Seven in ten publicly traded bitcoin (BTC) mining firms are having fun with a robust begin to 2025, with Riot Platforms main the pack when it comes to share good points among the many high ten companies by market cap.

Riot Platforms Rallies As 7 out of the Prime 10 Bitcoin Miners by Market Cap Begin 2025 within the Inexperienced

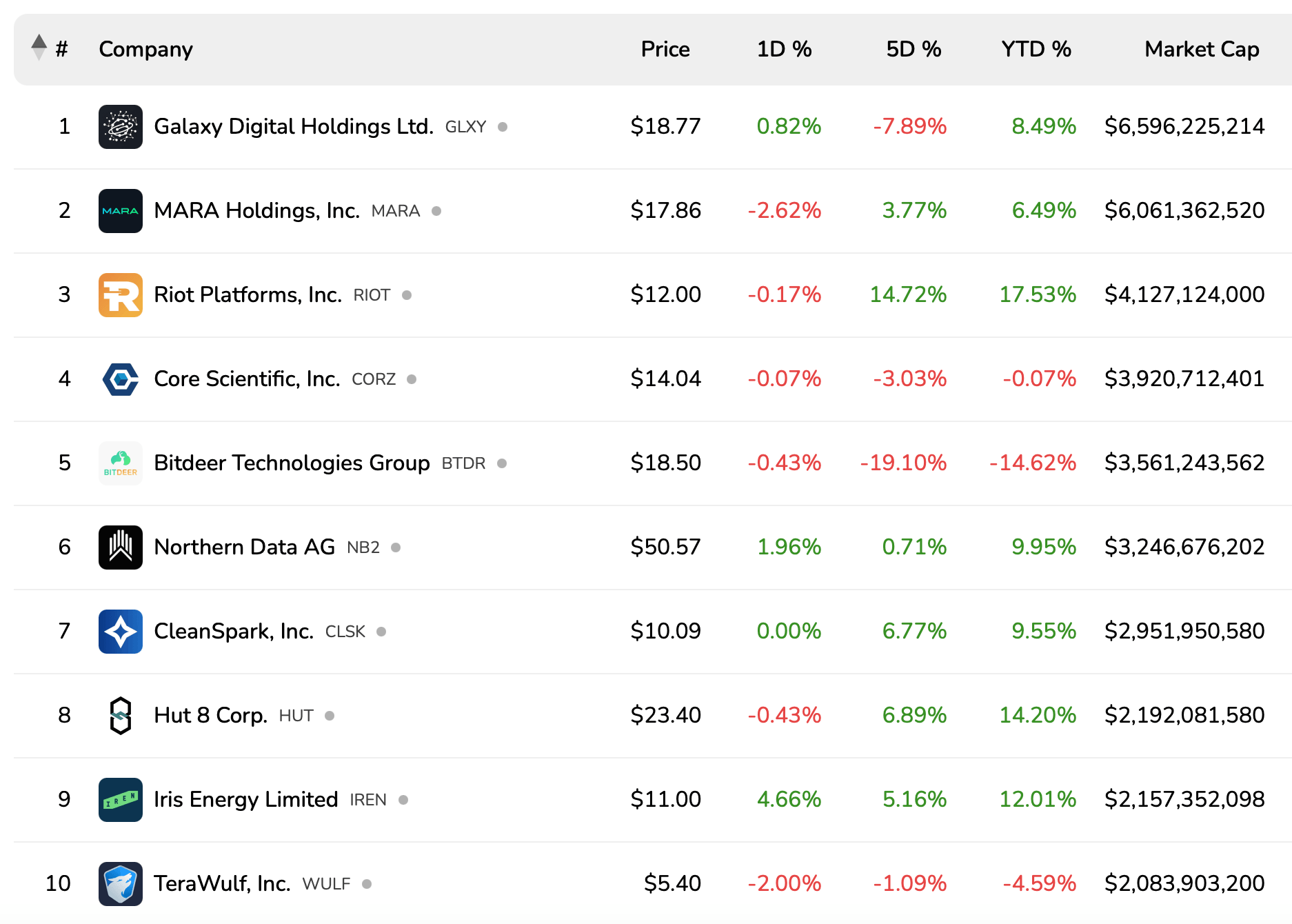

Though miners proceed to grapple with income constraints tied to bitcoin’s value holding beneath the $100,000 threshold, shares of those publicly listed BTC mining firms are trending upward, hinting at a positive begin to the yr. As of Saturday afternoon, information from bitcoinminingstock.io reveals the mixed market capitalization of 31 publicly traded bitcoin (BTC) mining companies stands at $44.09 billion. Amongst these, 26 firms have witnessed their inventory values rise in opposition to the U.S. greenback.

Supply: bitcoinminingstock.io

Main the cost is Cathedra Bitcoin, Inc. (TSXV: CBIT), which has soared 25% year-to-date, marking essentially the most important achieve. Throughout the high ten companies by market capitalization, Riot Platforms, Inc. (Nasdaq: RIOT) claimed the highest spot with a 17.53% improve in 2025. Following carefully is Hut 8 (Nasdaq: HUT), which has climbed 14.2%. In the meantime, firms like Galaxy, MARA, Northern Information, Cleanspark, and Iris Power skilled good points starting from MARA’s 6.49% to Iris Power’s 12.01%.

On the draw back, three companies have recorded declines this yr, with losses starting from a marginal 0.07% to a sharper 14.62%. Core Scientific (Nasdaq: CORZ), the fourth-largest agency by market capitalization, dipped by a mere 0.07%. Terawulf (Nasdaq: WULF) has fallen 4.59%, whereas Bitdeer (Nasdaq: BTDR) has seen a extra important drop of 14.62%. Aside from Bit Origin Restricted (Nasdaq: BTOG), which is down 10.32% year-to-date, BTDR emerges because the steepest decliner among the many group.

Amid these shifts, a number of firms are diversifying their focus, exploring high-performance computing (HPC) and synthetic intelligence (AI) internet hosting alongside their BTC strategic reserves. Notably, Blocksbridge Consulting’s theminermag.com studies that publicly listed miners collectively maintain report reserves of over 92,000 BTC as of Dec. 2024.