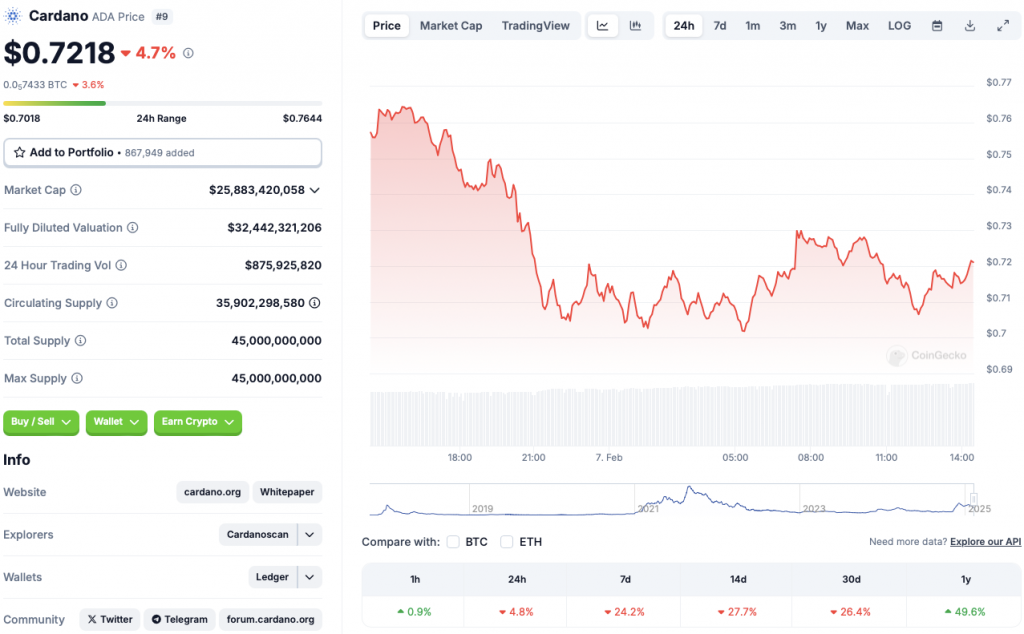

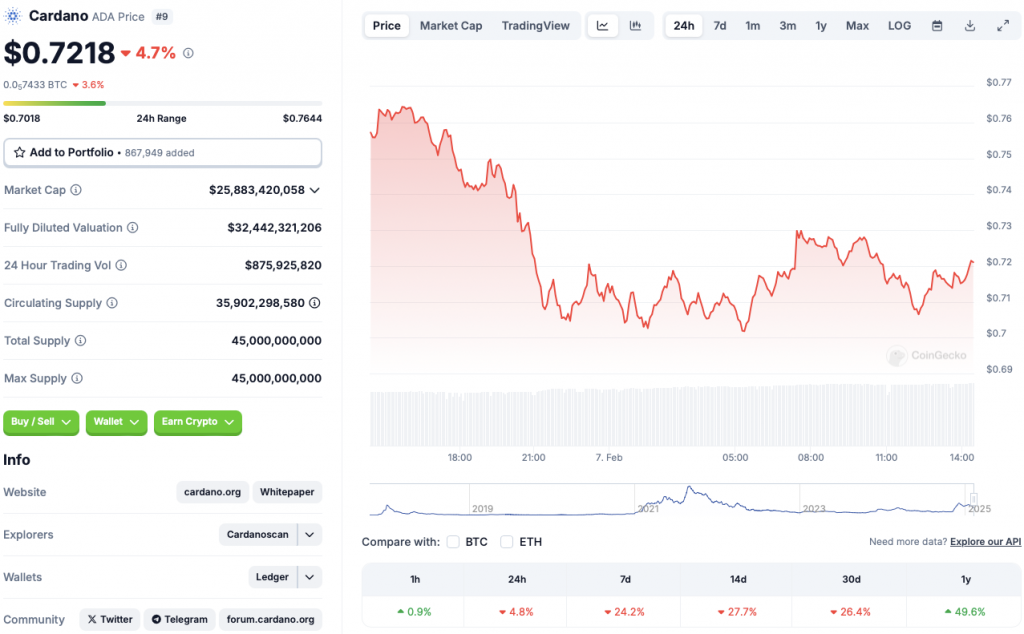

Cardano (ADA) has had a tough few weeks. The asset is down 4.8% within the every day charts, 24.2% within the weekly charts, 27.7% within the 14-day charts, and 26.4% over the earlier month. Regardless of the dip, the asset’s value has risen by almost 50% since February 2024.

