In a decade outlined by tech, Cathie Wooden has been some of the forward-thinking traders. The CEO of Ark Funding Administration (ARKK) is famend for her concentrate on disruptive applied sciences — however her bets haven’t all the time paid off.

ARKK was the best-performing actively-managed fund of 2020 — it has fallen from grace considerably since. Down from a February 2021 peak of $156.58, shares of the fund are actually buying and selling at simply $51.11, though the fund has marked a modest 6.38% year-to-date (YTD) acquire.

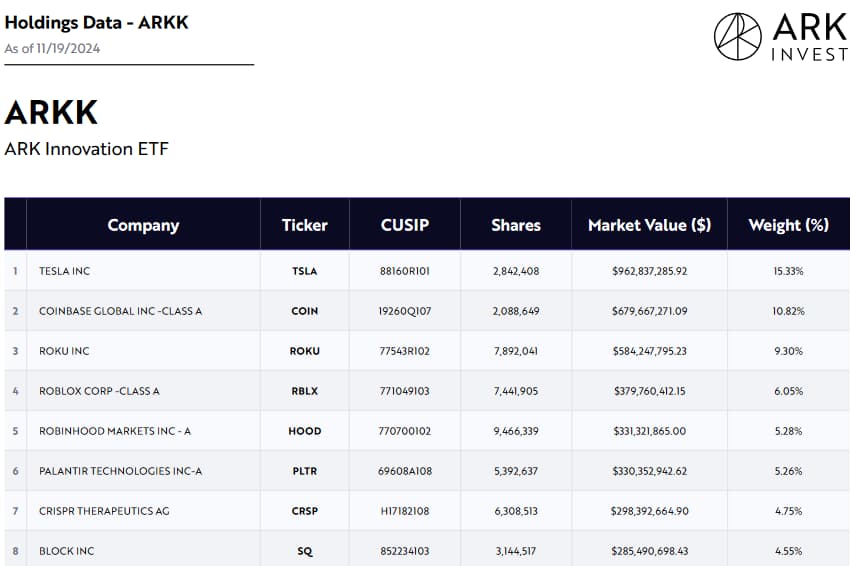

One among Wooden’s favourite corporations is electrical automobile maker Tesla (NASDAQ: TSLA), which can also be ARKK’s largest holding. As of late, the fund has been promoting the inventory despite its spectacular efficiency during the last month — resulting in issues as as to whether or not the rise in TSLA share worth is sustainable.

Wooden trims TSLA inventory holdings amidst worth upswing

The automaker’s inventory has spent most of 2024 within the pink — elevated competitors, manufacturing bottlenecks, and issues relating to valuation drew skepticism from a variety of traders. The standout Q3 2024 earnings name launched on October 23 introduced renewed curiosity in TSLA inventory — as did CEO Elon Musk’s assist of President-elect Donald Trump.

At press time, Tesla shares had been buying and selling at $339.86, having opened at $342.97 on Monday, November 18, for a 7% surge that has introduced YTD returns as much as 35.25%.

On the exact same day, Wooden’s fund offered 30,939 TSLA shares, value roughly $10.5 million. ARKK had beforehand offloaded 404,400 Tesla shares prior to now few weeks — refocusing the funds towards Amazon (NASDAQ: AMZN).

Nonetheless, wanting on the greater image, the commerce wasn’t all that vital — as TSLA continues to be ARKK’s largest holding — at current, the EV trailblazer makes up 15.33% of the fund, with 2,842,408 shares value roughly $962,837,285.

Is ARKK’s sale of Tesla inventory a bearish sign?

Whereas traders are likely to take any sale at face worth, finally, this newest transaction was a minor trimming of ARKK’s stake in Tesla. Wooden has beforehand predicted that TSLA inventory would attain costs as excessive as $2,600 in 5 years — and he or she has not walked again her optimistic appraisal of the enterprise since.

It’s additionally value remembering that her fund is actively managed — its most popular asset allocation may have drifted, administration may have recognized different, extra interesting alternatives in undervalued corporations, or it may merely be locking in beneficial properties at an opportune time.

Featured picture by way of Shutterstock