropping from 1.84 million BTC to 1.81 million BTC. Which means, along with shedding half or extra of their income after the fourth halving in April, miners have additionally parted with bitcoin reserves valued at roughly $1.8 billion at right this moment’s BTC alternate charges.

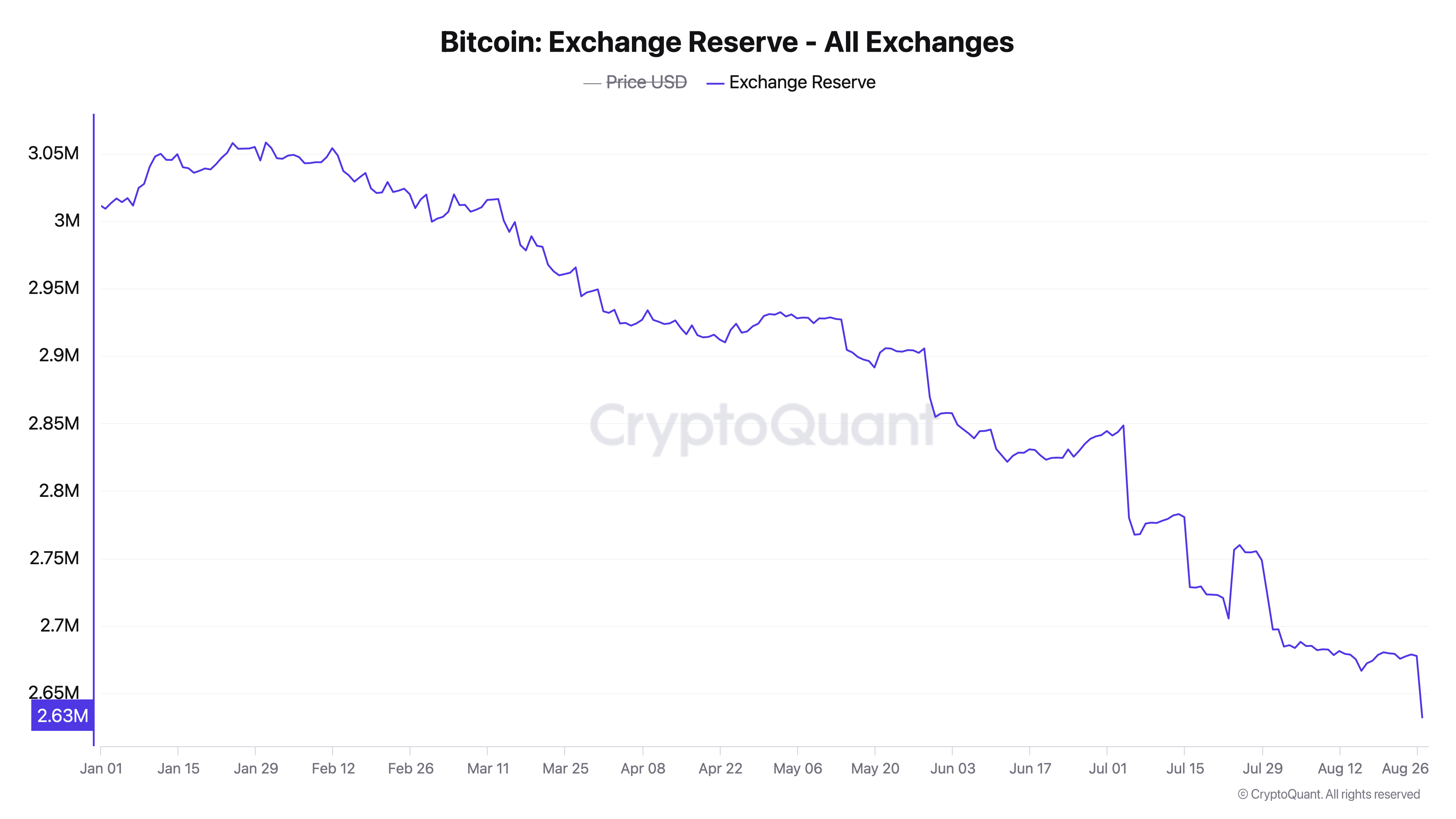

Between Aug. 24 via Aug. 26, cryptoquant information exhibits one other 46,497 BTC has left exchanges because the depend dropped from 2,678,679 BTC to 2,632,182 BTC as of Aug. 26, 2024.

Cryptoquant information reveals that centralized crypto exchanges have skilled a big outflow of BTC this yr. Between Jan. 1, 2024, and Aug. 24, a staggering 330,560 BTC, valued at $20.8 billion, has been withdrawn from these buying and selling platforms. Seven months in the past, exchanges collectively held 3,009,239 BTC, however right this moment that determine has dropped to 2,678,679 BTC. Moreover, exchanges have seen a considerable lower in ethereum (ETH) reserves, with 1.9 million ether, value $5.2 billion, leaving centralized buying and selling platforms because the begin of the yr.

Alternatively, exchanges have witnessed a notable inflow of Ethereum-based tether (USDT) this yr. Information signifies that since Jan. 1, the quantity of USDT on these platforms has grown from $12.6 billion to a big $21.7 billion. Whether or not pushed by institutional traders or retail merchants, the removing of $26 billion in BTC and ETH is reshaping the crypto asset panorama. If this sample persists, the growing shortage might have an effect on future market stability. At present, the quantity of BTC on exchanges is at its lowest degree since Nov. 2018.

What do you consider the $26 billion in bitcoin and ether that has left centralized crypto exchanges this yr? Share your ideas and opinions about this topic within the feedback part under.