Cardano’s Woes Proceed

ADA’s newest correction follows a market-wide dip. The cryptocurrency market confronted a significant plunge over the past weekend. The dip got here after the US imposed heavy tariffs on Canada and Mexico. The taxes are an try and fight commerce deficits and unlawful border crossings.

The crypto market recovered barely on Tuesday after the US mentioned it will pause tariffs for 30 days. Regardless of a slight restoration, Cardano (ADA) continues to commerce within the crimson zone.

Will The Asset Breach $1 Once more?

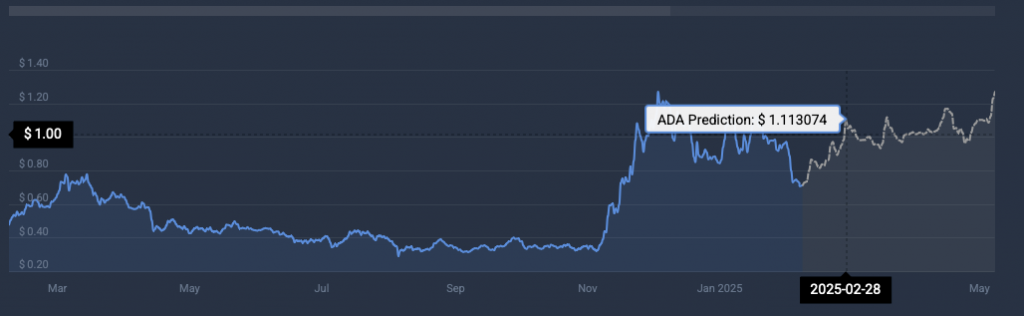

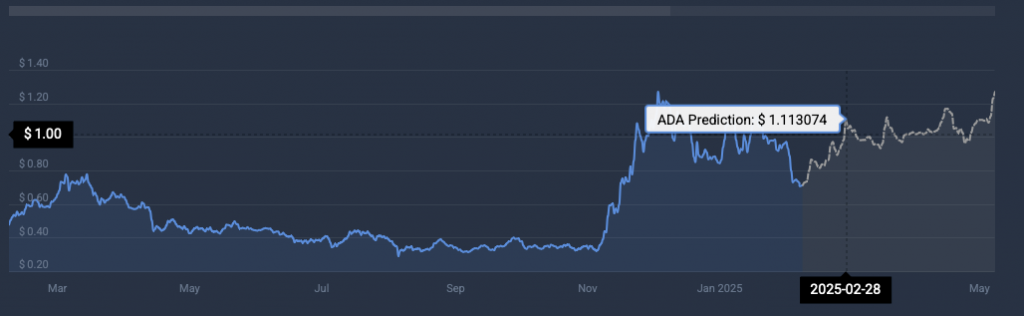

Based on CoinCodex, Cardano (ADA) will break right into a rally over the following few weeks. The platform anticipates the asset to hit $1.11 on Feb. 28, 2025. Hitting $1.11 from present value ranges will entail a rally of about 56%.

CoinCodex doesn’t count on ADA’s value to carry above $1. The platform anticipates the asset to dip until mid-March earlier than gaining traction in Might.

Macroeconomic components may additionally hamper Cardano’s (ADA) efficiency. The Federal Reserve is but to announce an rate of interest minimize. Worldwide commerce wars may additionally current a problem to the crypto market. If inflation within the US dips and the Fed pronounces a price minimize, ADA and different cryptocurrencies may rally.

How the asset performs over the following few months is but to be seen.