Cathie Wooden’s Ark was the primary firm to hunt permission to create a spot ether exchange-traded fund (ETF) in September, a pioneer who blazed the path earlier than a wave of different high-profile candidates.

After which, throughout the previous week, it bowed out with out explaining why.

Chalk it as much as the extreme battle to lure clients with low charges for crypto ETFs, in accordance with specialists.

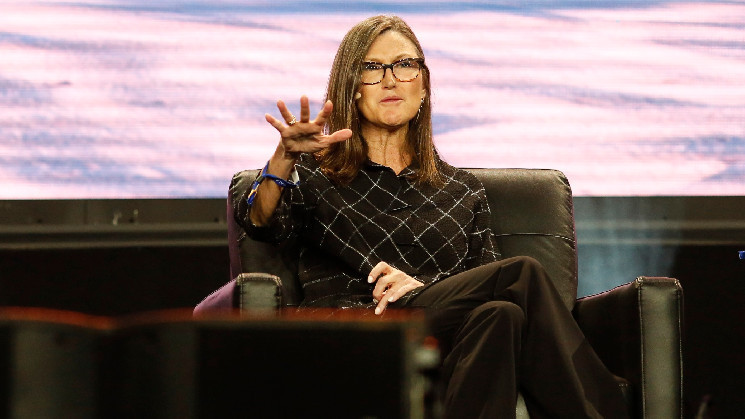

Throughout a fireplace chat at CoinDesk’s Consensus convention in Austin, Texas, final week, Wooden stated ARK’s spot bitcoin ETF, launched earlier this yr, wasn’t making the agency any cash as a result of it fees traders such a low charge: 0.21%. Whereas that is corresponding to what different bitcoin ETF issuers cost, it is considerably decrease than what non-crypto ETFs sometimes cost.

“Maybe this can be a easy enterprise determination,” stated Nate Geraci, president of the ETF Retailer. “If Ark 21Shares Bitcoin ETF (ARKB) can eclipse $3.5 billion in lower than 5 months and Ark can’t make any cash, that’s clearly a difficulty.”

ETF issuers cost traders a charge to compensate for managing the fund. Many traders search to attenuate that charge because it cuts into returns.

Within the race to launch a spot bitcoin ETF, Grayscale set its charge considerably greater than its rivals, at 1.5%, which seems to be one of many essential the reason why traders have pulled billions of {dollars} out of the fund and the fund misplaced its early lead, by way of property, to BlackRock.

“I don’t assume anybody really anticipated the charge struggle to get that aggressive earlier than we even noticed launches,” stated James Seyffart, ETF analyst at Bloomberg Intelligence.

Seyffart additionally believes that Ark made the choice based mostly on the low charges. “It’s potential that the partnership made a ton of sense, significantly with the demand for bitcoin ETFs,” he stated. “However after the charges received so low proper off the bat, there may merely not have been sufficient cash from charges to go round for each companies, significantly on an Ethereum ETF if they’re anticipating much less demand versus bitcoin ETFs.”

Just one wannabe issuer, Franklin Templeton, has revealed the charge for its fund up to now, which it set at 0.19% in accordance with a submitting, the identical quantity it fees for the Franklin Bitcoin ETF.

Regardless of the low charge construction of the ETFs, Ark’s departure from the race got here as a shock, given the asset supervisor’s robust footing within the business and its providing of a number of different ether-related funds.

“It is a shocking transfer from my perspective,” stated Geraci. “From a longer-term branding perspective, I’m shocked Ark wouldn’t discover worth in being concerned within the spot ether ETF class. Ark has been far more forward-thinking round crypto than lots of their rivals, so it’s odd to see them sit this one out.”

A consultant for Ark Make investments couldn’t be reached for remark.